Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume that SImple Company had credit sales of $288,000 and cost of goods sold of $169,000 for the perlod. It estimates that 3 percent of

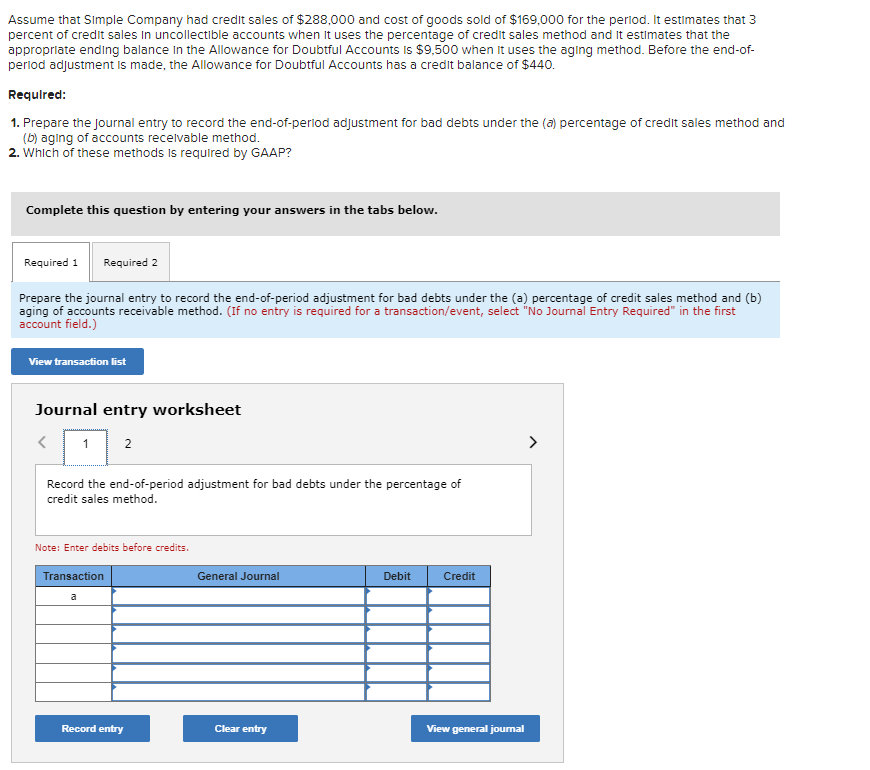

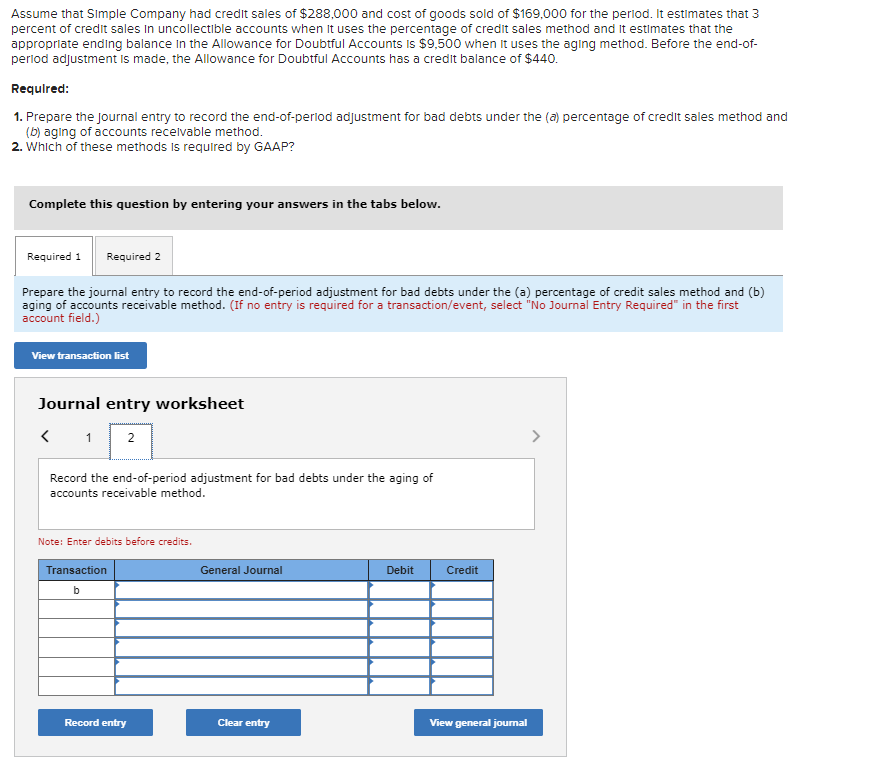

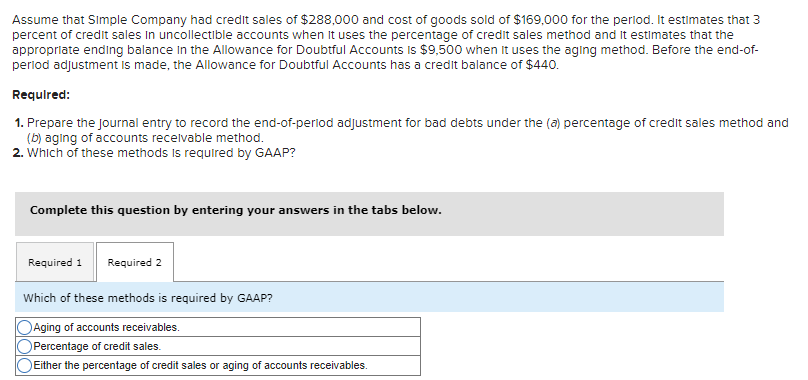

Assume that SImple Company had credit sales of $288,000 and cost of goods sold of $169,000 for the perlod. It estimates that 3 percent of credit sales in uncollectible accounts when It uses the percentage of credit sales method and It estimates that the approprlate ending balance in the Allowance for Doubtful Accounts Is $9,500 when It uses the aging method. Before the end-ofperlod adjustment Is made, the Allowance for Doubtful Accounts has a credit balance of $440. Required: 1. Prepare the Journal entry to record the end-of-perlod adjustment for bad debts under the (a) percentage of credit sales method and (b) aging of accounts recelvable method. 2. Which of these methods is required by GAAP? Complete this question by entering your answers in the tabs below. Prepare the journal entry to record the end-of-period adjustment for bad debts under the (a) percentage of credit sales method and (b) aging of accounts receivable method. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet Record the end-of-period adjustment for bad debts under the aging of accounts receivable method. Note: Enter debits before credits. Assume that SImple Company had credit sales of $288,000 and cost of goods sold of $169,000 for the perlod. It estlmates that 3 percent of credit sales in uncollectible accounts when It uses the percentage of credit sales method and It estimates that the approprlate ending balance In the Allowance for Doubtful Accounts Is $9,500 when It uses the aging method. Before the end-ofperlod adjustment Is made, the Allowance for Doubtful Accounts has a credit balance of $440. Required: 1. Prepare the Journal entry to record the end-of-perlod adjustment for bad debts under the (a) percentage of credit sales method and (b) aging of accounts recelvable method. 2. Which of these methods is required by GAAP? Complete this question by entering your answers in the tabs below. Which of these methods is required by GAAP? Assume that Simple Company had credit sales of $288,000 and cost of goods sold of $169,000 for the perlod. It estimates that 3 percent of credit sales in uncollectible accounts when It uses the percentage of credit sales method and It estimates that the approprlate ending balance in the Allowance for Doubtful Accounts is $9,500 when It uses the aging method. Before the end-ofperlod adjustment is made, the Allowance for Doubtful Accounts has a credit balance of $440. Required: 1. Prepare the Journal entry to record the end-of-perlod adjustment for bad debts under the (a) percentage of credit sales method and (b) aging of accounts recelvable method. 2. Which of these methods is required by GAAP? Complete this question by entering your answers in the tabs below. Prepare the journal entry to record the end-of-period adjustment for bad debts under the (a) percentage of credit sales method and (b) aging of accounts receivable method. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet Record the end-of-period adjustment for bad debts under the percentage of credit sales method. Note: Enter debits before credits

