Answered step by step

Verified Expert Solution

Question

1 Approved Answer

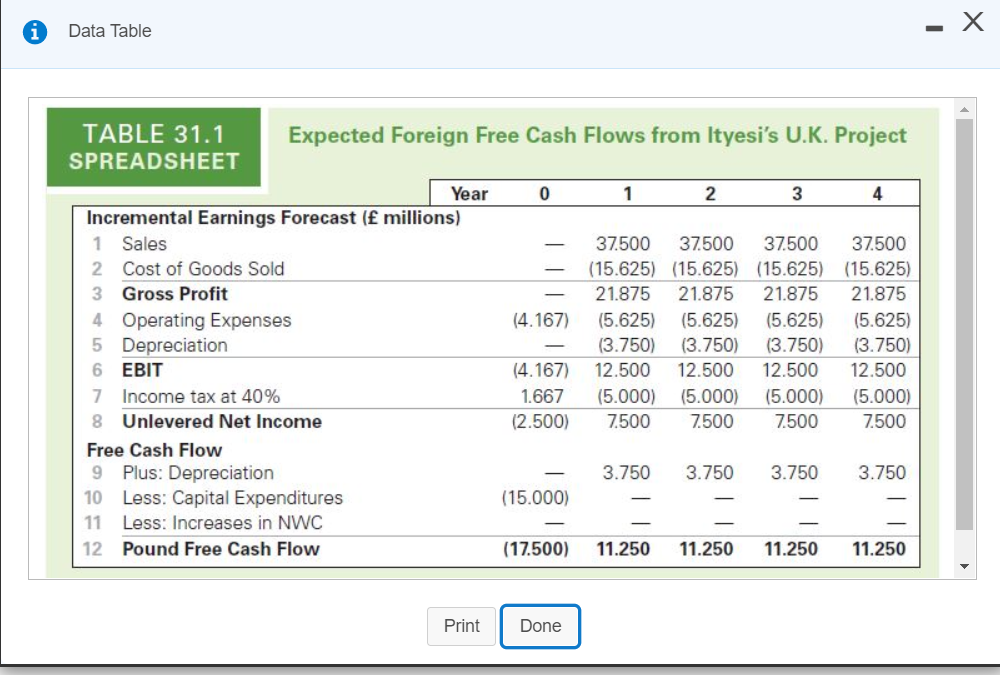

Assume that in the original Ityesi example in Table, all sales actually occur in the United States and are projected to be $ 64.8 million

Assume that in the original Ityesi example in Table, all sales actually occur in the United States and are projected to be $ 64.8 million per year for four years. Keeping other costs the same, calculate the NPV of the investment opportunity. Assume the WACC is 6.6 %. The forward exchange rates are given below.

| Year | 0 | 1 | 2 | 3 | 4 |

| Forward Exchange Rate ($/pound) | 1.5089 | 1.5873 | 1.4873 | 1.3252 | 1.3502 |

Calcualte the cash flows below:(Round to three decimal places. Forward exchange rates must be rounded to four decimal places.)

| Year | 0 | 1 | 2 | 3 | 4 |

| Free cash flow (millons of pounds) | |||||

| Forward exchange rate | |||||

| Free cash flow (millons of dollars) | |||||

| Sales in the US (millons of dollars) | |||||

| Cash flow (millons of dollars) |

The NPV is $____million.(Round to three decimal places.)

Data Table TABLE 31.1 Expected Foreign Free Cash Flows from Ityesi's U.K. Project SPREADSHEET Year 0 1 2 3 4 Incremental Earnings Forecast ( millions) 1 Sales 37.500 37.500 37.500 37.500 2 Cost of Goods Sold (15.625) (15.625) (15.625) (15.625) 3 Gross Profit 21.875 21.875 21.875 21.875 4 Operating Expenses (4.167) (5.625) (5.625) (5.625) (5.625) 5 Depreciation (3.750) (3.750) (3.750) (3.750) 6 EBIT (4.167) 12.500 12.500 12.500 12.500 7 Income tax at 40% 1.667 (5.000) (5.000) (5.000) (5.000) 8 Unlevered Net Income (2.500) 7.500 7.500 7.500 7.500 Free Cash Flow 9 Plus: Depreciation - 3.750 3.750 3.750 3.750 10 Less: Capital Expenditures (15.000) 11 Less: Increases in NWC 12 Pound Free Cash Flow (17.500) 11.250 11.250 11.250 11.250 Print Done

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started