Answered step by step

Verified Expert Solution

Question

1 Approved Answer

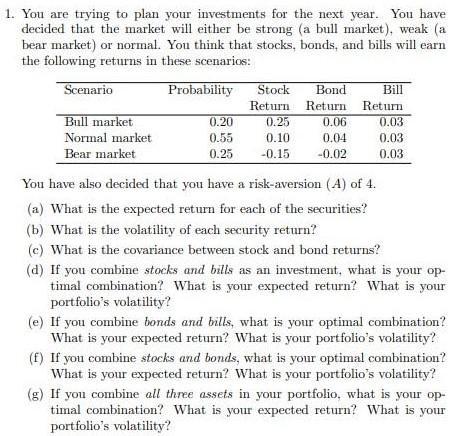

1. You are trying to plan your investments for the next year. You have decided that the market will either be strong (a bull

1. You are trying to plan your investments for the next year. You have decided that the market will either be strong (a bull market), weak (a bear market) or normal. You think that stocks, bonds, and bills will earn the following returns in these scenarios: Probability Scenario Bull market Normal market Bear market 0.20 0.55 0.25 Stock Bond Return Return 0.25 0.06 0.10 0.04 -0.15 -0.02 Bill Return 0.03 0.03 0.03 You have also decided that you have a risk-aversion (A) of 4. (a) What is the expected return for each of the securities? (b) What is the volatility of each security return? (c) What is the covariance between stock and bond returns? (d) If you combine stocks and bills as an investment, what is your op- timal combination? What is your expected return? What is your portfolio's volatility? (e) If you combine bonds and bills, what is your optimal combination? What is your expected return? What is your portfolio's volatility? (f) If you combine stocks and bonds, what is your optimal combination? What is your expected return? What is your portfolio's volatility? (g) If you combine all three assets in your portfolio, what is your op- timal combination? What is your expected return? What is your portfolio's volatility?

Step by Step Solution

★★★★★

3.34 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

a Stock return 025 x 020 015 x 055 002 x 010 011 Bond return 006 x 020 003 x 055 004 x 010 003 Bill ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

635d6eb49ce5e_175566.pdf

180 KBs PDF File

635d6eb49ce5e_175566.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started