Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Journalize the following admission of Ocampo in the ELM partnership assuming the following capital balances and income ratios: (10 points) Capital Edwin Balance Leon

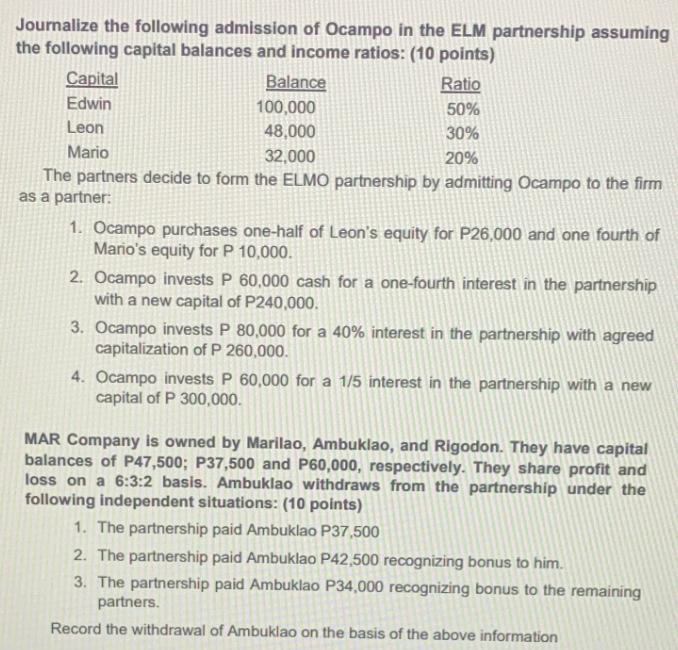

Journalize the following admission of Ocampo in the ELM partnership assuming the following capital balances and income ratios: (10 points) Capital Edwin Balance Leon Mario Ratio 50% 30% 20% 100,000 48,000 32,000 The partners decide to form the ELMO partnership by admitting Ocampo to the firm as a partner: 1. Ocampo purchases one-half of Leon's equity for P26,000 and one fourth of Mario's equity for P 10,000. 2. Ocampo invests P 60,000 cash for a one-fourth interest in the partnership with a new capital of P240,000. 3. Ocampo invests P 80,000 for a 40% interest in the partnership with agreed capitalization of P 260,000. 4. Ocampo invests P 60,000 for a 1/5 interest in the partnership with a new capital of P 300,000. MAR Company is owned by Marilao, Ambuklao, and Rigodon. They have capital balances of P47,500; P37,500 and P60,000, respectively. They share profit and loss on a 6:3:2 basis. Ambuklao withdraws from the partnership under the following independent situations: (10 points) 1. The partnership paid Ambuklao P37,500 2. The partnership paid Ambuklao P42,500 recognizing bonus to him. 3. The partnership paid Ambuklao P34,000 recognizing bonus to the remaining partners. Record the withdrawal of Ambuklao on the basis of the above information

Step by Step Solution

★★★★★

3.41 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

ELMO Partnership Admission of Ocampo 1 Journal Entry to record the purchase of onehalf of Leons equi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started