Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Recording and Reporting Transactions with Short-Term, Interest-Bearing Note Receivable On April 1, 2020, Welsch Company sold merchandise to Customer Rodriguez for $21,600, terms 2/10,

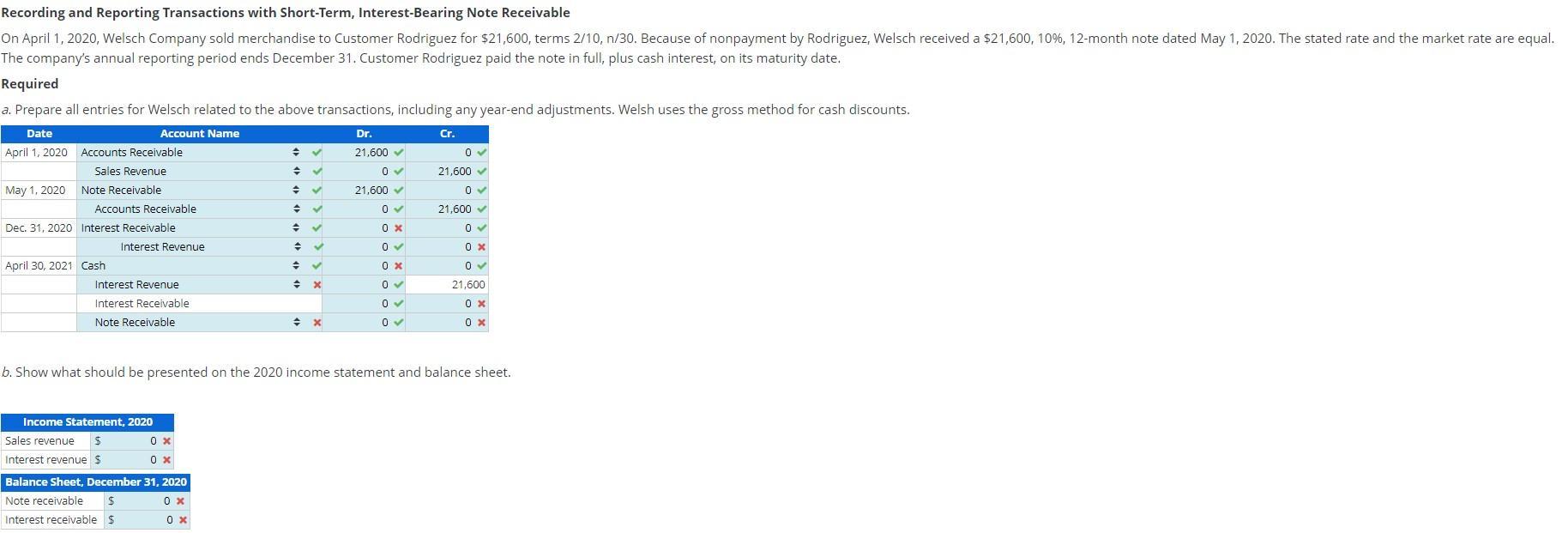

Recording and Reporting Transactions with Short-Term, Interest-Bearing Note Receivable On April 1, 2020, Welsch Company sold merchandise to Customer Rodriguez for $21,600, terms 2/10, n/30. Because of nonpayment by Rodriguez, Welsch received a $21,600, 10%, 12-month note dated May 1, 2020. The stated rate and the market rate are equal. The company's annual reporting period ends December 31. Customer Rodriguez paid the note in full, plus cash interest, on its maturity date. Required a. Prepare all entries for Welsch related to the above transactions, including any year-end adjustments. Welsh uses the gross method for cash discounts. Date Account Name April 1, 2020 Accounts Receivable Sales Revenue May 1, 2020 Note Receivable Accounts Receivable Dec. 31, 2020 Interest Receivable April 30, 2021 Cash Interest Revenue Interest Revenue Interest Receivable Note Receivable Income Statement, 2020 Sales revenue $ Interest revenue $ 0 x 0 x + + + + Balance Sheet, December 31, 2020 Note receivable $ 0x Interest receivable $ 0 x + + x x b. Show what should be presented on the 2020 income statement and balance sheet. Dr. 21,600 0 21,600 0 0 x 0 0x 0 0 0 Cr. 0 21,600 0 21,600 0 0 x 0 21,600 0x 0 x

Step by Step Solution

★★★★★

3.40 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started