Assume that in September you purchased a Sony HDTV from Best Buy (BBY). At the same time, you purchased a Denon surround sound system for $599.99. You liked your surround sound so well that in November you purchased an identical Denon system on sale for $549.99 for your bedroom TV. Over the holidays, you moved to a new apartment and in the process of unpacking discovered that one of the Denon surround sound systems was missing. Luckily, your renters or homeowners insurance policy will cover the theft; but the insurance company needs to know the cost of the system that was stolen.

The Denon systems were identical. However, to respond to the insurance company, you will need to identify which system was stolen. Was it the first system, which cost $599.99, or was it the second system, which cost $549.99? Whichever assumption you make may determine the amount that you receive from the insurance company.

Businesses such as Best Buy make similar assumptions when identical merchandise is purchased at different costs. For example, Best Buy may have purchased thousands of Denon surround sound systems over the past year at different costs. At the end of a period, some of the Denon systems will still be in inventory, and some will have been sold. But which costs relate to the sold systems, and which costs relate to the Denon systems still in inventory? Best Buys assumption about inventory costs can involve large dollar amounts and, thus, can have a significant impact on the financial statements. For example, Best Buy reported $5,051 million of inventory and net income of $897 million for a recent year.

This chapter discusses such issues as how to determine the cost of merchandise in inventory and the cost of goods sold. However, this chapter begins by discussing the importance of control over inventory.

