Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume that investors want to plan what should be a fraction x; of their assets j = 1,2,..., n. To help with the planning

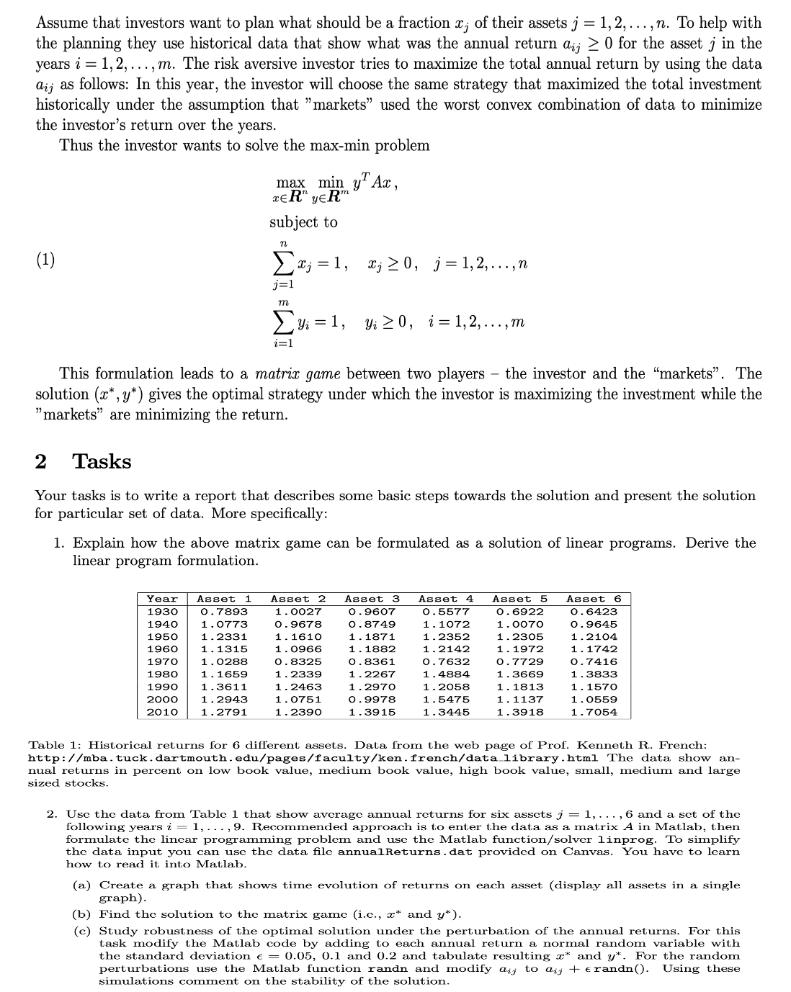

Assume that investors want to plan what should be a fraction x; of their assets j = 1,2,..., n. To help with the planning they use historical data that show what was the annual return a 20 for the asset j in the years i=1,2,..., m. The risk aversive investor tries to maximize the total annual return by using the data aij as follows: In this year, the investor will choose the same strategy that maximized the total investment historically under the assumption that "markets" used the worst convex combination of data to minimize the investor's return over the years. Thus the investor wants to solve the max-min problem (1) max min y Ax, TER" YER subject to 72 j=1 m i=1 = 1, 2, 20, j=1,2,...,n =1, 20, i=1,2,..., m This formulation leads to a matrix game between two players the investor and the "markets". The solution (x,y) gives the optimal strategy under which the investor is maximizing the investment while the "markets" are minimizing the return. 2 Tasks Your tasks is to write a report that describes some basic steps towards the solution and present the solution for particular set of data. More specifically: 1. Explain how the above matrix game can be formulated as a solution of linear programs. Derive the linear program formulation. Year Asset 1 Asset 2 Asset 3 1930 0.7893 0.9607 1940 1.0773 0.8749 1.1871 1.1315 1.1882 1950 1.2331 1960 1970 1.0288 1980 1990 1.1659 1.3611 2000 1.2943 2010 1.2791 1.0027 0.9678 1.1610 1.0966 Asset 4 0.5577 1.1072 1.2352 1.2142 0.8361 0.7632 1.2267 1.4884 1.2970 1.2058 0.9978 1.5475 1.3915 1.3445 0.8325 1.2339 1.2463 1.0751 1.2390 Asset 5 Asset 6 0.6423 0.9645 1.2104 1.1742 0.7416 1.3833 1.1570 1.0559 1.7054 0.6922 1.0070 1.2305 1.1972 0.7729 1.3669 1.1813 1.1137 1.3918 Table 1: Historical returns for 6 different assets. Data from the web page of Prof. Kenneth R. French: http://mba.tuck.dartmouth.edu/pages/faculty/ken. french/data library.html The data show an- nual returns in percent on low book value, medium book value, high book value, small, medium and large sized stocks. 2. Use the data from Table 1 that show average annual returns for six assets j = 1,..., 6 and a set of the following years i = 1,..., 9. Recommended approach is to enter the data as a matrix A in Matlab, then formulate the lincar programming problem and use the Matlab function/solver linprog. To simplify the data input you can use the data file annual Returns.dat provided on Canvas. You have to learn how to read it into Matlab. (a) Create a graph that shows time evolution of returns on each asset (display all assets in a single graph). (b) Find the solution to the matrix game (i.c., z* and y). (c) Study robustness of the optimal solution under the perturbation of the annual returns. For this task modify the Matlab code by adding to each annual return a normal random variable with the standard deviation = 0.05, 0.1 and 0.2 and tabulate resulting z* and y*. For the random perturbations use the Matlab function randn and modify ay to a + erandn(). Using these simulations comment on the stability of the solution.

Step by Step Solution

★★★★★

3.35 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

To formulate the matrix game as a linear programming problem we can define the following variables x A vector of decision variables representing the fraction of assets chosen by the investor Each elem...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started