Question

Assume that par value of the bond is $1,000. What was the last price of the bond in $$$ (listed in Last Trade Price)? Assume

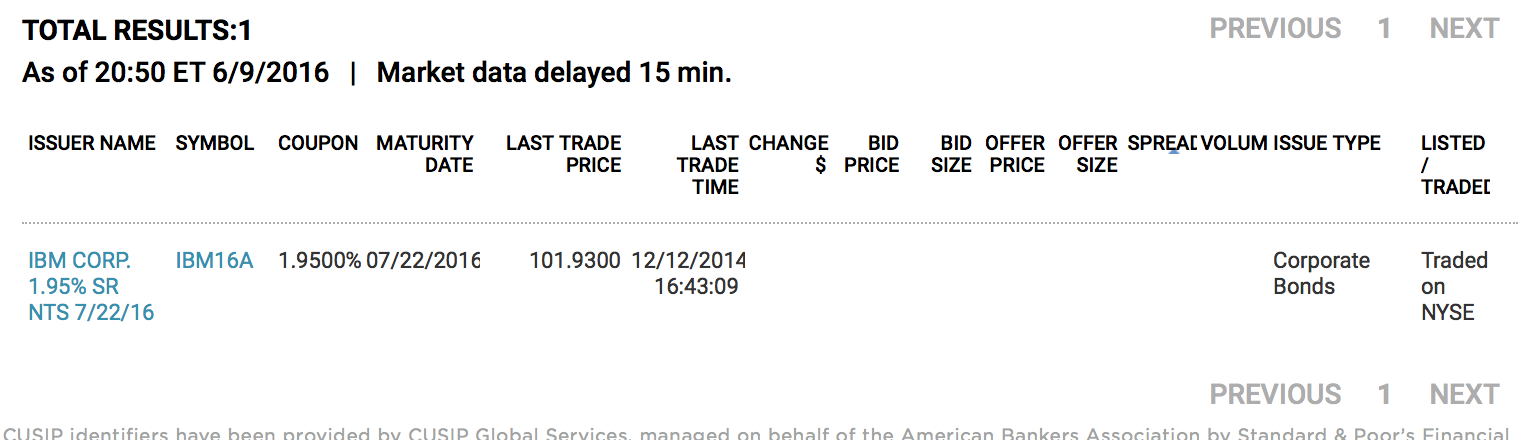

Assume that par value of the bond is $1,000. What was the last price of the bond in $$$ (listed in Last Trade Price)?

Assume that par value of the bond is $1,000. Calculate annual coupon interest payments.

Assume that par value of the bond is $1,000. Calculate current yield of the bond.

Assume that par value of the bond is $1,000. Assume annual coupon payments. Calculate YTM of the bond using the last price (listed in Last Trade Price). (Round the number of years to the whole number). You should use Excel or financial calculator. Show your work.

Describe one major shortcoming for YTM and current yield.

How would the following affect the yield on newly issued bond? Please explain your answer.

a) The bonds are callable.

b) The bonds are subordinated to the existing bond issue.

c) The bond rating is better or worse than the Moodys Aa3

TOTAL RESULTS:1 PREVIOUS 1 NEXT As of 20:50 ET 6/9/2016 Market data delayed 15 min. ISSUER NAME SYMBOL COUPON MATURITY LAST TRADE PRICE LAST C HANGE BID BID OFFER OFFER SPREACVOLUM ISSUE TYPE LISTED DATE TRADE $ PRICE SIZE PRICE SIZE TIME TRADED IBM CORP. 1.95% SR NTS 7/22/16 Corporate Traded Bonds IBM16A 1.9500% 07/22/2016 101.9300 12/12/2014 16:43:09 on NYSE PREVIOUS 1 NEXT CUSIP identifiers have been provided by CUSP Global Services, managed on behalf of the American Bankers Association by Standard & Poor's FinancialStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started