Answered step by step

Verified Expert Solution

Question

1 Approved Answer

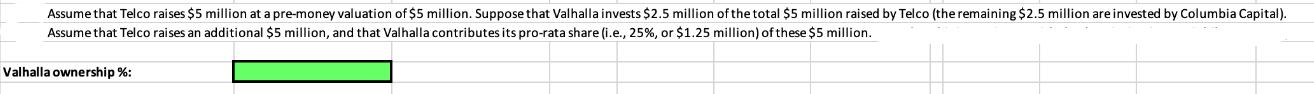

Assume that Telco raises $5 million at a pre-money valuation of $5 million. Suppose that Valhalla invests $2.5 million of the total $5 million

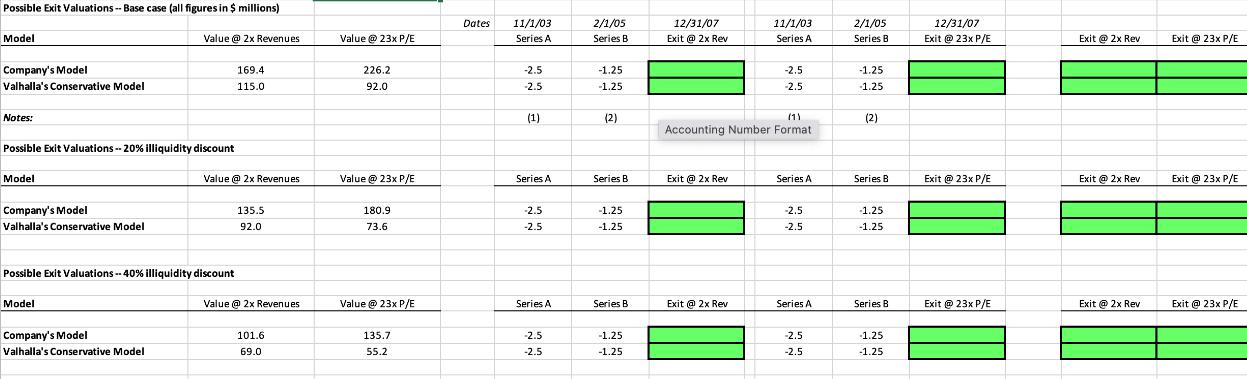

Assume that Telco raises $5 million at a pre-money valuation of $5 million. Suppose that Valhalla invests $2.5 million of the total $5 million raised by Telco (the remaining $2.5 million are invested by Columbia Capital). Assume that Telco raises an additional $5 million, and that Valhalla contributes its pro-rata share (i.e., 25%, or $1.25 million) of these $5 million. Valhalla ownership %: Dates Value @ 2x Revenues Value @23x P/E 11/1/03 Series A 2/1/05 Series B 12/31/07 11/1/03 Exit @ 2x Rev Series A 2/1/05 Series B 12/31/07 Exit @23x P/E Exit @2x Rev Exit @23x P/E Possible Exit Valuations--Base case (all figures in $ millions) Model Company's Model Valhalla's Conservative Model 169.4 115.0 Notes: Possible Exit Valuations -- 20% illiquidity discount Model Company's Model Valhalla's Conservative Model 226.2 92.0 -2.5 -2.5 -1.25 -1.25 -2.5 -1.25 -2.5 -1.25 (1) (2) (1) (2) Accounting Number Format Value @ 2x Revenues Value @23x P/E Series A Series B Exit @2x Rev Series A Series B Exit @23x P/E Exit @ 2x Rev Exit @ 23x P/E 135.5 92.0 180.9 73.6 -2.5 -2.5 -1.25 -1.25 -2.5 -2.5 -1.25 -1.25 Possible Exit Valuations -- 40% illiquidity discount Model Company's Model Valhalla's Conservative Model Value @ 2x Revenues Value @23x P/E Series A Series B Exit @ 2x Rev Series A Series B Exit @23x P/E Exit @ 2x Rev Exit @ 23x P/E 101.6 69.0 135.7 55.2 -2.5 -1.25 -2.5 -1.25 -2.5 -1.25 -2.5 -1.25

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started