Answered step by step

Verified Expert Solution

Question

1 Approved Answer

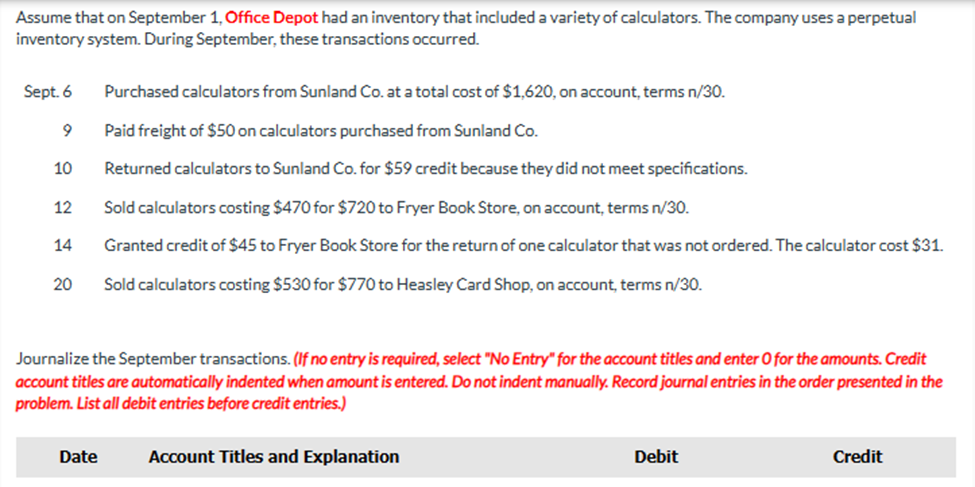

Assume that on September 1, Office Depot had an inventory that included a variety of calculators. The company uses a perpetual inventory system. During September,