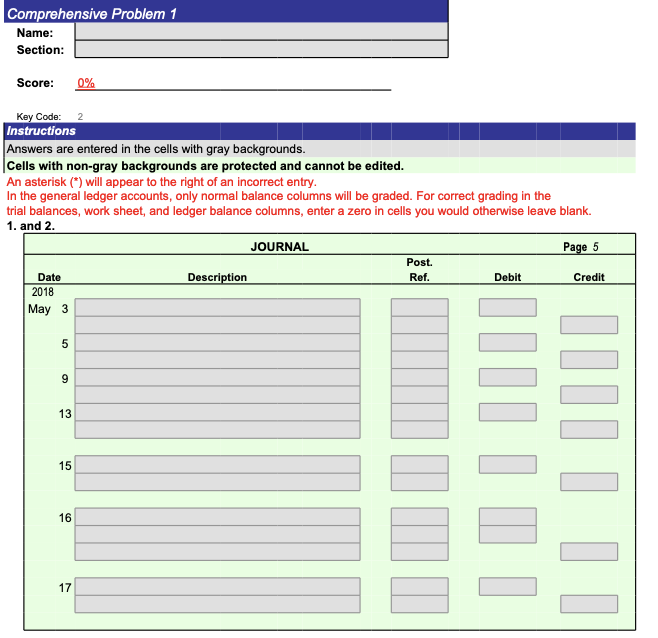

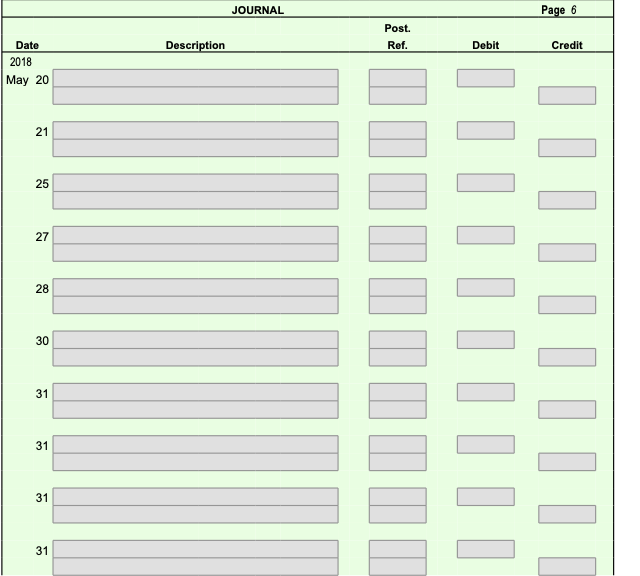

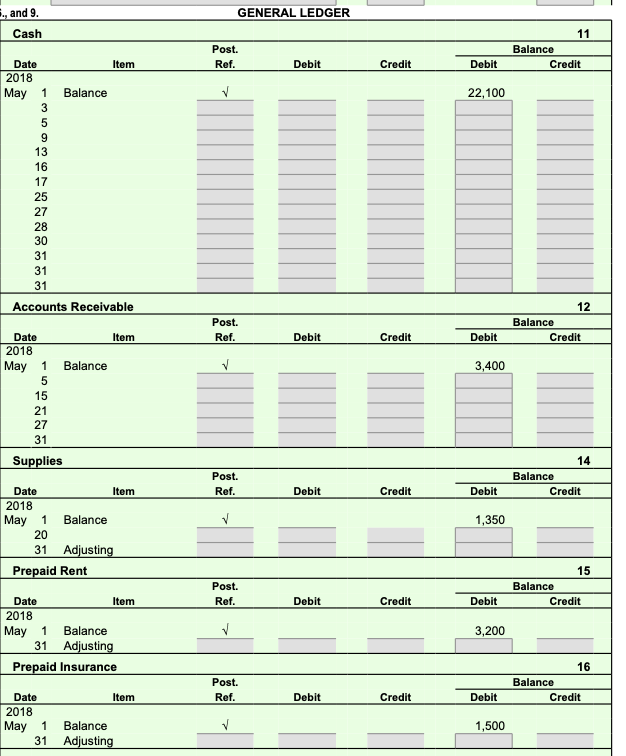

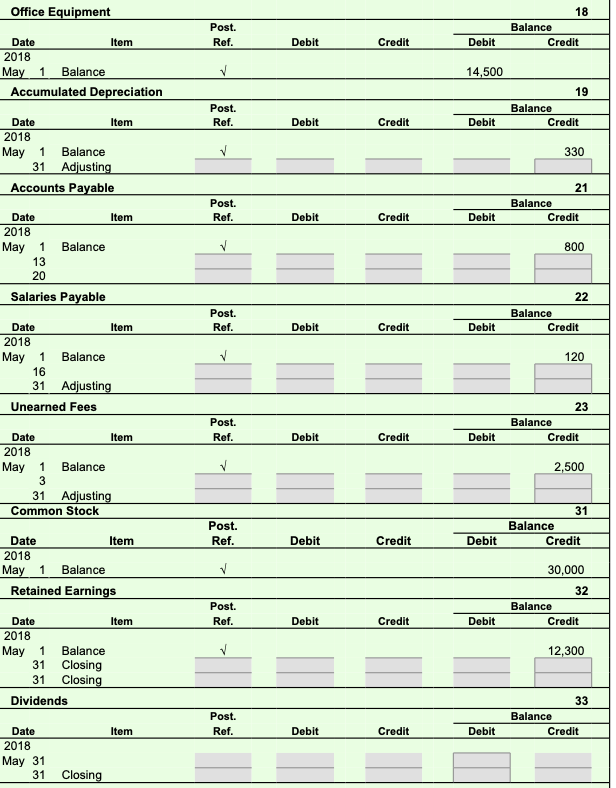

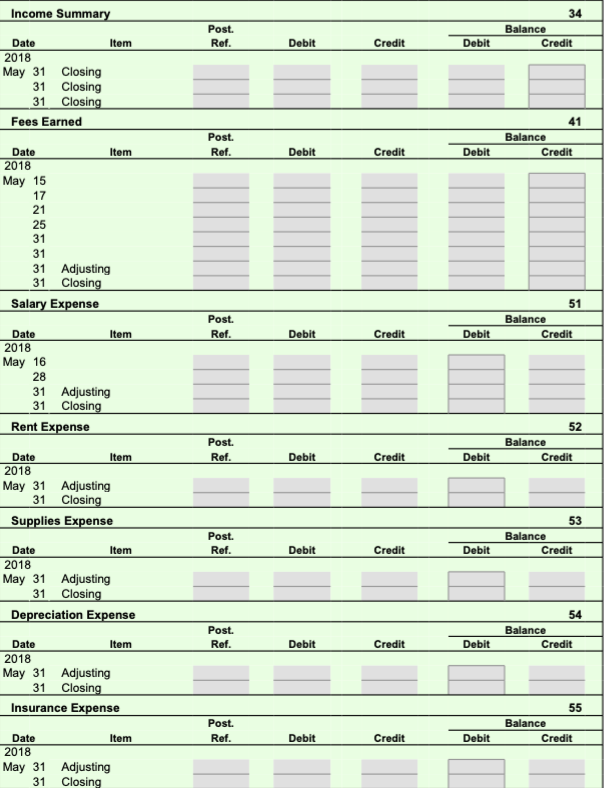

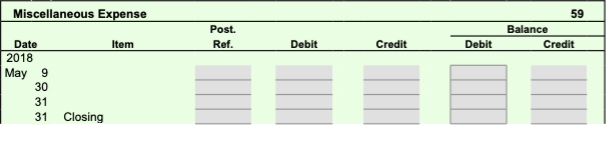

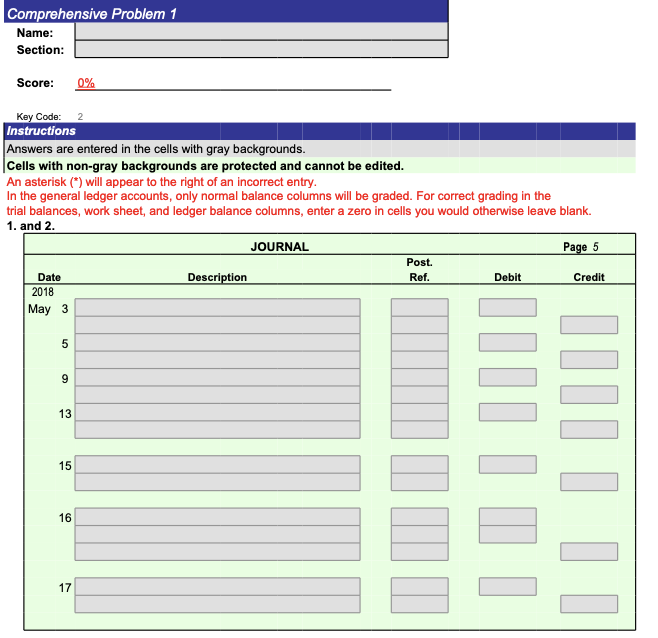

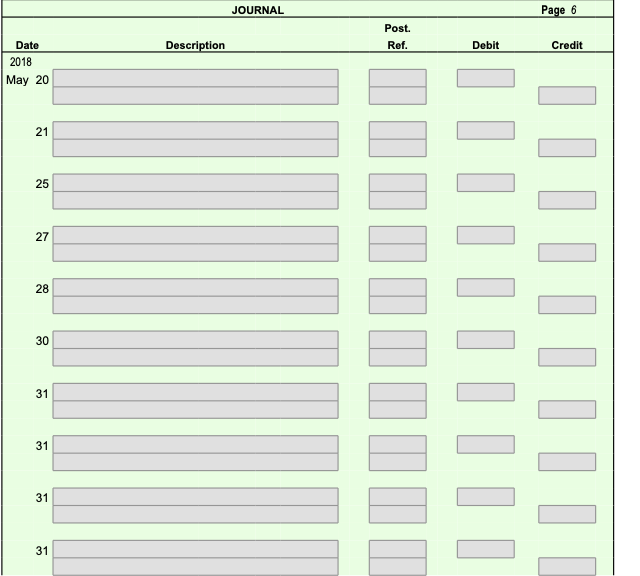

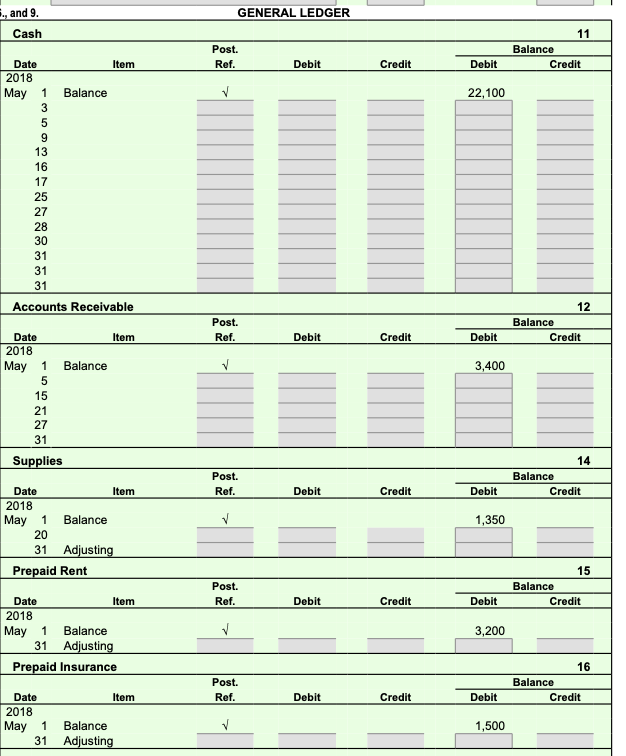

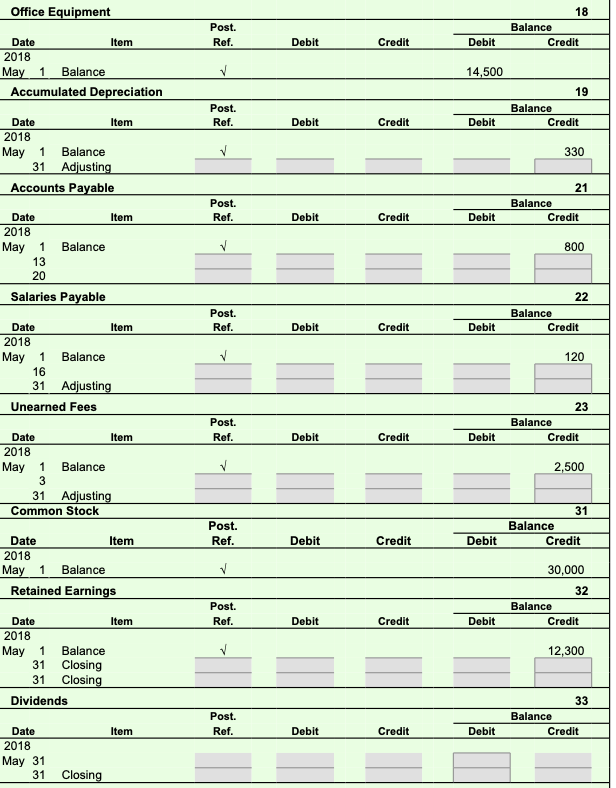

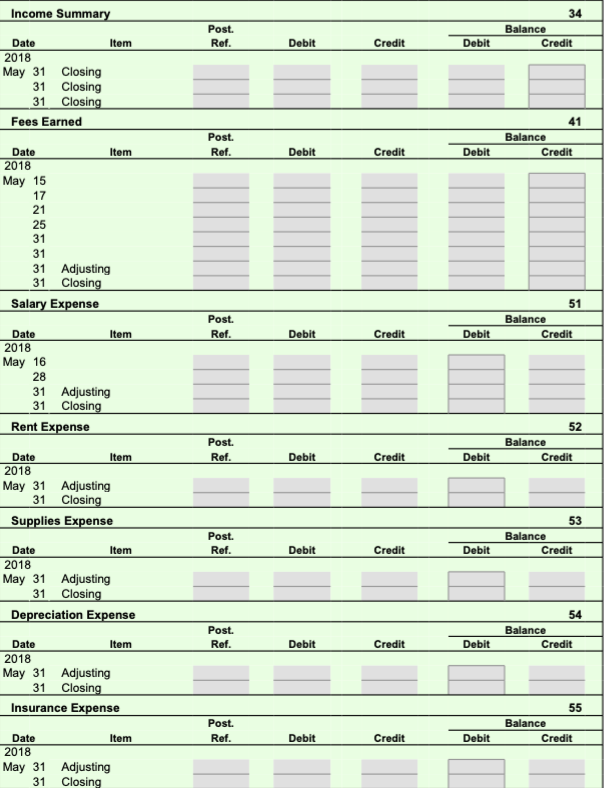

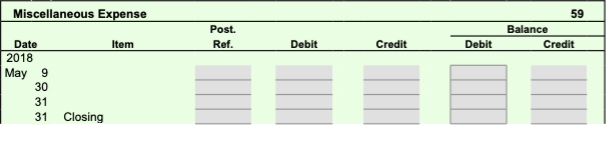

Comprehensive Problem 1 Name: Section: Score: 0% Key Code: 2. Instructions Answers are entered in the cells with gray backgrounds. Cells with non-gray backgrounds are protected and cannot be edited. An asterisk (*) will appear to the right of an incorrect entry. In the general ledger accounts, only normal balance columns will be graded. For correct grading in the trial balances, work sheet, and ledger balance columns, enter a zero in cells you would otherwise leave blank. 1. and 2. JOURNAL Post. Date Description Debit 2018 May 3 Page 5 Ref. Credit 5 9 13 15 16 17 JOURNAL Page 6 Post. Ref. Description Debit Credit Date 2018 May 20 21 25 27 28 IIIIIIIIII 30 IIIIIIIIII 31 GENERAL LEDGER ... and 9. Cash Post. Ref. 11 Balance Credit Debit Credit Debit 22,100 Date Item 2018 May 1 Balance 3 5 9 13 16 17 