Assume that SImple Company had credit sales of $288,000 and cost of goods sold of $169,000 for the perlod. It estimates that 3 percent of credit sales in uncollectible accounts when It uses the percentage of credit sales method and It estimates that the approprlate ending balance in the Allowance for Doubtful Accounts Is $9,500 when It uses the aging method. Before the end-ofperlod adjustment Is made, the Allowance for Doubtful Accounts has a credit balance of $440. Required: 1. Prepare the Journal entry to record the end-of-perlod adjustment for bad debts under the (a) percentage of credit sales method and (b) aging of accounts recelvable method. 2. Which of these methods is required by GAAP? Complete this question by entering your answers in the tabs below. Prepare the journal entry to record the end-of-period adjustment for bad debts under the (a) percentage of credit sales method and (b) aging of accounts receivable method. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet Record the end-of-period adjustment for bad debts under the aging of accounts receivable method. Note: Enter debits before credits. Assume that SImple Company had credit sales of $288,000 and cost of goods sold of $169,000 for the perlod. It estlmates that 3 percent of credit sales in uncollectible accounts when It uses the percentage of credit sales method and It estimates that the approprlate ending balance In the Allowance for Doubtful Accounts Is $9,500 when It uses the aging method. Before the end-ofperlod adjustment Is made, the Allowance for Doubtful Accounts has a credit balance of $440. Required: 1. Prepare the Journal entry to record the end-of-perlod adjustment for bad debts under the (a) percentage of credit sales method and (b) aging of accounts recelvable method. 2. Which of these methods is required by GAAP? Complete this question by entering your answers in the tabs below. Which of these methods is required by GAAP? Assume that Simple Company had credit sales of $288,000 and cost of goods sold of $169,000 for the perlod. It estimates that 3 percent of credit sales in uncollectible accounts when It uses the percentage of credit sales method and It estimates that the approprlate ending balance in the Allowance for Doubtful Accounts is $9,500 when It uses the aging method. Before the end-ofperlod adjustment is made, the Allowance for Doubtful Accounts has a credit balance of $440. Required: 1. Prepare the Journal entry to record the end-of-perlod adjustment for bad debts under the (a) percentage of credit sales method and (b) aging of accounts recelvable method. 2. Which of these methods is required by GAAP? Complete this question by entering your answers in the tabs below. Prepare the journal entry to record the end-of-period adjustment for bad debts under the (a) percentage of credit sales method and (b) aging of accounts receivable method. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet Record the end-of-period adjustment for bad debts under the percentage of credit sales method. Note: Enter debits before credits Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started