Answered step by step

Verified Expert Solution

Question

1 Approved Answer

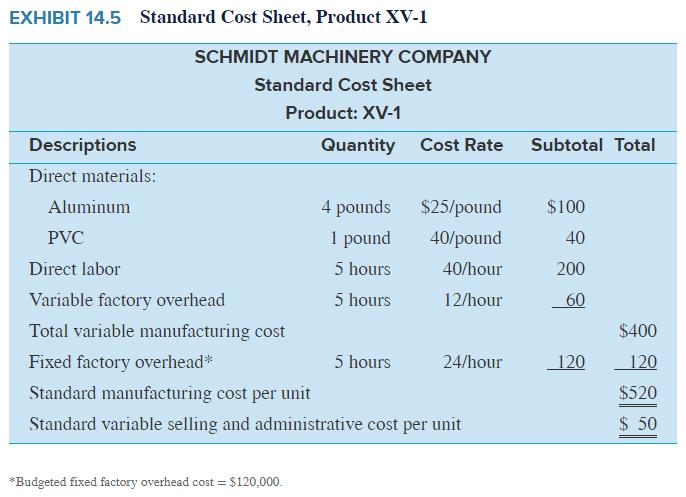

Assume that Schmidt Machinery Company had the standard costs reflected in Exhibit 14.5. In a given month, the company used 3,450 pounds of aluminum to

Assume that Schmidt Machinery Company had the standard costs reflected in Exhibit 14.5. In a given month, the company used 3,450 pounds of aluminum to manufacture 920 units. The company paid $28.50 per pound during the month to purchase aluminum. At the beginning of the month, the company had 50 pounds of aluminum on hand. At the end of the month, the company had only 30 pounds of aluminum in its warehouse. Schmidt used 4,200 direct labor hours during the month, at an average cost of $41.50 per hour.

Required:

Compute for the month the following variances:

1. The purchase-price variance for aluminum. Indicate whether this variance is favorable (F) or unfavorable (U).

2. The usage variance for aluminum. Indicate whether this variance is favorable (F) or unfavorable (U).

3. The direct labor rate variance. Indicate whether this variance is favorable (F) or unfavorable (U).

4. The direct labor efficiency variance. Indicate whether this variance is favorable (F) or unfavorable (U).

EXHIBIT 14.5 Standard Cost Sheet, Product XV-1 SCHMIDT MACHINERY COMPANY Standard Cost Sheet Product: XV-1 Descriptions Quantity Cost Rate Subtotal Total Direct materials: Aluminum 4 pounds $25/pound $100 PVC 1 pound 40/pound 40 Direct labor 5 hours 40/hour 200 Variable factory overhead 5 hours 12/hour 60 Total variable manufacturing cost $400 Fixed factory overhead* 5 hours 24/hour 120 120 Standard manufacturing cost per unit $520 Standard variable selling and administrative cost per unit $ 50 *Budgeted fixed factory overhead cost =$120,000.

Step by Step Solution

★★★★★

3.50 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

All working forms part of the answer Requirement 1 Purchase Price Varianc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started