25 27 28 30 31 31 31 Accounts Receivable Post. Ref. 12 Balance Credit Debit Credit Debit 3,400 Date Item 2018 May 1 Balance 5 15 21 27 31 Supplies Post. Ref. 14 Balance Credit Debit Credit Debit 1,350 Date Item 2018 May 1 Balance 20 31 Adjusting Prepaid Rent Post. Ref. 15 Balance Credit Item Debit Credit Debit Date 2018 May 1 Balance 31 Adjusting Prepaid Insurance 3,200 Post. Ref. 16 Balance Credit Debit Credit Debit Date Item 2018 May 1 Balance 31 Adjusting 1,500 Office Equipment Post. Ref. 18 Balance Credit Item Debit Credit Debit Date 2018 May 1 Balance Accumulated Depreciation Item 2018 May 1 Balance 31 Adjusting Accounts Payable 14,500 19 Balance Debit Credit Post. Ref. Date Debit Credit 330 Post. Ref. 21 Balance Credit Item Debit Credit Debit Date 2018 May 1 13 20 Balance 800 Salaries Payable Post. Ref. 22 Balance Credit Debit Credit Debit 120 Date Item 2018 May 1 Balance 16 31 Adjusting Unearned Fees Post. Ref. 23 Balance Credit Debit Credit Debit 2,500 Date Item 2018 May 1 Balance 3 31 Adjusting Common Stock Post. Ref. 31 Balance Credit Debit Credit Debit Date Item 2018 May 1 Balance Retained Earnings 30,000 32 Balance Credit Post. Ref. Debit Credit Debit 12,300 Date Item 2018 May 1 Balance 31 Closing 31 Closing Dividends Post. Ref. 33 Balance Credit Item Debit Credit Debit Date 2018 