Answered step by step

Verified Expert Solution

Question

1 Approved Answer

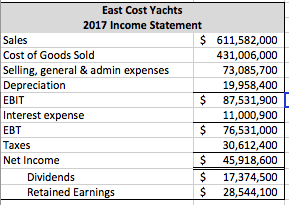

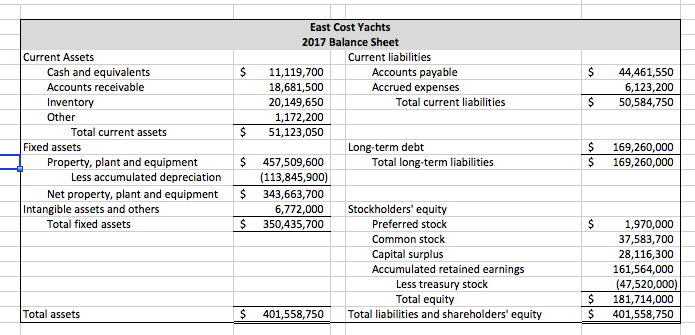

Assume that East Coast Yachts is currently producing at 100% of capacity and sales are expected to grow at 20%. As a result, to expand

Assume that East Coast Yachts is currently producing at 100% of capacity and sales are expected to grow at 20%. As a result, to expand production, the company must set up an entirely new line at a cost of 95,000,000. Prepare the pro forma income statement and balance sheet. What is the External Financing Needed with these assumptions? What does this imply about the capacity utilization for east Coast Yachts next year?

East Cost Yachts 2017 Income Statement 611,582,000 431,006,000 73,085,700 19,958,400 S 87,531,900 11,000,900 $ 76,531,000 30,612,400 $ 45,918,600 $ 17,374,500 $ 28,544,100 Sales Cost of Goods Sold Selling, general & admin expenses Depreciation EBIT nterest expense EBT Taxes Net Income Dividends Retained Earnin East Cost Yachts 2017 Balance Sheet Current Assets Current iabilities Cash and equivalents Accounts receivable Invento Other $11,119,700 18,681,500 20,149,650 1,172,200 $ 51,123,050 $ 44,461,550 6,123,200 50,584,750 Accounts payable Accrued expenses Total current liabilities Total current assets $ 169,260,000 169,260,000 Fixed assets Long-term debt Property, plant and equipment Net property, plant and equipment Total fixed assets $ 457,509,600 (113,845,900) 343,663,700 Total long-term liabilities Less accumulated depreciation Intangible assets and others 6,772,000 Stockholders' equity $ 350,435,700 Preferred stock Common stock Capital surplus Accumulated retained earnings $1,970,000 37,583,700 28,116,300 161,564,000 (47,520,000) $181,714,000 $ 401,558,750 Less treasury stock Total equity Total assets $ 401,558,750Total liabilities and shareholders' equityStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started