Assume that GTD Inc., a domestic corporation engaged in the sale of goods, has the following income and expenses in the Philippines and abroad

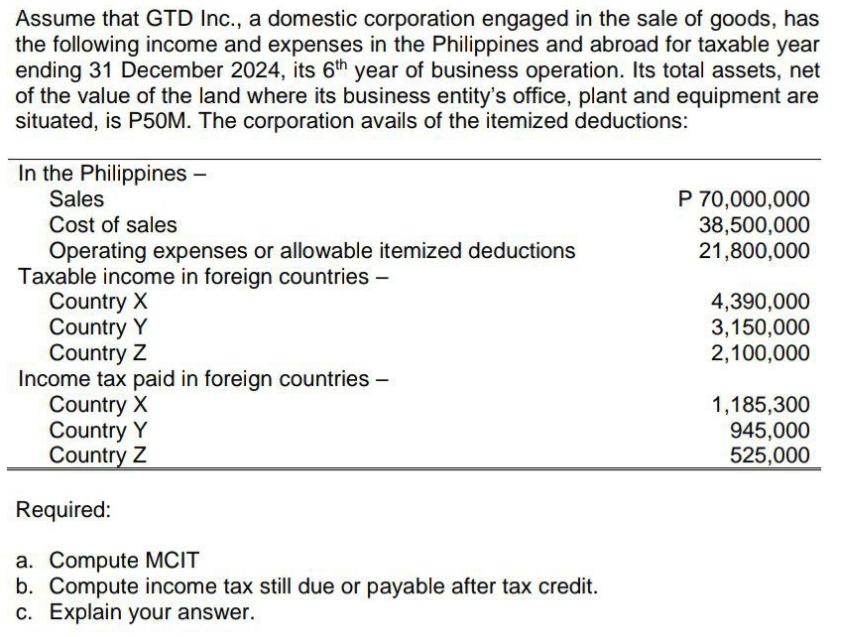

Assume that GTD Inc., a domestic corporation engaged in the sale of goods, has the following income and expenses in the Philippines and abroad for taxable year ending 31 December 2024, its 6th year of business operation. Its total assets, net of the value of the land where its business entity's office, plant and equipment are situated, is P50M. The corporation avails of the itemized deductions: In the Philippines - Sales Cost of sales Operating expenses or allowable itemized deductions Taxable income in foreign countries - Country X Country Y Country Z Income tax paid in foreign countries - Country X Country Y Country Z Required: a. Compute MCIT b. Compute income tax still due or payable after tax credit. c. Explain your answer. P 70,000,000 38,500,000 21,800,000 4,390,000 3,150,000 2,100,000 1,185,300 945,000 525,000

Step by Step Solution

3.51 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

To compute the Minimum Corporate Income Tax MCIT income tax still due or payable after tax credit and provide an explanation we need to consider the t...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started