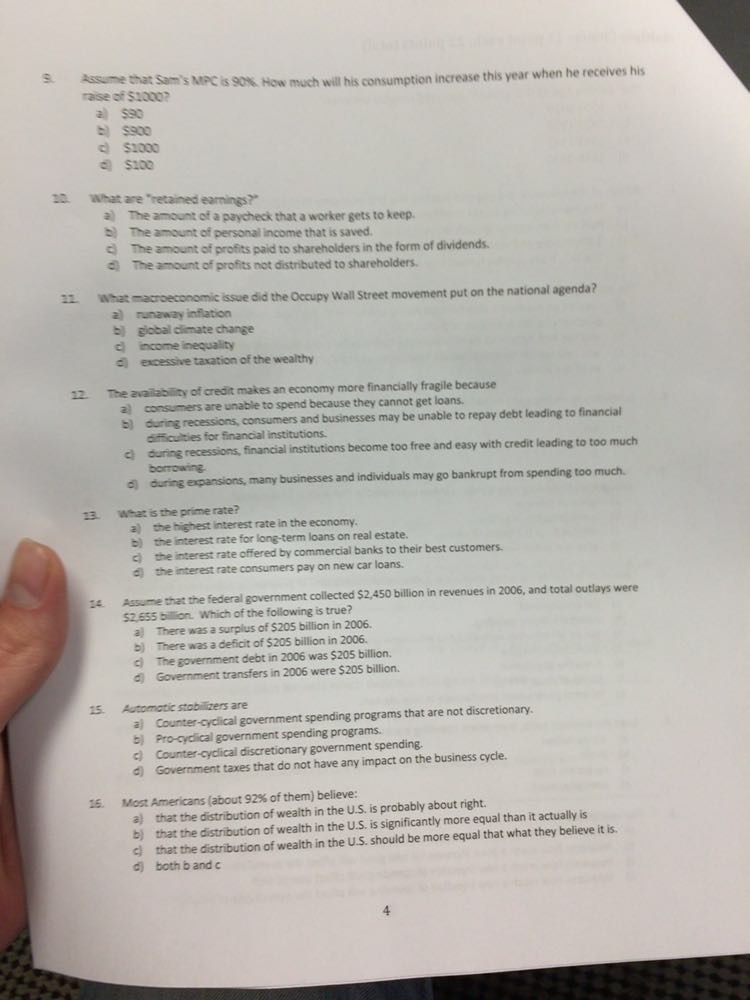

Assume that Sam's MPC is 90 %. How much will his consumption increase this year when he receives his raise of $1000? $90 $900 $1000 $100 What are "retained earnings?" The amount of a paycheck that a worker gets to keep. The amount of personal income that is saved. The amount of profits paid to shareholders in the form of dividends. The amount of profits not distributed to shareholders. What macroeconomic issue did the Occupy Wall Street movements put on the national agenda? runaway inflation global-climate change income inequality excessive taxation of the wealthy The availability of credit makes an economy one financially fragile because consumers are unable to spend because they cannot get loans. during recessions, consumers and businesses may be unable to repay debt leading to financial difficulties for financial institutions. during recessions, financial institutions become too free and easy with credit leading to too much borrowing. during expansions, many businesses and individuals may go bankrupt from spending too much. What is the prime rate? the highest interest rate in the economy. the interest rate for long-term loans on real estate. the interest rate offered by commercial banks to their best customers. the interest rate consumers pay on new car loans. Assume that the federal government collected $2,450 billion in revenue in 2006, and totally outlays were $2,655 billion. Which of the following is true? There was a surplus of $205 billion in 2006. There was a deficit of $05 billion in 2006. The government debt in 2006 was $205 billion. Government transfer in 2006 were $205 billion. Automatic stabilizers are Counter-cyclical government spending programs that are not discretionary. Pro-cyclical government spending programs. Counter-cyclical discretionary government spending. Government taxes that do not have any impact on the business cycle. Most Americans (about 92% of them) believe: that the distribution of wealth in the U.S. is probably about right. that the distribution of wealth in the U.S. is significantly more equal than it actually is that the distribution of wealth in the U.S. should be more equal that what they believe it is. both b and c