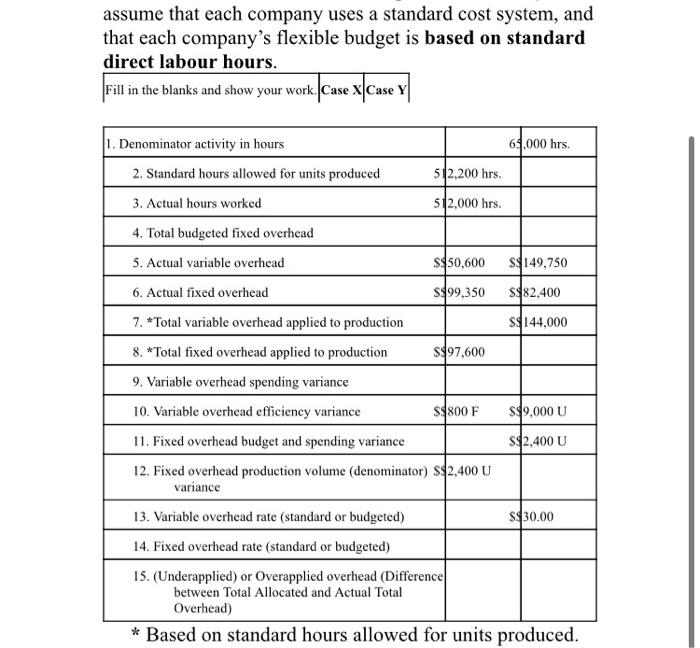

assume that each company uses a standard cost system, and that each company's flexible budget is based on standard direct labour hours. Fill in the blanks and show your work. Case X Case Y 1. Denominator activity in hours 69,000 hrs. 2. Standard hours allowed for units produced 512,200 hrs. 3. Actual hours worked 512.000 hrs. 4. Total budgeted fixed overhead 5. Actual variable overhead S$50,600 S$149,750 6. Actual fixed overhead $$99,350 S$82.400 7. *Total variable overhead applied to production S$144,000 8. *Total fixed overhead applied to production $$97,600 9. Variable overhead spending variance 10. Variable overhead efficiency variance $$800 F $$9,000 U 11. Fixed overhead budget and spending variance S$2,400 U 12. Fixed overhead production volume (denominator) S$2,400 U variance 13. Variable overhead rate (standard or budgeted) $$30.00 14. Fixed overhead rate (standard or budgeted) 15. (Underapplied) or Overapplied overhead (Difference between Total Allocated and Actual Total Overhead) * Based on standard hours allowed for units produced. assume that each company uses a standard cost system, and that each company's flexible budget is based on standard direct labour hours. Fill in the blanks and show your work. Case X Case Y 1. Denominator activity in hours 69,000 hrs. 2. Standard hours allowed for units produced 512,200 hrs. 3. Actual hours worked 512.000 hrs. 4. Total budgeted fixed overhead 5. Actual variable overhead S$50,600 S$149,750 6. Actual fixed overhead $$99,350 S$82.400 7. *Total variable overhead applied to production S$144,000 8. *Total fixed overhead applied to production $$97,600 9. Variable overhead spending variance 10. Variable overhead efficiency variance $$800 F $$9,000 U 11. Fixed overhead budget and spending variance S$2,400 U 12. Fixed overhead production volume (denominator) S$2,400 U variance 13. Variable overhead rate (standard or budgeted) $$30.00 14. Fixed overhead rate (standard or budgeted) 15. (Underapplied) or Overapplied overhead (Difference between Total Allocated and Actual Total Overhead) * Based on standard hours allowed for units produced