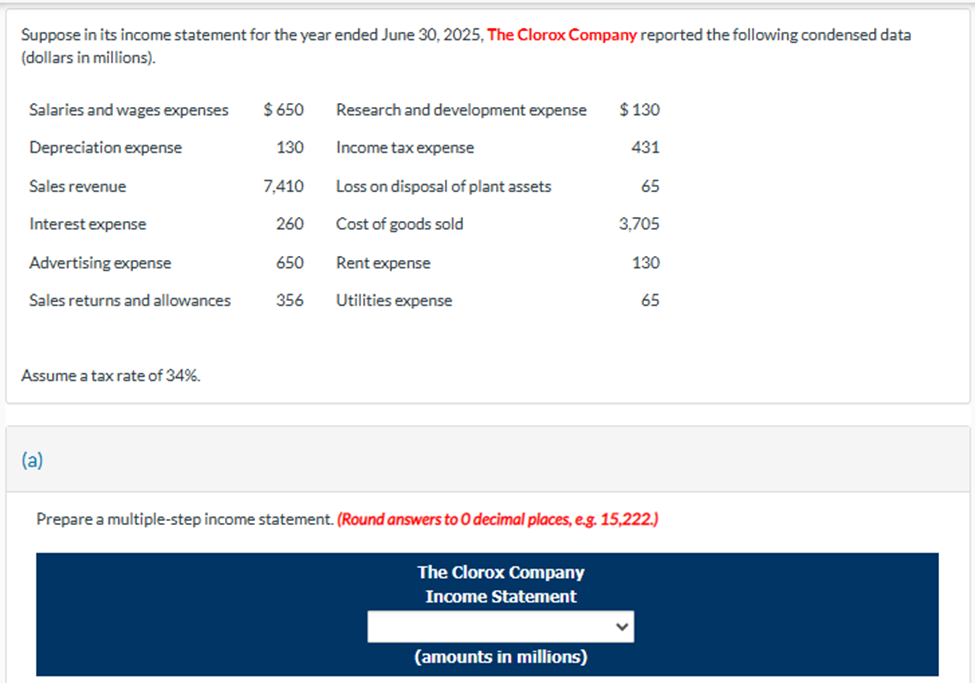

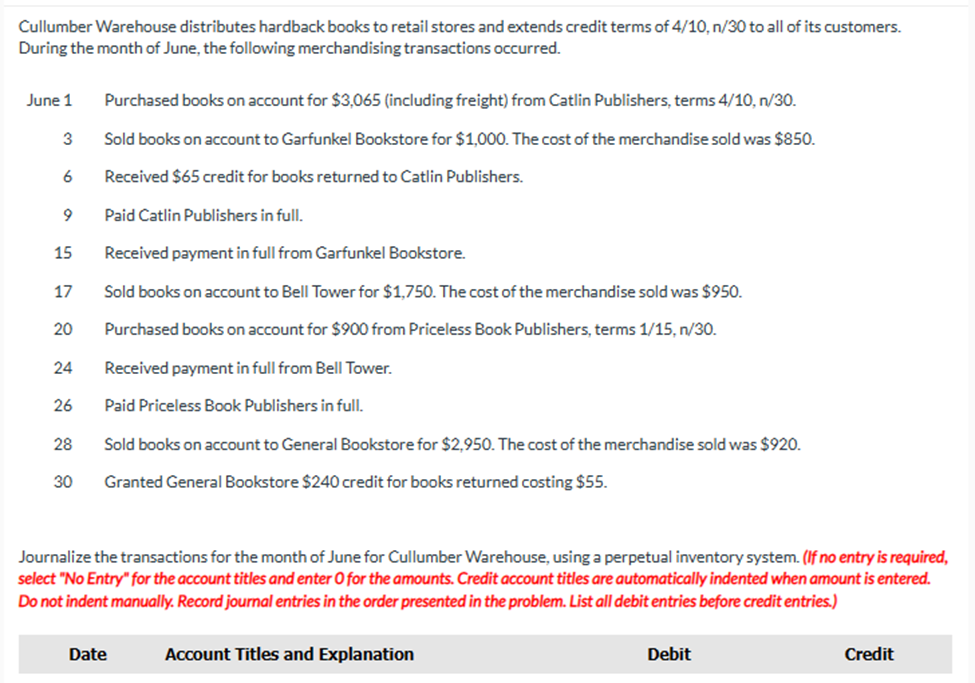

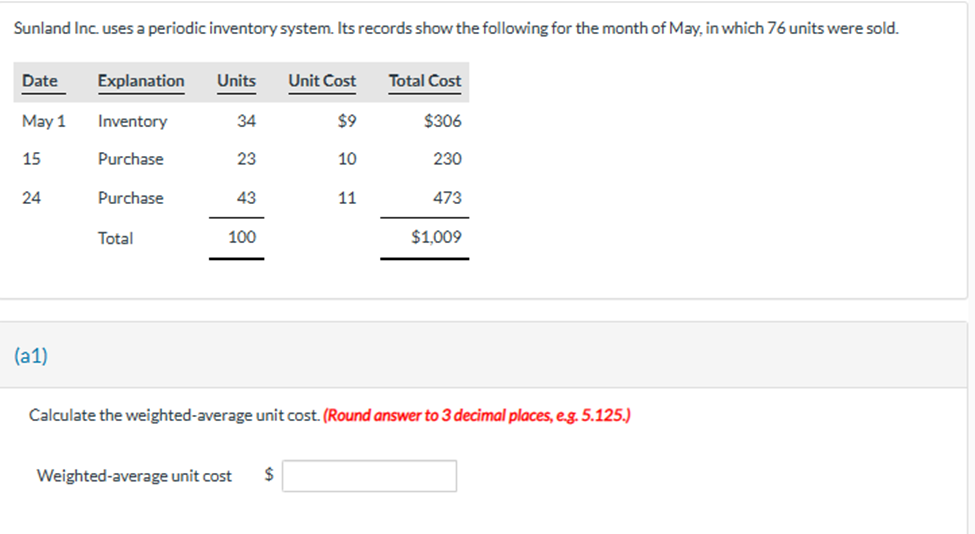

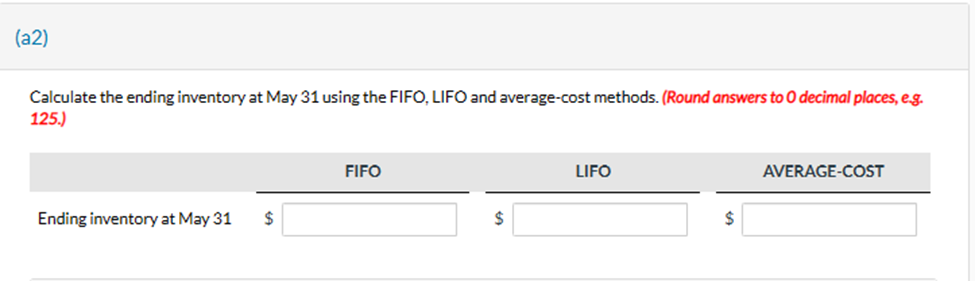

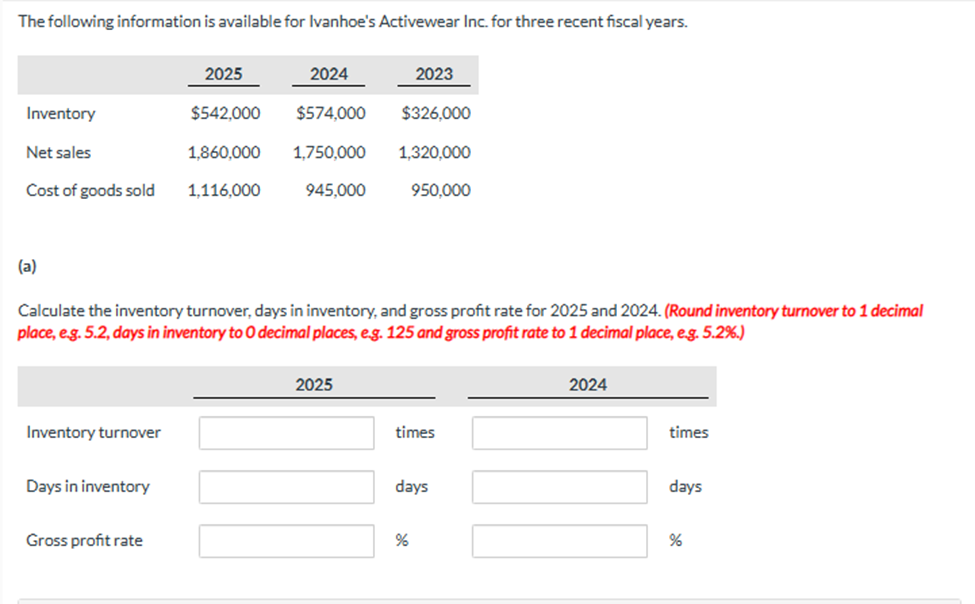

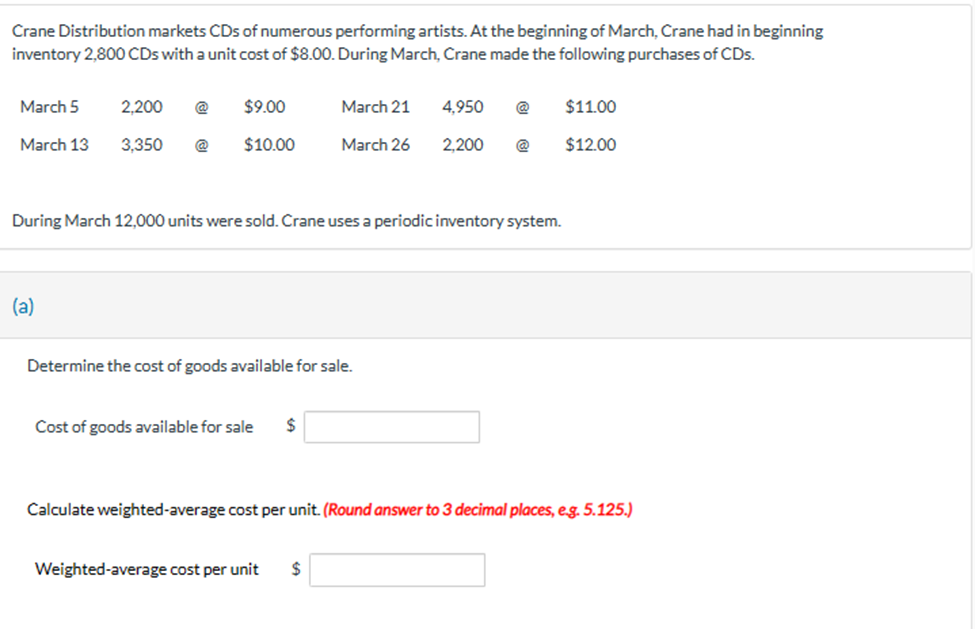

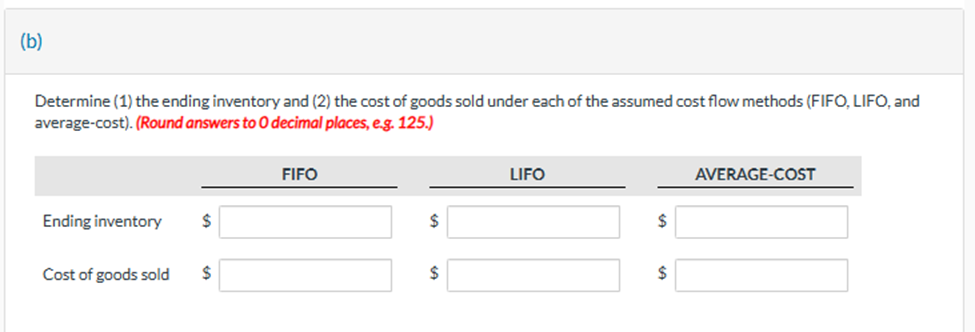

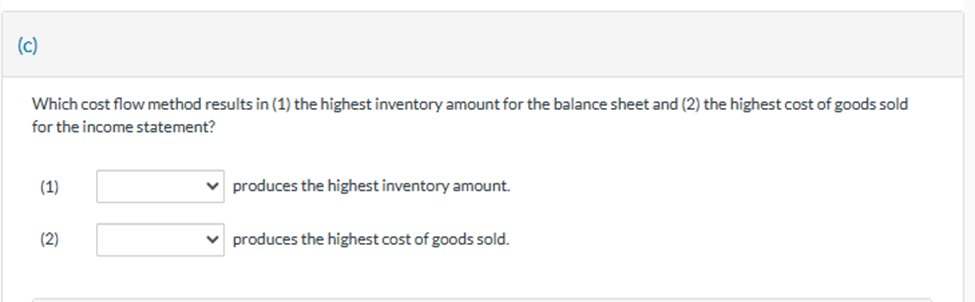

Assume that on September 1, Office Depot had an inventory that included a variety of calculators. The company uses a perpetual inventory system. During September, these transactions occurred. Sept. 6 Purchased calculators from Sunland Co. at a total cost of $1,620, on account, terms n/30. 9 Paid freight of $50 on calculators purchased from Sunland Co. 10 Returned calculators to Sunland Co. for $59 credit because they did not meet specifications. 12 Sold calculators costing $470 for $720 to Fryer Book Store, on account, terms n/30. 14 Granted credit of $45 to Fryer Book Store for the return of one calculator that was not ordered. The calculator cost $31. 20 Sold calculators costing $530 for $770 to Heasley Card Shop, on account, terms n/30. Journalize the September transactions. (If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem. List all debit entries before credit entries.) Suppose in its income statement for the year ended June 30, 2025, The Clorox Company reported the following condensed data (dollars in millions). Assume a tax rate of 34%. (a) Prepare a multiple-step income statement. (Round answers to 0 decimal