Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume that Deposits from other banks earn 1.5%, Mortgaged Backed Securities earn 3.5% and Home Mortgages earn 5.0% (also assume that the bank received $

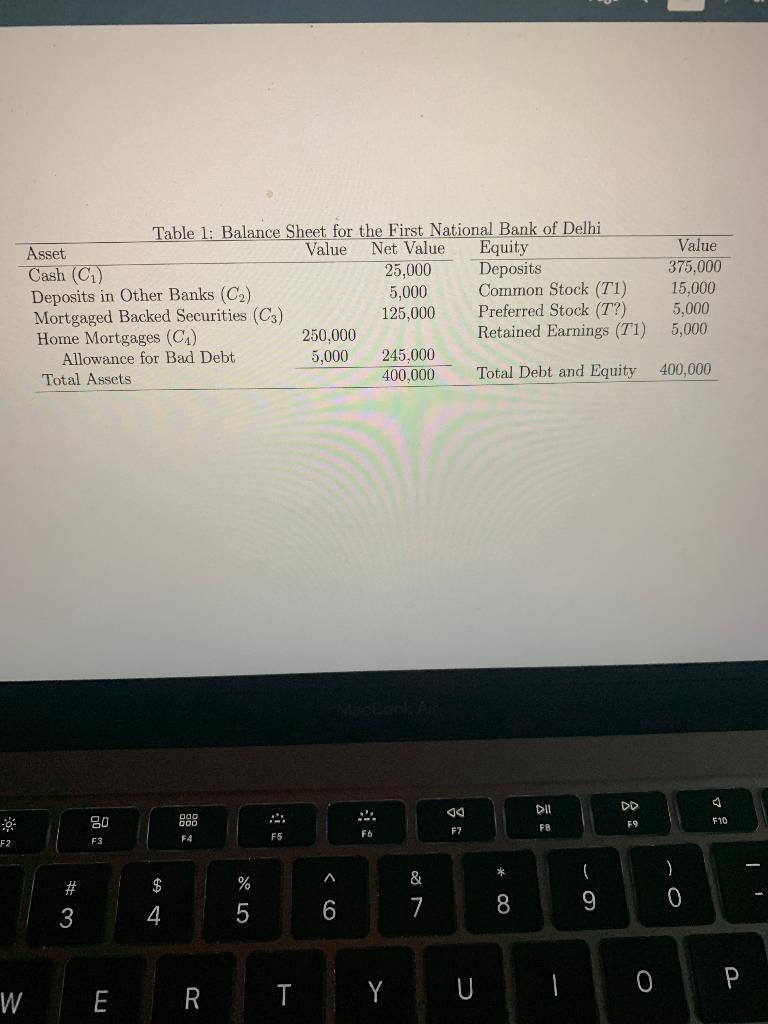

Assume that Deposits from other banks earn 1.5%, Mortgaged Backed Securities earn 3.5% and Home Mortgages earn 5.0% (also assume that the bank received $ 15,000 in principal payments during the year, but made an addition $ 17,500 in loans). Assume further that the operating expenses were $ 7,500. Make the accounting entries to recognize this years transactions assuming that $ 2,500 is paid in dividends. Create the income statement and balance sheets for the bank at the end of the year. How did capital adequacy change? Is that better or worse?

Assume that Deposits from other banks earn 1.5%, Mortgaged Backed Securities earn 3.5% and Home Mortgages earn 5.0% (also assume that the bank received $ 15,000 in principal payments during the year, but made an addition $ 17,500 in loans). Assume further that the operating expenses were $ 7,500. Make the accounting entries to recognize this years transactions assuming that $ 2,500 is paid in dividends. Create the income statement and balance sheets for the bank at the end of the year. How did capital adequacy change? Is that better or worse?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started