Answered step by step

Verified Expert Solution

Question

1 Approved Answer

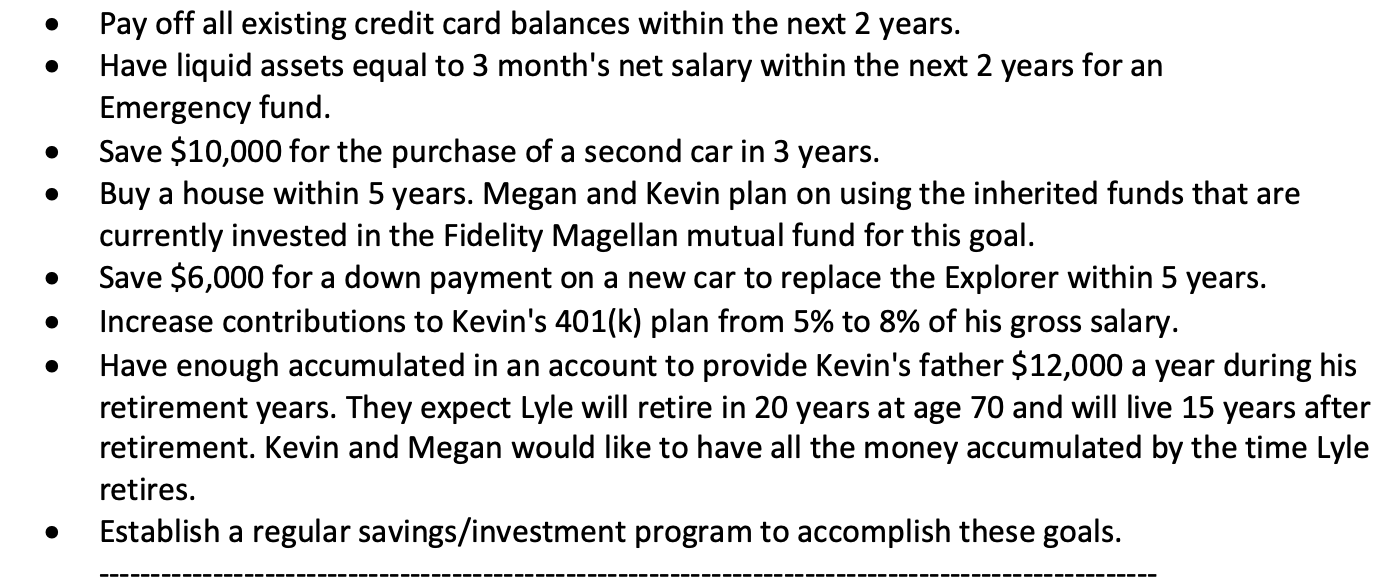

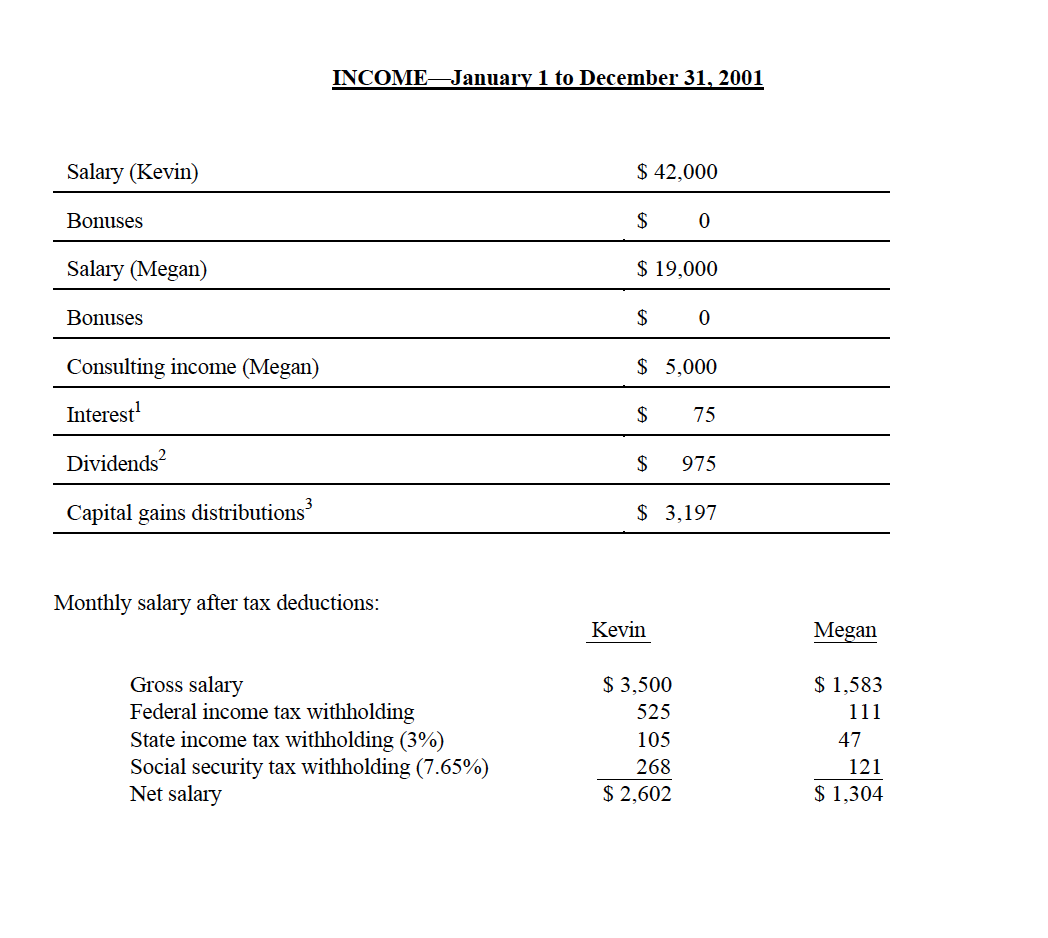

Assume that Megan and Kevin 6% (after inflation and taxes on the car goals). In figuring the savings required for Kevin's father's retirement fund, Megan

Assume that Megan and Kevin 6% (after inflation and taxes on the car goals). In figuring the savings required for Kevin's father's retirement fund, Megan and Kevin assume that they could earn 6.5% (after taxes and inflation ) on the money once his father retires. While they are accumulating the money, they feel they can take more risk and earn 8% after taxes and inflation. Using time value calculations, how much would Megan and Kevin have to save this year to be on track in meeting their goals for the second car?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started