Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume that LL has shares outstanding. These shares are traded relatively infrequently, but the last trade (made several weeks ago) was at a price of

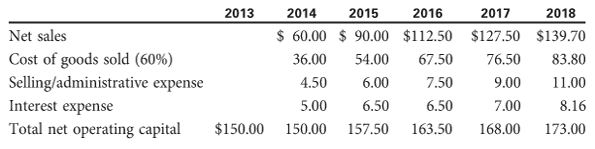

Assume that LL has shares outstanding. These shares are traded relatively infrequently, but the last trade (made several weeks ago) was at a price of . Should Hagers make an offer for Lyons Lighting? If so, how much should it offer per share? How would the analysis be different if Hagers intended to recapitalize LL with debt costing at the end of ? This amounts to in debt as of the end of 2017.

Assume that LL has shares outstanding. These shares are traded relatively infrequently, but the last trade (made several weeks ago) was at a price of . Should Hagers make an offer for Lyons Lighting? If so, how much should it offer per share? How would the analysis be different if Hagers intended to recapitalize LL with debt costing at the end of ? This amounts to in debt as of the end of 2017.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started