May 31 31 Closing Income Summary Post. Ref. 34 Balance Credit Item Debit Credit Debit Date 2018 May 31 Closing 31 Closing 31 Closing Fees Earned Post. Ref. 41 Balance Credit Debit Credit Debit Date Item 2018 May 15 17 21 25 31 31 31 Adjusting 31 Closing Salary Expense Post. Ref. 51 Balance Credit Debit Credit Debit Date Item 2018 May 16 28 31 Adjusting 31 Closing Rent Expense 52 Post. Ref. Balance Credit Item Debit Credit Debit Date 2018 May 31 Adjusting 31 Closing Supplies Expense Post. Ref. 53 Balance Credit Date Item Debit Credit Debit 2018 May 31 Adjusting 31 Closing Depreciation Expense Post. Ref. 54 Balance Credit Debit Credit Debit Date Item 2018 May 31 Adjusting 31 Closing Insurance Expense Post. Ref. 55 Balance Credit Debit Credit Debit Date Item 2018 May 31 Adjusting 31 Closing Miscellaneous Expense Post. Ref. 59 Balance Credit Item Debit Credit Debit Date 2018 May 9 30 31 31 Closing Comprehensive Problem 1 Name: Section: Score: 0% Key Code: 2. Instructions Answers are entered in the cells with gray backgrounds. Cells with non-gray backgrounds are protected and cannot be edited. An asterisk (*) will appear to the right of an incorrect entry. In the general ledger accounts, only normal balance columns will be graded. For correct grading in the trial balances, work sheet, and ledger balance columns, enter a zero in cells you would otherwise leave blank. 