Question

Assume that the 10-year bund has a EU 68.10 DV01 (dollar value of a basis point) The 10-year gilt has a 83.40 DV01 The

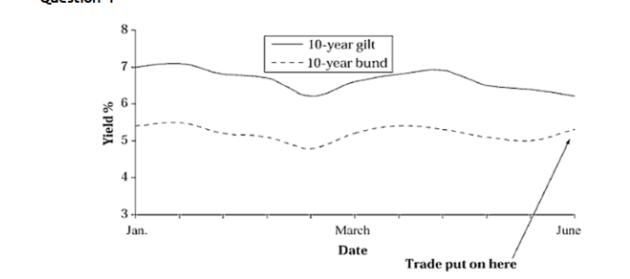

Assume that the 10-year bund has a EU 68.10 DV01 (dollar value of a basis point) The 10-year gilt has a 83.40 DV01 The /EU exchange rate is 1.2767 Sterling Pound to an EU The current spread between the Gilt and the Bund is 91 bps. If you expect the spread to widen to 160 points in a month, how should you put on trades to benefit from such speculation? Assumption: The exchange rate does not change over the course of the trade a. The gilt increases by 91bps b. The bund decreases by 91bps c. The gilt decreases by 9bps and the bund decreases by 100bps d. The gilt increases by 105bps and the bund increases by 14bps. Examine the effect of changes in exchange rate in this trade. 8 Yield% 7. 9 13 4 3. 10-year gilt -10-year bund Jan. March Date Trade put on here June

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

International financial management

Authors: Jeff Madura

9th Edition

978-0324593495, 324568207, 324568193, 032459349X, 9780324568202, 9780324568196, 978-0324593471

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App