Question

Assume that, if you undertake the project, you can alternatively install a different energy system that is more environmentally friendly energy system (e.g., solar or

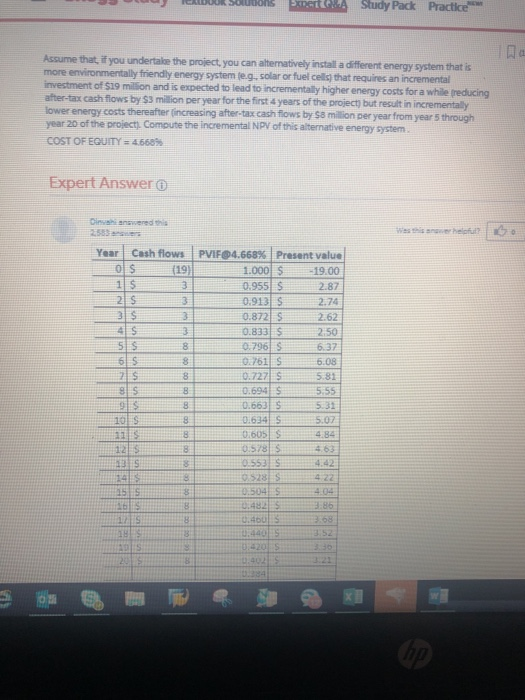

Assume that, if you undertake the project, you can alternatively install a different energy system that is more environmentally friendly energy system (e.g., solar or fuel cells) that requires an incremental investment of $19 million and is expected to lead to incrementally higher energy costs for a while (reducing after-tax cash flows by $3 million per year for the first 4 years of the project) but result in incrementally lower energy costs thereafter (increasing after-tax cash flows by $8 million per year from year 5 through year 20 of the project). Compute the incremental NPV of this alternative energy system . COST OF EQUITY = 4.668%

how do i enter formula in excel to get Present value

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started