1. and 2. JOURNAL Post. Date Description Debit 2018 May 3 Page 5 Ref. Credit 5 9 13 15 16 17 JOURNAL Page 6 Post. Ref. Description Debit Credit Date 2018 May 20 21 25 27 28 IIIIIIIIII 30 IIIIIIIIII 31 GENERAL LEDGER ... and 9. Cash Post. Ref. 11 Balance Credit Debit Credit Debit 22,100 Date Item 2018 May 1 Balance 3 5 9 13 16 17 25 27 28 30 31 31 31 Accounts Receivable Post. Ref. 12 Balance Credit Debit Credit Debit 3,400 Date Item 2018 May 1 Balance 5 15 21 27 31 Supplies Post. Ref. 14 Balance Credit Debit Credit Debit 1,350 Date Item 2018 May 1 Balance 20 31 Adjusting Prepaid Rent Post. Ref. 15 Balance Credit Item Debit Credit Debit Date 2018 May 1 Balance 31 Adjusting Prepaid Insurance 3,200 Post. Ref. 16 Balance Credit Debit Credit Debit Date Item 2018 May 1 Balance 31 Adjusting 1,500 Office Equipment Post. Ref. 18 Balance Credit Item Debit Credit Debit Date 2018 May 1 Balance Accumulated Depreciation Item 2018 May 1 Balance 31 Adjusting Accounts Payable 14,500 19 Balance Debit Credit Post. Ref. Date Debit Credit 330 Post. Ref. 21 Balance Credit Item Debit Credit Debit Date 2018 May 1 13 20 Balance 800 Salaries Payable Post. Ref. 22 Balance Credit Debit Credit Debit 120 Date Item 2018 May 1 Balance 16 31 Adjusting