Answered step by step

Verified Expert Solution

Question

1 Approved Answer

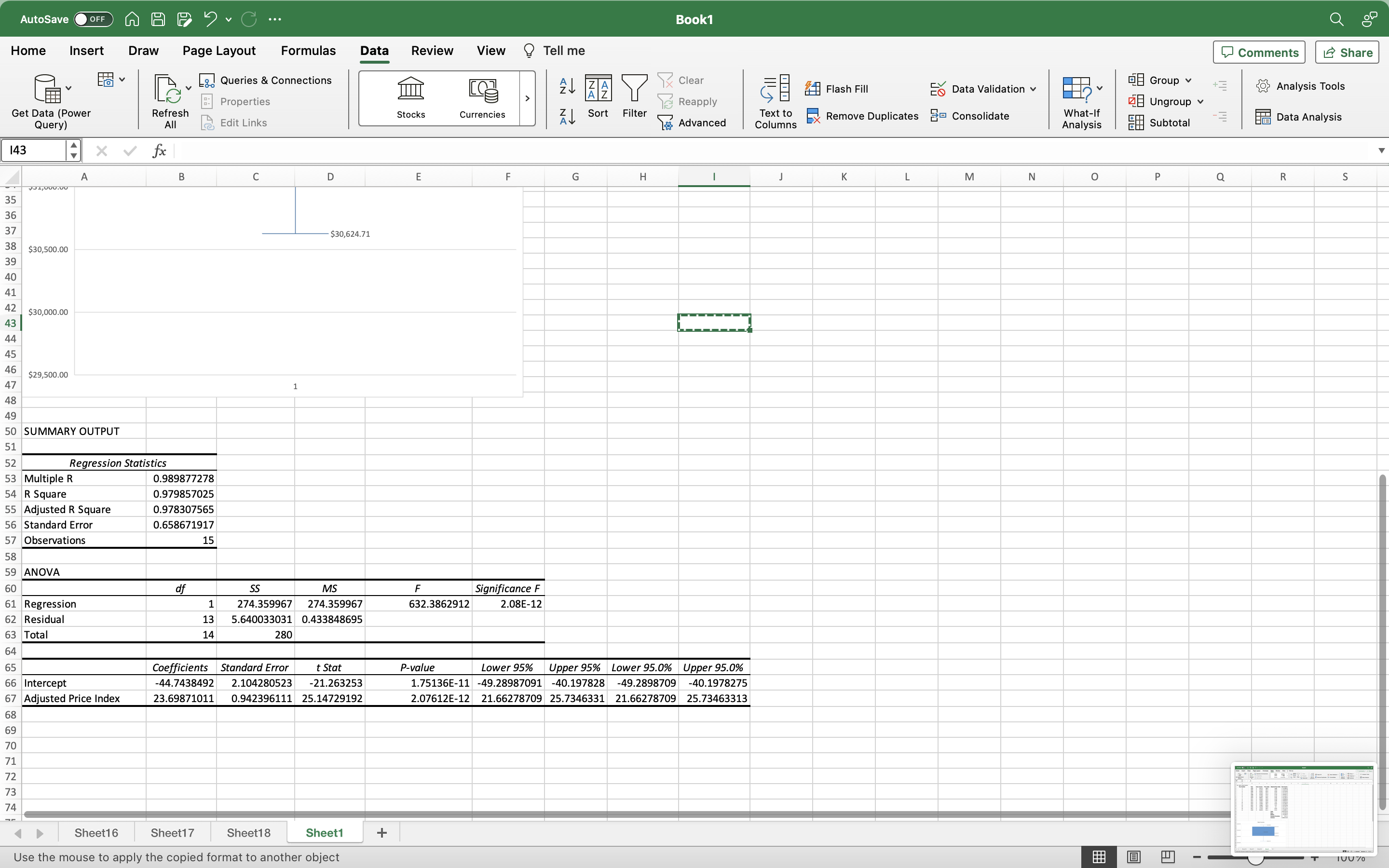

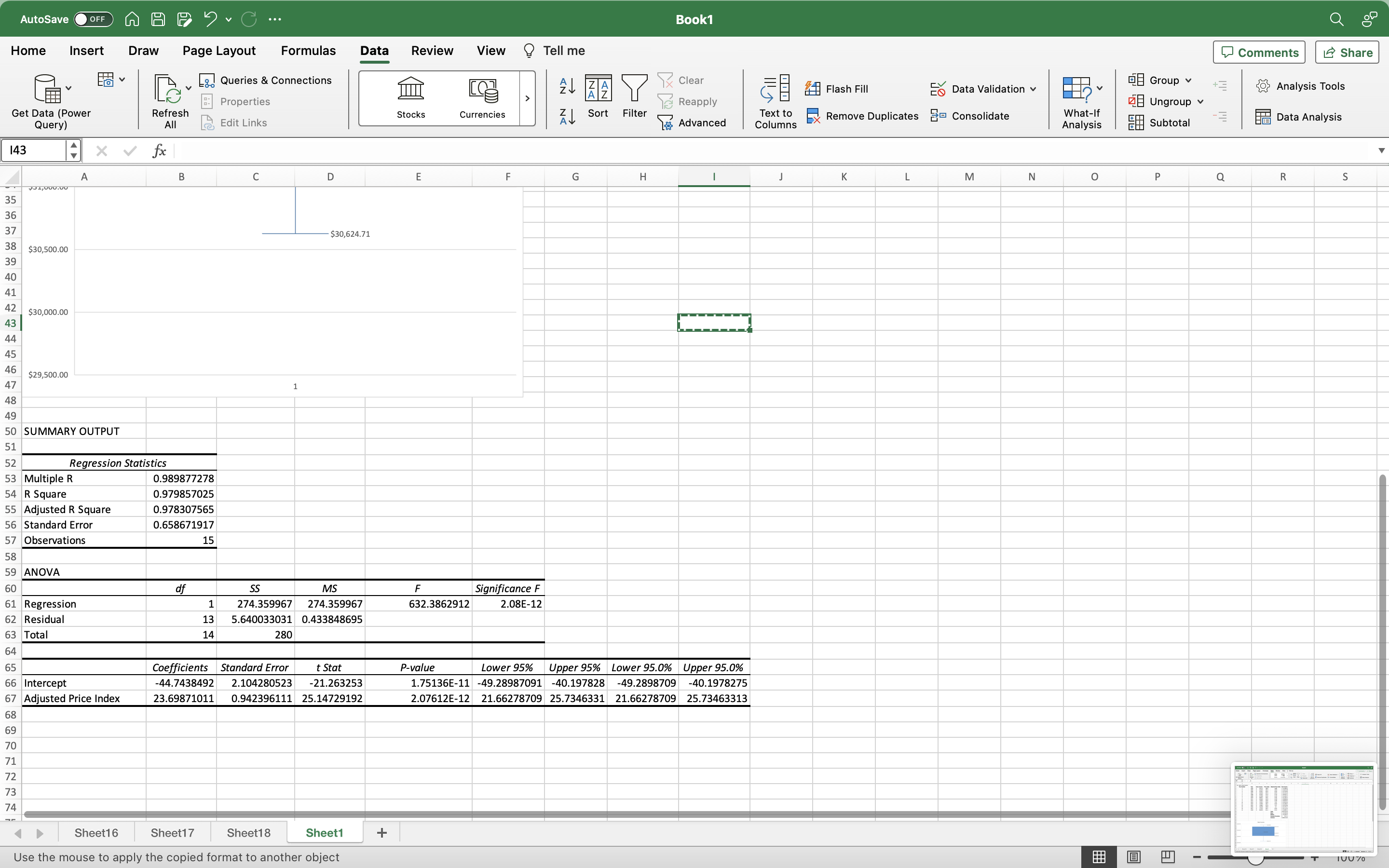

Assume that Mrs. Ivory's real income will not change over the next sixteen years. Use the mean real income from question 1 to determine projected

Assume that Mrs. Ivory's real income will not change over the next sixteen years. Use

the mean real income from question 1 to determine projected real income for the future

sixteen years of Mrs. Ivory's work expectancy. Use the regression equation from

question 2 to project adjusted price indices for the next sixteen years. Assume that Mrs.

Ivory pays 20% of her actual income in taxes and that Green will not provide significant

state assistance. Use the projected real income and adjusted price indices to estimate

Mrs. Ivory's net actual income for the next sixteen years. What would be the likely

amount of an award to Mrs. Ivory based on a present value rate of 8%? Discuss the

factors that could cause Mrs. Ivory's future income to differ from your estimate

the mean real income from question 1 to determine projected real income for the future

sixteen years of Mrs. Ivory's work expectancy. Use the regression equation from

question 2 to project adjusted price indices for the next sixteen years. Assume that Mrs.

Ivory pays 20% of her actual income in taxes and that Green will not provide significant

state assistance. Use the projected real income and adjusted price indices to estimate

Mrs. Ivory's net actual income for the next sixteen years. What would be the likely

