Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume that on January 1, 2018, Allan and Boom formed a partnership with an investment of P40,000 by Allan and P60,000 by Boom. On

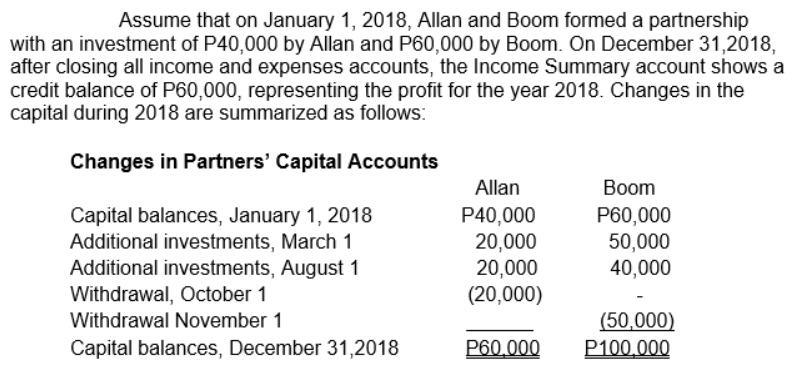

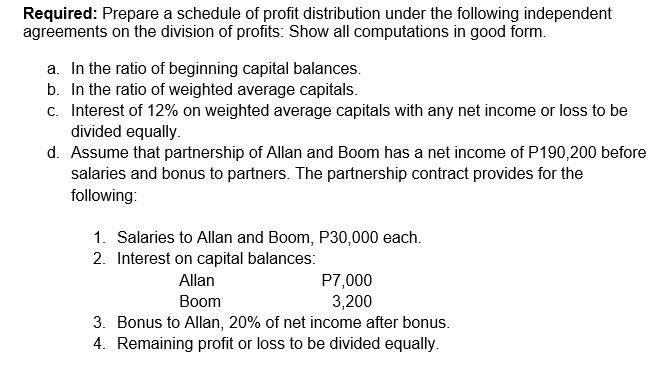

Assume that on January 1, 2018, Allan and Boom formed a partnership with an investment of P40,000 by Allan and P60,000 by Boom. On December 31,2018, after closing all income and expenses accounts, the Income Summary account shows a credit balance of P60,000, representing the profit for the year 2018. Changes in the capital during 2018 are summarized as follows: Changes in Partners' Capital Accounts Capital balances, January 1, 2018 Additional investments, March 1 Additional investments, August 1 Withdrawal, October 1 Withdrawal November 1 Capital balances, December 31,2018 Allan P40,000 20,000 20,000 (20,000) P60,000 Boom P60,000 50,000 40,000 (50,000) P100.000 Required: Prepare a schedule of profit distribution under the following independent agreements on the division of profits: Show all computations in good form. a. In the ratio of beginning capital balances. b. In the ratio of weighted average capitals. c. Interest of 12% on weighted average capitals with any net income or loss to be divided equally. d. Assume that partnership of Allan and Boom has a net income of P190,200 before salaries and bonus to partners. The partnership contract provides for the following: 1. Salaries to Allan and Boom, P30,000 each. 2. Interest on capital balances: Allan Boom 3. Bonus to Allan, 20% of net income after bonus. 4. Remaining profit or loss to be divided equally. P7,000 3,200

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To create a schedule of profit distribution under the different scenarios well first review the capital contributions and withdrawals as listed and then apply each set of agreements to the net income ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started