Answered step by step

Verified Expert Solution

Question

1 Approved Answer

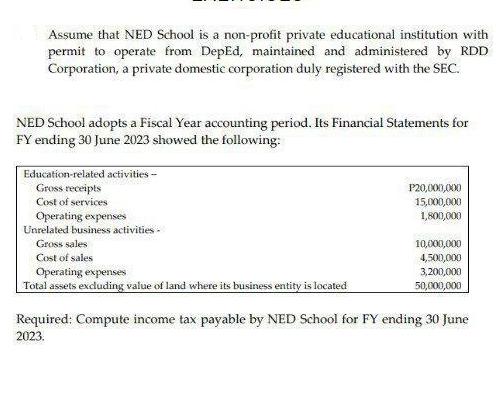

Assume that NED School is a non-profit private educational institution with permit to operate from DepEd, maintained and administered by RDD Corporation, a private

Assume that NED School is a non-profit private educational institution with permit to operate from DepEd, maintained and administered by RDD Corporation, a private domestic corporation duly registered with the SEC. NED School adopts a Fiscal Year accounting period. Its Financial Statements for FY ending 30 June 2023 showed the following: Education-related activities - Gross receipts Cost of services Operating expenses Unrelated business activities. Gross sales Cost of sales Operating expenses Total assets excluding value of land where its business entity is located P20,000,000 15,000,000 1,800,000 10,000,000 4,500,000 3,200,000 50,000,000 Required; Compute income tax payable by NED School for FY ending 30 June 2023.

Step by Step Solution

★★★★★

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Let us assume the income tax is 30 assuming Philippines as jurisdiction Taxable income receipts ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started