amount of an award to Mrs. Ivory based on a present value rate of 8%? Discuss the

factors that could cause Mrs. Ivory's future income to differ from your estimate

AutoSave OFF Book1 Home Insert Draw Page Layout Formulas Data Review View Tell me Queries & Connections Clear Properties Reapply Get Data (Power Query) Refresh All Stocks Currencies Sort Filter Edit Links Advanced Text to Columns 143 fx A B C D E F G H 350,000.00 35 36 37 38 $30,500.00 39 40 41 42 $30,000.00 43 44 45 46 $29,500.00 47 48 49 50 SUMMARY OUTPUT 51 52 Regression Statistics 53 Multiple R 0.989877278 54 R Square 0.979857025 55 Adjusted R Square 0.978307565 56 Standard Error 0.658671917 57 Observations 15 58 59 ANOVA 60 61 Regression 62 Residual 63 Total 64 65 66 Intercept 67 Adjusted Price Index 68 69 70 71 72 73 74 Sheet16 1 $30,624.71 df SS 1 274.359967 13 MS 274.359967 5.640033031 0.433848695 14 280 F 632.3862912 Significance F 2.08E-12 Lower 95% Upper 95% Lower 95.0% Upper 95.0% 1.75136E-11 -49.28987091 -40.197828 2.07612E-12 21.66278709 25.7346331 -49.2898709 21.66278709 -40.1978275 25.73463313 Coefficients -44.7438492 23.69871011 Standard Error t Stat 2.104280523 -21.263253 0.942396111 25.14729192 P-value Sheet17 Sheet18 Sheet1 + Use the mouse to apply the copied format to another object Comments BD Share Group v Flash Fill Remove Duplicates Consolidate Data Validation Analysis Tools z Ungroup v What-If Analysis Data Analysis Subtotal J K L M N O P Q R S B A 100%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Factors That Could Cause Mrs Ivorys Future Income to Differ from the Estimate The estimate assumes s...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started