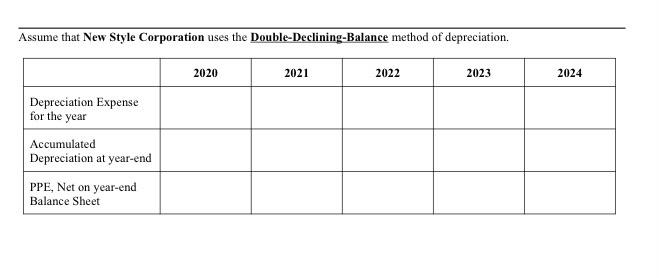

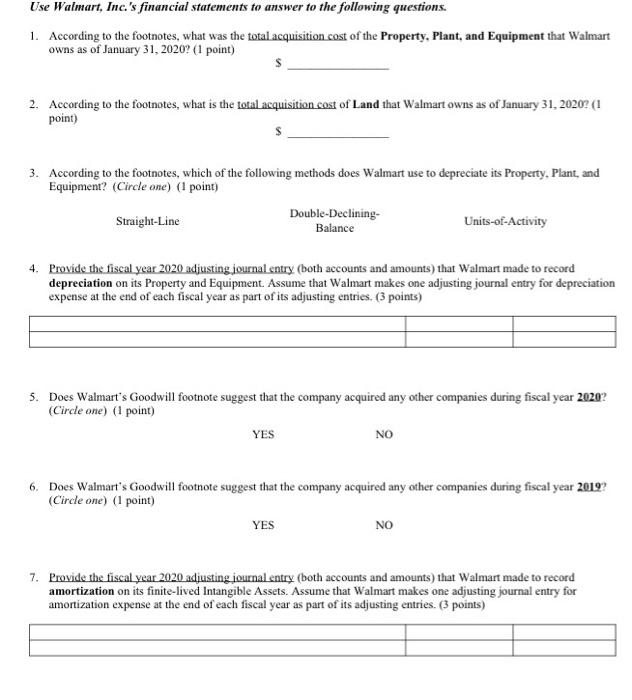

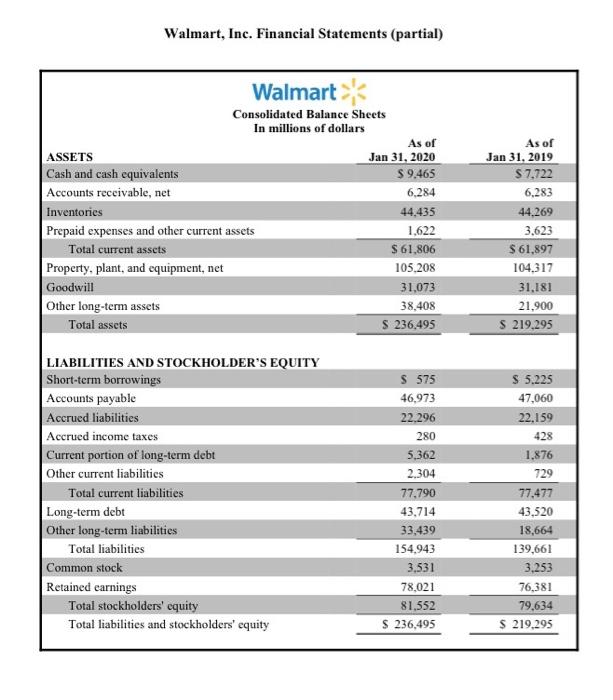

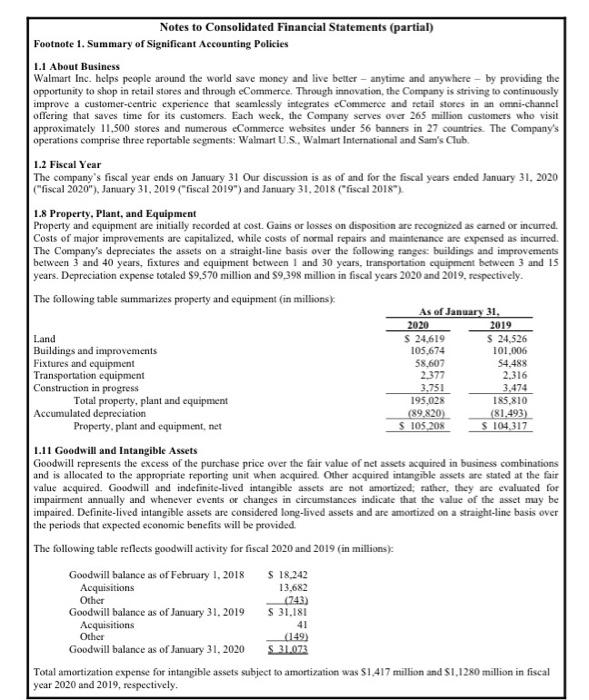

Assume that New Style Corporation uses the Double-Declining-Balance method of depreciation. 2020 2021 2022 2023 2024 Depreciation Expense for the year Accumulated Depreciation at year-end PPE, Net on year-end Balance Sheet Use Walmart, Inc.'s financial statements to answer to the following questions. 1. According to the footnotes, what was the total acquisition cost of the Property, Plant, and Equipment that Walmart owns as of January 31, 2020? (1 point) 2. According to the footnotes, what is the total acquisition cost of Land that Walmart owns as of January 31, 2020? (1 point) 3. According to the footnotes, which of the following methods does Walmart use to depreciate its Property, Plant, and Equipmen? (Circle one) (1 point) Double-Declining. Straight-Line Balance Units-of-Activity 4. Provide the fiscal year 2020 adjusting journal entry (both accounts and amounts) that Walmart made to record depreciation on its Property and Equipment. Assume that Walmart makes one adjusting journal entry for depreciation expense at the end of each fiscal year as part of its adjusting entries. (3 points) 5. Does Walmart's Goodwill footnote suggest that the company acquired any other companies during fiscal year 2020? (Circle one) (1 point) YES NO 6. Does Walmart's Goodwill footnote suggest that the company acquired any other companies during fiscal year 2019? (Circle one) (1 point) YES NO 7. Provide the fiscal year 2020 adjusting journal entry (both accounts and amounts) that Walmart made to record amortization on its finite-lived Intangible Assets. Assume that Walmart makes one adjusting journal entry for amortization expense at the end of each fiscal year as part of its adjusting entries. (3 points) Walmart, Inc. Financial Statements (partial) Walmart Consolidated Balance Sheets In millions of dollars As of ASSETS Jan 31, 2020 Cash and cash equivalents $ 9,465 Accounts receivable, net 6,284 Inventories 44,435 Prepaid expenses and other current assets 1,622 Total current assets $ 61,806 Property, plant, and equipment, net 105,208 Goodwill 31,073 Other long-term assets 38,408 Total assets S 236,495 As of Jan 31, 2019 $ 7.722 6,283 44.269 3,623 $ 61,897 104.317 31,181 21,900 S 219.295 LIABILITIES AND STOCKHOLDER'S EQUITY Short-term borrowings Accounts payable Accrued liabilities Accrued income taxes Current portion of long-term debt Other current liabilities Total current liabilities Long-term debt Other long-term liabilities Total liabilities Common stock Retained earnings Total stockholders' equity Total liabilities and stockholders' equity S 575 46,973 22.296 280 5,362 2.304 77,790 43,714 33,439 154.943 3,531 78,021 81,552 $ 236,495 S 5.225 47,060 22.159 428 1.876 729 77,477 43,520 18,664 139,661 3,253 76,381 79.634 $ 219,295 Notes to Consolidated Financial Statements (partial) Footnote 1. Summary of Significant Accounting Policies 1.1 About Business