Question

Assume that on Jan 1, 2014, an investor company purchased 100% of the outstanding voting CS of the investee. On the date of the acquistion,

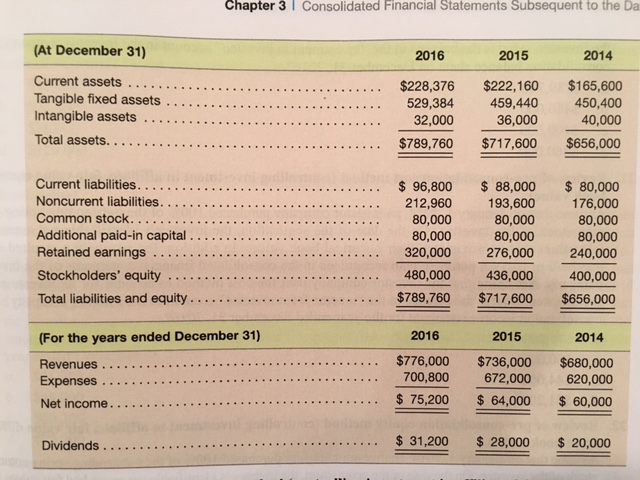

Assume that on Jan 1, 2014, an investor company purchased 100% of the outstanding voting CS of the investee. On the date of the acquistion, the investee's identifiable net assets had fair values that approximated their historical book values, except for tangible fixed assets, which had fair value that was $90,000 higher than the investee's recorded book value. The tangible fixed assets had a remaining useful life of 6 years. In addition, the acquisition resulted in goodwill in the amount of $175,000 recongnized in the consolidated financial statements of the investor company. On Jan. 1, 2014, the investee's R/E balance was $200,000. Assuming that the investor company uses the cost method to account for its investment in the investee, what is the amount of the (ADJ) entry necessary to prepare the consolidated financial statements for the year ended Dec 31, 2016?

a.) $46,000

b.) $75,000

c.) $76,000

d.) $120,000

Chapter 3l Consolidated Financial Statements Subsequent to the Da (At December 31) Current assets Tangible fixed assets Intangible assets Total assets. 2016 2015 2014 . $228,376 32,000 36,000 40,000 $789,760 $717,600 $656,000 193,600 176,000 80,000 80,000 240,000 400,000 $789,760$717,600 $656,000 212,960 .80,000 80,000 80,000 80,000 .. ..320,000 276,000 436,000 Stockholders' equity . 480,000 For the years ended December 31) 2016 2015 2014 $776,000 $%736,000 $680,000 672,000 Expenses . 700,800 620,000 31,200 $ 28,000 20,000 DividendsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started