Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Construct a short-term financial plan for Springfield Snowboards based on its expansion opportunity described in the Positive Cash Flow Shocks part of Section 20.1.

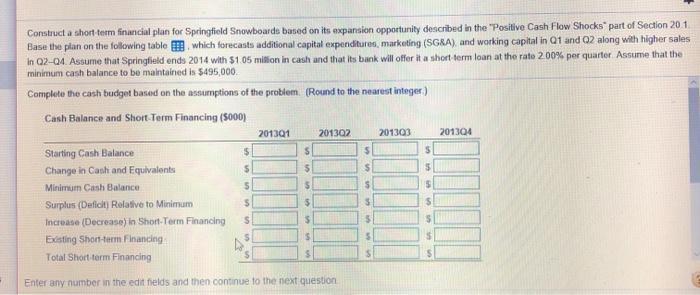

Construct a short-term financial plan for Springfield Snowboards based on its expansion opportunity described in the "Positive Cash Flow Shocks" part of Section 20.1. Base the plan on the following table, which forecasts additional capital expenditures, marketing (SG&A), and working capital in Q1 and Q2 along with higher sales in Q2-04. Assume that Springfield ends 2014 with $1.05 million in cash and that its bank will offer it a short-term loan at the rate 2.00% per quarter. Assume that the minimum cash balance to be maintained is $495,000. Complete the cash budget based on the assumptions of the problem. (Round to the nearest integer.) Cash Balance and Short-Term Financing (5000) 201301 $ S $ S $ Starting Cash Balance Change in Cash and Equivalents Minimum Cash Balance Surplus (Deficit) Relative to Minimum Increase (Decrease) in Short-Term Financing Existing Short-term Financing Total Short-term Financing Enter any number in the edit fields and then continue to the next question $ $ $ 201302 $ $ $ $ $ $ $ $ 201303 $ $ S $ $ 201304

Step by Step Solution

★★★★★

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Cash Balance and Short Term Financing 000 Particulars Starting Cash Balance Change in Cash and Equiv...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

635d8d2da56b1_176677.pdf

180 KBs PDF File

635d8d2da56b1_176677.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started