Unearned Fees Post. Ref. 23 Balance Credit Debit Credit Debit 2,500 Date Item 2018 May 1 Balance 3 31 Adjusting Common Stock Post. Ref. 31 Balance Credit Debit Credit Debit Date Item 2018 May 1 Balance Retained Earnings 30,000 32 Balance Credit Post. Ref. Debit Credit Debit 12,300 Date Item 2018 May 1 Balance 31 Closing 31 Closing Dividends Post. Ref. 33 Balance Credit Item Debit Credit Debit Date 2018 May 31 31 Closing Income Summary Post. Ref. 34 Balance Credit Item Debit Credit Debit Date 2018 May 31 Closing 31 Closing 31 Closing Fees Earned Post. Ref. 41 Balance Credit Debit Credit Debit Date Item 2018 May 15 17 21 25 31 31 31 Adjusting 31 Closing Salary Expense Post. Ref. 51 Balance Credit Debit Credit Debit Date Item 2018 May 16 28 31 Adjusting 31 Closing Rent Expense 52 Post. Ref. Balance Credit Item Debit Credit Debit Date 2018 May 31 Adjusting 31 Closing Supplies Expense Post. Ref. 53 Balance Credit Date Item Debit Credit Debit 2018 May 31 Adjusting 31 Closing Depreciation Expense Post. Ref. 54 Balance Credit Debit Credit Debit Date Item 2018 May 31 Adjusting 31 Closing Insurance Expense Post. Ref. 55 Balance Credit Debit Credit Debit Date Item 2018 May 31 Adjusting 31 Closing Miscellaneous Expense Post. Ref. 59 Balance Credit Item Debit Credit Debit Date 2018 May 9 30 31 31 Closing