Walmart Inc. helps people around the world save money and live better - anytime and anywhere - by providing the opportunity to shop in retail stores and through eCommerce. Through innovation, the Company is striving to continuously improve a customer-centric experience that seamlessly integrates eCommerce and retail stores in an omni-channel offering that saves time for its customers. Each week, the Company serves over 265 million customers who visit approximately 11.500 stores and numerous Commerce websites under 56 banners in 27 countries. The Company's operations comprise three reportable segments: Walmart U.S., Walmart International and Sam's Club 1.2 Fiscal Year The company's fiscal year ends on January 31 Our discussion is as of and for the fiscal years ended January 31, 2020 ("fiscal 2020"), January 31, 2019 ("fiscal 2019") and January 31, 2018 ("fiscal 2018") 1.8 Property. Plant, and Equipment Property and equipment are initially recorded at cost. Gains or losses on disposition are recognized as carned or incurred. Costs of major improvements are capitalized, while costs of normal repairs and maintenance are expensed as incurred. The Company's depreciates the assets on a straight-line basis over the following ranges: buildings and improvements between 3 and 40 years, fixtures and equipment between 1 and 30 years, transportation cquipment between 3 and 15 years. Depreciation expense totaled $9,570 million and 59.398 million in fiscal years 2020 and 2019, respectively. The following table summarizes property and equipment (in millions) As of January 31. 2020 2019 Land $ 24,619 $ 24,526 Buildings and improvements 105,674 101.006 Fixtures and equipment 58,607 54.488 Transportation equipment 2.377 2.316 Construction in progress 3.751 3,474 Total property, plant and equipment 195,028 185,810 Accumulated depreciation (89.820 (81.493) Property, plant and equipment, net S 105,208 S 104.317 1.11 Goodwill and Intangible Assets Goodwill represents the excess of the purchase price over the fair value of net assets acquired in business combinations and is allocated to the appropriate reporting unit when acquired. Other acquired intangible assets are stated at the fair value acquired. Goodwill and indefinite-lived intangible assets are not amortized rather, they are evaluated for impairment annually and whenever events or changes in circumstances indicate that the value of the asset may be impaired. Definite-lived intangible assets are considered long-lived assets and are amortized on a straight-line basis over the periods that expected economic benefits will be provided. The following table reflects goodwill activity for fiscal 2020 and 2019 (in millions) Goodwill balance as of February 1, 2018 S 18.242 Acquisitions 13,682 Other (743) Goodwill balance as of January 31, 2019 S 31.181 Acquisitions 41 Other (149) Goodwill balance as of January 31, 2020 S31073 Total amortization expense for intangible assets subject to amortization was $1.417 million and S1,1280 million in fiscal year 2020 and 2019, respectively