places, e.g. 15,222.) Cullumber Warehouse distributes hardback books to retail stores and extends credit terms of 4/10,n/30 to all of its customers. During the month of June, the following merchandising transactions occurred. June 1 Purchased books on account for $3,065 (including freight) from Catlin Publishers, terms 4/10, n/30. 3 Sold books on account to Garfunkel Bookstore for $1,000. The cost of the merchandise sold was $850. 6 Received $65 credit for books returned to Catlin Publishers. 9 Paid Catlin Publishers in full. 15 Received payment in full from Garfunkel Bookstore. 17 Sold books on account to Bell Tower for $1,750. The cost of the merchandise sold was $950. 20 Purchased books on account for $900 from Priceless Book Publishers, terms 1/15,n/30. 24 Received payment in full from Bell Tower. 26 Paid Priceless Book Publishers in full. 28 Sold books on account to General Bookstore for $2,950. The cost of the merchandise sold was $920. 30 Granted General Bookstore $240 credit for books returned costing $55. Journalize the transactions for the month of June for Cullumber Warehouse, using a perpetual inventory system. (If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem. List all debit entries before credit entries.) Sunland Inc. uses a periodic inventory system. Its records show the following for the month of May, in which 76 units were sold. (a1) Calculate the weighted-average unit cost. (Round answer to 3 decimal places, e.g. 5.125.) Weighted-average