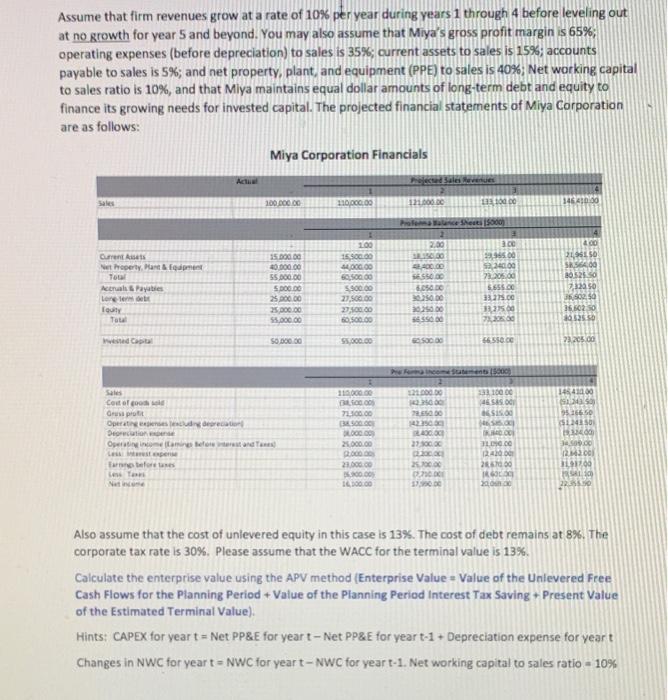

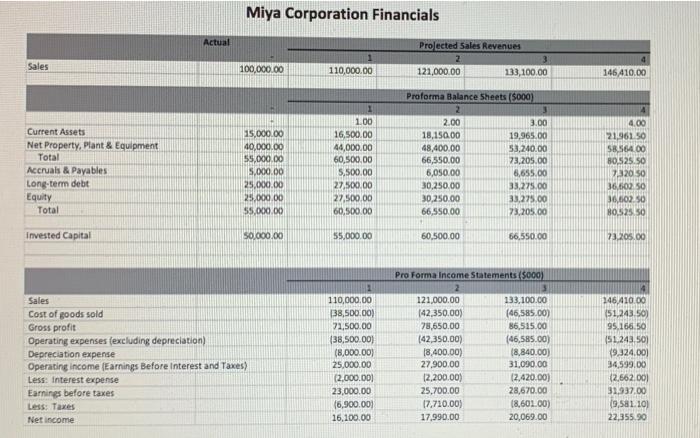

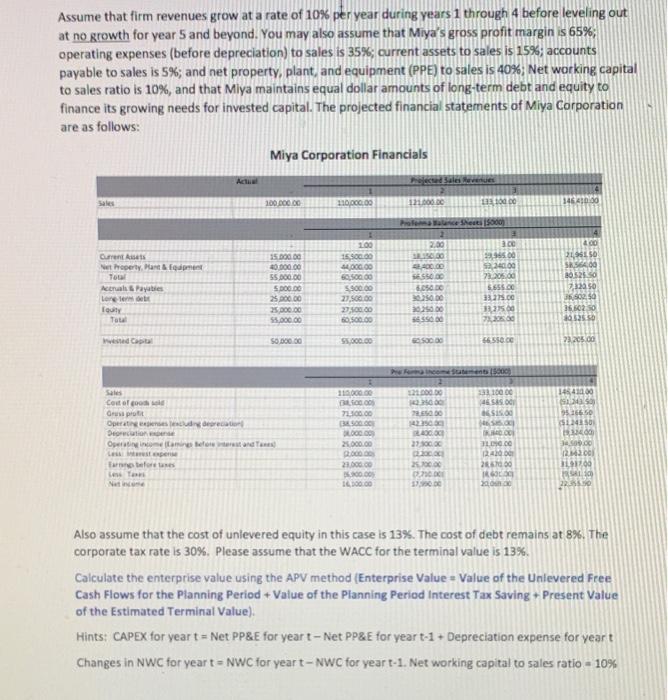

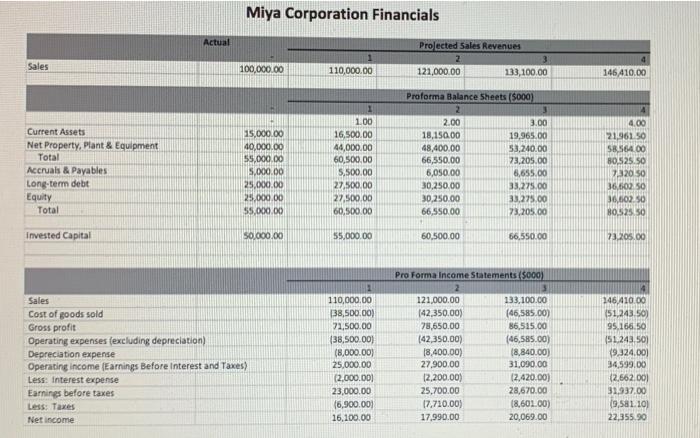

Assume that firm revenues grow at a rate of 10% per year during years 1 through 4 before leveling out at no growth for year 5 and beyond. You may also assume that Miya's gross profit margin is 65%; operating expenses (before depreciation) to sales is 35%; current assets to sales is 15%; accounts payable to sales is 5%; and net property, plant, and equipment (PPE) to sales is 40%; Net working capital to sales ratio is 10%, and that Miya maintains equal dollar amounts of long-term debt and equity to finance its growing needs for invested capital. The projected financial statements of Miya Corporation are as follows: Miya Corporation Financials Act Sales Sales 100.000.00 10,000.00 1H00 % |||||| H C 346.00 Preface the 15000 2.00 300 595 SESSID Current throperty, and Total Actual Payables Lorele Toy 15.000.00 10.000.00 55.000.00 500.00 25.000.00 25,000.00 5.000.00 200 15,90 400.00 5000 59000 27,500.00 27,500.00 6.500.00 11,96150 SRS 80523. 7,32350 36 S 35 50250 1625.50 7305.00 5.6550 33275.00 275.00 7 125000 2000 556d wa SO 30000 95.000.00 56550 2000 Pent 115.000 310000 46 SIS OSIS Sales Cost of the Grupo Operating Deco O LI Tambor Les ar Net 71.100.00 BLOG BLOOD 28.000.00 1.000.00 100 00 1422503 200 270 95 1565 11450 1146 pertand SODO ROC 300.00 12.40 266000 I 00 21.000 300.00 16,100.00 26.000 DOC 225 Also assume that the cost of unlevered equity in this case is 13%. The cost of debt remains at 8%. The corporate tax rate is 30%. Please assume that the WACC for the terminal value is 13%. Calculate the enterprise value using the APV method (Enterprise Value = Value of the Unlevered Free Cash Flows for the Planning Period + Value of the Planning Period Interest Tax Saving - Present Value of the Estimated Terminal Value) Hints: CAPEX for yeart - Net PP&E for yeart-Net PP&E for year t-1 + Depreciation expense for yeart Changes in NWC for yeart - NWC for year t-NWC for year t-1. Net working capital to sales ratio - 10% Miya Corporation Financials Actual Prolected Sales Revenues 2 121,000.00 133,100.00 Sales 100,000.00 110,000.00 146410.00 Current Assets Net Property, Plant & Equipment Total Accruals & Payables Long-term debt Equity Total 15,000.00 40,000.00 55,000.00 5,000.00 25,000.00 29.0x00.00 $5,000.00 1.00 16,500.00 44,000.00 60,500,00 5,500.00 27,500.00 27,500.00 60,500.00 Proforma Balance Sheets (5000) 2 3 2.00 3.00 18,150.00 19,965.00 48,400.00 53,240.00 66,550,00 23.205.00 6,050.00 5,655.00 30,250.00 33.275.00 30.250.00 33,275.00 66,550,00 73,205.00 4 4.00 21,961.50 S.564.00 80.525.50 232050 36,602 50 36,602.50 80.525 50 Invested Capital 50,000.00 55,000.00 60,500.00 66,550.00 73.205.00 Sales Cost of goods sold Gross profit Operating expenses (excluding depreciation) Depreciation expense Operating income (Earnings Before Interest and Taxes) Less interest expense Earnings before taxes Less: Taxes Net income 110,000.00 138,500.00) 23,500.00 (38,500.00) (8,000.00) 25,000.00 (2,000.00 23,000.00 (6,900.00 16,100.00 Pro Forma Income Statements/5000) 3 121,000.00 133,100.00 142,350.00) (46,585.00) 78,650.00 86,515.00 (42,350.00) (46,585.00) 18,400.00) (8,840.00) 27,900.00 31.090.00 12,200.00) 12,420.00) 25,700.00 28,670.00 17.710.00) (8,601.00) 17,990.00 20,069.00 4 146,410.00 (51 243.50) 95.168.50 (51.243.50) (9,324.00) 34,599.00 (2.562.00) 31,937.00 (9.581.10) 22,355.30 Assume that firm revenues grow at a rate of 10% per year during years 1 through 4 before leveling out at no growth for year 5 and beyond. You may also assume that Miya's gross profit margin is 65%; operating expenses (before depreciation) to sales is 35%; current assets to sales is 15%; accounts payable to sales is 5%; and net property, plant, and equipment (PPE) to sales is 40%; Net working capital to sales ratio is 10%, and that Miya maintains equal dollar amounts of long-term debt and equity to finance its growing needs for invested capital. The projected financial statements of Miya Corporation are as follows: Miya Corporation Financials Act Sales Sales 100.000.00 10,000.00 1H00 % |||||| H C 346.00 Preface the 15000 2.00 300 595 SESSID Current throperty, and Total Actual Payables Lorele Toy 15.000.00 10.000.00 55.000.00 500.00 25.000.00 25,000.00 5.000.00 200 15,90 400.00 5000 59000 27,500.00 27,500.00 6.500.00 11,96150 SRS 80523. 