Answered step by step

Verified Expert Solution

Question

1 Approved Answer

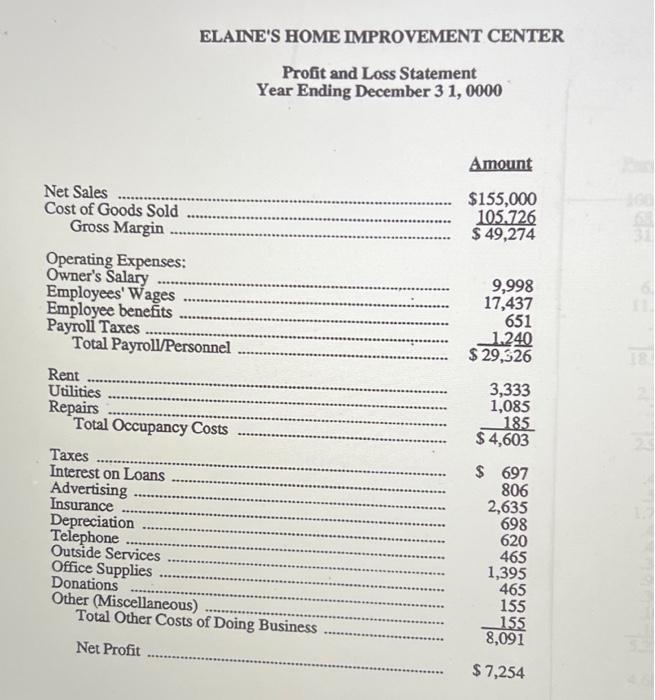

Calculate the gross profit margin Net Sales Cost of Goods Sold Gross Margin Operating Expenses: Owner's Salary Employees' Wages Employee benefits Payroll Taxes Total Payroll/Personnel

Calculate the gross profit margin

Net Sales Cost of Goods Sold Gross Margin Operating Expenses: Owner's Salary Employees' Wages Employee benefits Payroll Taxes Total Payroll/Personnel Rent Utilities Repairs ********* Taxes Interest on Loans Advertising Insurance Depreciation Telephone Outside Services ***** Office Supplies Donations *********** Total Occupancy Costs *********** ************ ELAINE'S HOME IMPROVEMENT CENTER Profit and Loss Statement Year Ending December 3 1, 0000 ********** ******* ********* Other (Miscellaneous) *********** Total Other Costs of Doing Business Net Profit ********** *************.. ********** Amount $155,000 105.726 $ 49,274 9,998 17,437 651 1.240 $ 29,326 3,333 1,085 185 $ 4,603 $ 697 806 2,635 698 620 465 1,395 465 155 155 8,091 $7,254

Step by Step Solution

★★★★★

3.42 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

Answer 1 Cost of goods sold 4900012525 9800 will be removed as intra entity transfer Pol...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started