Assume that Greg asks for your advice about how to make the order decision. As a first pass, you suggest simplifying the possible future states

Assume that Greg asks for your advice about how to make the order decision. As a first pass, you suggest simplifying the possible future states and order quantities. For the future demand, you suggest that Greg use the average number of possible units (i.e., assume that demand will be 350,000 for a dog, 1,250,000 for an average success, and 2,250,000 for a hit). Also assume that the only possible order quantities exactly match these three possible demand values.

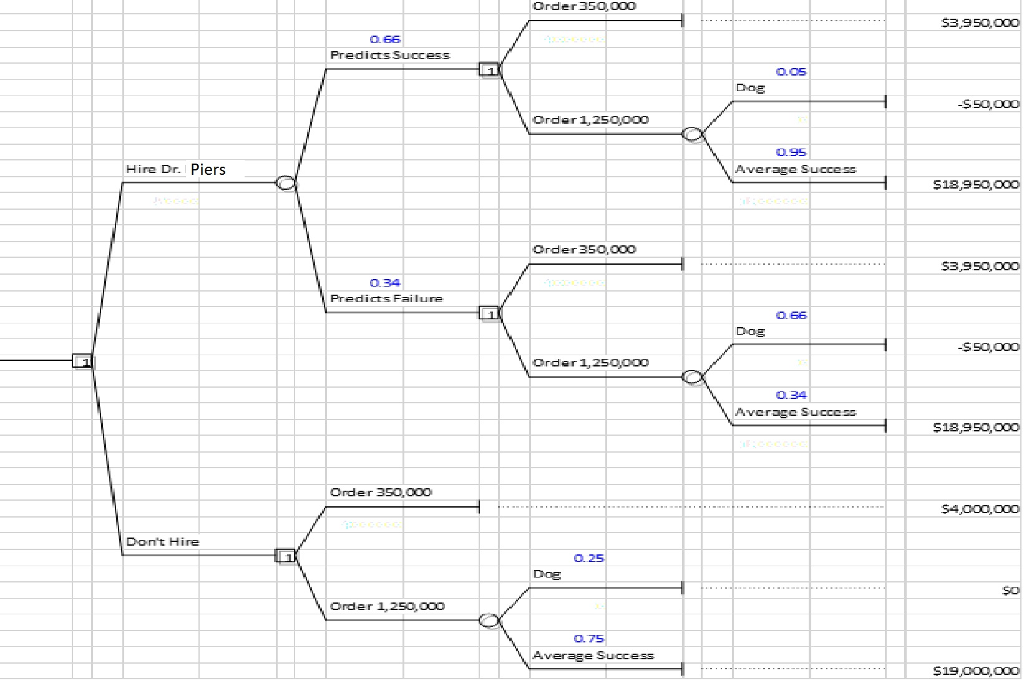

g. For this problem, assume that you can ignore the possibility of the Blu-Ray being a smash hit. Hence you can also ignore the possibility of ordering 2,250,000 units. Use the following information for this problem only.

With no new information, the Blu-Ray disc can be either an average success with probability 0.75 or a dog with probability 0.25. The payoffs for these cases remain the same as they were in problem 1b above. Professor Piers will again either predict a success or failure. No matter what you found in any earlier questions, assume that you and Paul make the following probability assessments.

Probability of an average success given Professor Piers predicts a failure: 0.34

Probability of an average success given Professor Piers predicts a success: 0.95

Probability that Professor Piers will predict a success: 0.66

The Tree below shows a decision tree for Gregs decision problem when the possibility of hiring Professor Piers is included. Using the table, what is Gregs best decision if he is risk neutral?

Best Strategy ??

EMV if Greg hires Dr. Piers ??

EMV if Greg doesnt hire Dr. Piers ???

Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started