7,32350 36 S 35 50250 1625.50 7305.00 5.6550 33275.00 275.00 7 125000 2000 556d wa SO 30000 95.000.00 56550 2000 Pent 115.000 310000 46 SIS OSIS Sales Cost of the Grupo Operating Deco O LI Tambor Les ar Net 71.100.00 BLOG BLOOD 28.000.00 1.000.00 100 00 1422503 200 270 95 1565 11450 1146 pertand SODO ROC 300.00 12.40 266000 I 00 21.000 300.00 16,100.00 26.000 DOC 225 Also assume that the cost of unlevered equity in this case is 13%. The cost of debt remains at 8%. The corporate tax rate is 30%. Please assume that the WACC for the terminal value is 13%. Calculate the enterprise value using the APV method (Enterprise Value = Value of the Unlevered Free Cash Flows for the Planning Period + Value of the Planning Period Interest Tax Saving - Present Value of the Estimated Terminal Value) Hints: CAPEX for yeart - Net PP&E for yeart-Net PP&E for year t-1 + Depreciation expense for yeart Changes in NWC for yeart - NWC for year t-NWC for year t-1. Net working capital to sales ratio - 10% Miya Corporation Financials Actual Prolected Sales Revenues 2 121,000.00 133,100.00 Sales 100,000.00 110,000.00 146410.00 Current Assets Net Property, Plant & Equipment Total Accruals & Payables Long-term debt Equity Total 15,000.00 40,000.00 55,000.00 5,000.00 25,000.00 29.0x00.00 $5,000.00 1.00 16,500.00 44,000.00 60,500,00 5,500.00 27,500.00 27,500.00 60,500.00 Proforma Balance Sheets (5000) 2 3 2.00 3.00 18,150.00 19,965.00 48,400.00 53,240.00 66,550,00 23.205.00 6,050.00 5,655.00 30,250.00 33.275.00 30.250.00 33,275.00 66,550,00 73,205.00 4 4.00 21,961.50 S.564.00 80.525.50 232050 36,602 50 36,602.50 80.525 50 Invested Capital 50,000.00 55,000.00 60,500.00 66,550.00 73.205.00 Sales Cost of goods sold Gross profit Operating expenses (excluding depreciation) Depreciation expense Operating income (Earnings Before Interest and Taxes) Less interest expense Earnings before taxes Less: Taxes Net income 110,000.00 138,500.00) 23,500.00 (38,500.00) (8,000.00) 25,000.00 (2,000.00 23,000.00 (6,900.00 16,100.00 Pro Forma Income Statements/5000) 3 121,000.00 133,100.00 142,350.00) (46,585.00) 78,650.00 86,515.00 (42,350.00) (46,585.00) 18,400.00) (8,840.00) 27,900.00 31.090.00 12,200.00) 12,420.00) 25,700.00 28,670.00 17.710.00) (8,601.00) 17,990.00 20,069.00 4 146,410.00 (51 243.50) 95.168.50 (51.243.50) (9,324.00) 34,599.00 (2.562.00) 31,937.00 (9.581.10) 22,355.30