Question

Assume that on January 1, 2016 an investor company paid $14,500 to an investee company in exchange for the following assets and liabilities transferred from

Assume that on January 1, 2016 an investor company paid $14,500 to an investee company in exchange for the following assets and liabilities transferred from the investee company:

| Asset (Liability) | Investee's Book Value | Estimated Fair Value |

|---|---|---|

| Production equipment | $1,500 | $1,300 |

| Factory | 7,500 | 7,150 |

| Land | 500 | 1,950 |

| Patents | - | 2,600 |

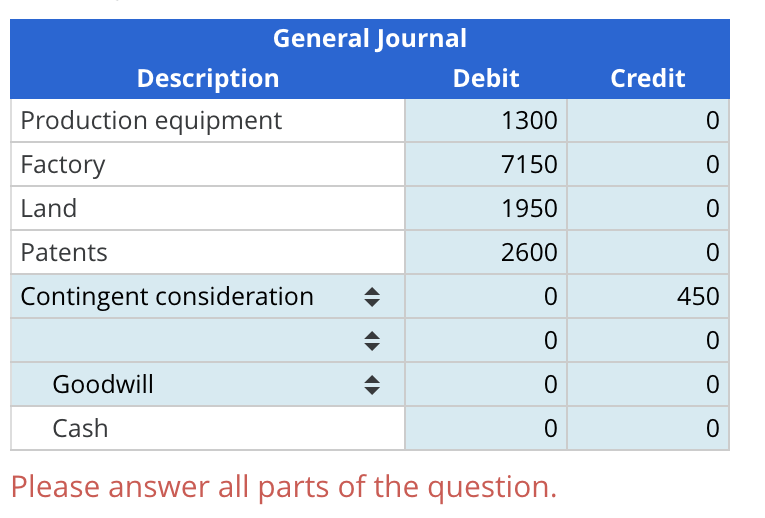

In addition, the investor provided to the seller contingent consideration with a fair value of $200 and the investor paid an additional $500 of transaction costs to an unaffiliated third party. The contingent consideration has a potential settlement value of $450 in two years, and is not a derivative financial instrument. The book values are from the investees financial records immediately before the exchange. The fair values are measured in accordance with FASB ASC 820: Fair Value Measurement.

Parts a. and b. are independent of each other.

If no additional debit or credit entries are required, select "No entry" as the answer.

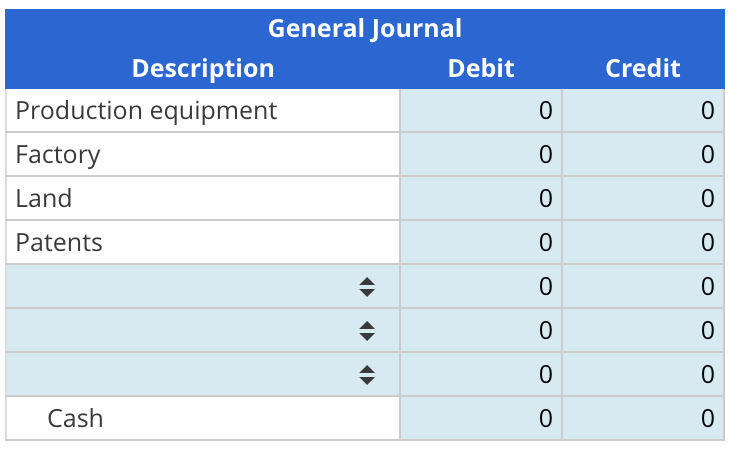

a. Provide the journal entry recorded by the investor company assuming that the net assets transferred from the investee do not qualify as a business, as that term is defined in FASB ASC Master Glossary.

b. Provide the journal entry recorded by the investor company assuming that the net assets transferred from the investee qualify as a business, as that term is defined in FASB ASC Master Glossary.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started