unit cost $ Calculate the ending inventory at May 31 using the FIFO, LIFO and average-cost methods. (Round answers to 0 decimal places, e.g. 125.) The following information is available for Ivanhoe's Activewear Inc. for three recent fiscal years. (a) Calculate the inventory turnover, days in inventory, and gross profit rate for 2025 and 2024. (Round inventory turnover to 1 decimal place, e.g. 5.2, days in inventory to 0 decimal places, e.g. 125 and gross profit rate to 1 decimal place, e.g. 5.2\%.) Crane Distribution markets CDs of numerous performing artists. At the beginning of March, Crane had in beginning inventory 2,800CDs with a unit cost of $8.00. During March, Crane made the following purchases of CDs. During March 12,000 units were sold. Crane uses a periodic inventory system. (a) Determine the cost of goods available for sale. Cost of goods available for sale $ Calculate weighted-average cost per unit. (Round answer to 3 decimal places, e.g. 5.125.) Determine (1) the ending inventory and (2) the cost of goods sold under each of the assumed cost flow methods (FIFO, LIFO, and average-cost). (Round answers to 0 decimal places, e.g. 125.) Which cost flow method results in (1) the highest inventory amount for the balance sheet and (2) the highest cost of goods sold for the income statement? (1) produces the highest inventory amount. (2) produces the highest cost of goods sold

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started