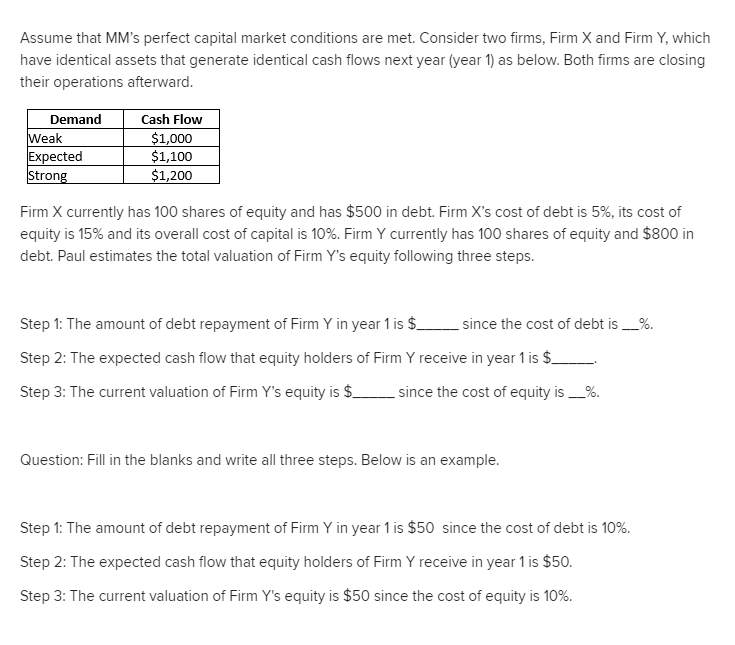

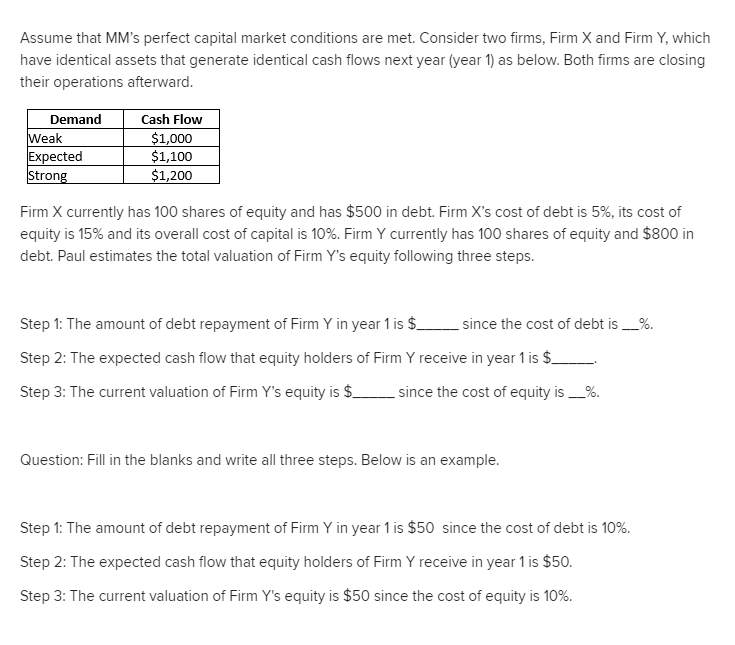

Assume that MM's perfect capital market conditions are met. Consider two firms, Firm X and Firm Y, which have identical assets that generate identical cash flows next year (year 1) as below. Both firms are closing their operations afterward. Demand Weak Expected Strong Cash Flow $1,000 $1,100 $1,200 Firm X currently has 100 shares of equity and has $500 in debt. Firm X's cost of debt is 5%, its cost of equity is 15% and its overall cost of capital is 10%. Firm Y currently has 100 shares of equity and $800 in debt. Paul estimates the total valuation of Firm Y's equity following three steps. Step 1: The amount of debt repayment of Firm Y in year 1 is $_ since the cost of debt is __%. Step 2: The expected cash flow that equity holders of Firm Y receive in year 1 is $_ Step 3: The current valuation of Firm Y's equity is $___ since the cost of equity is _%. Question: Fill in the blanks and write all three steps. Below is an example. Step 1: The amount of debt repayment of Firm Y in year 1 is $50 since the cost of debt is 10%. Step 2: The expected cash flow that equity holders of Firm Y receive in year 1 is $50. Step 3: The current valuation of Firm Y's equity is $50 since the cost of equity is 10%. Assume that MM's perfect capital market conditions are met. Consider two firms, Firm X and Firm Y, which have identical assets that generate identical cash flows next year (year 1) as below. Both firms are closing their operations afterward. Demand Weak Expected Strong Cash Flow $1,000 $1,100 $1,200 Firm X currently has 100 shares of equity and has $500 in debt. Firm X's cost of debt is 5%, its cost of equity is 15% and its overall cost of capital is 10%. Firm Y currently has 100 shares of equity and $800 in debt. Paul estimates the total valuation of Firm Y's equity following three steps. Step 1: The amount of debt repayment of Firm Y in year 1 is $_ since the cost of debt is __%. Step 2: The expected cash flow that equity holders of Firm Y receive in year 1 is $_ Step 3: The current valuation of Firm Y's equity is $___ since the cost of equity is _%. Question: Fill in the blanks and write all three steps. Below is an example. Step 1: The amount of debt repayment of Firm Y in year 1 is $50 since the cost of debt is 10%. Step 2: The expected cash flow that equity holders of Firm Y receive in year 1 is $50. Step 3: The current valuation of Firm Y's equity is $50 since the cost of equity is 10%