Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume that the 2015 errors were not corrected, and that no errors occurred in 2014. By what amount will 2015 income before income taxes be

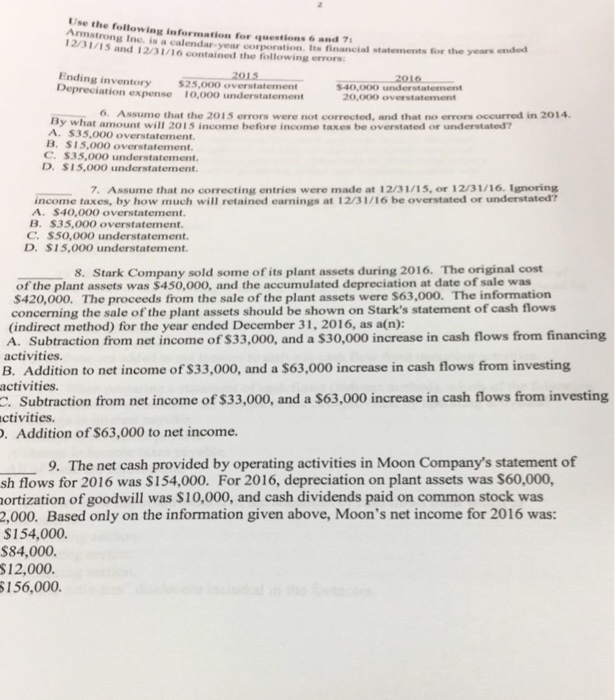

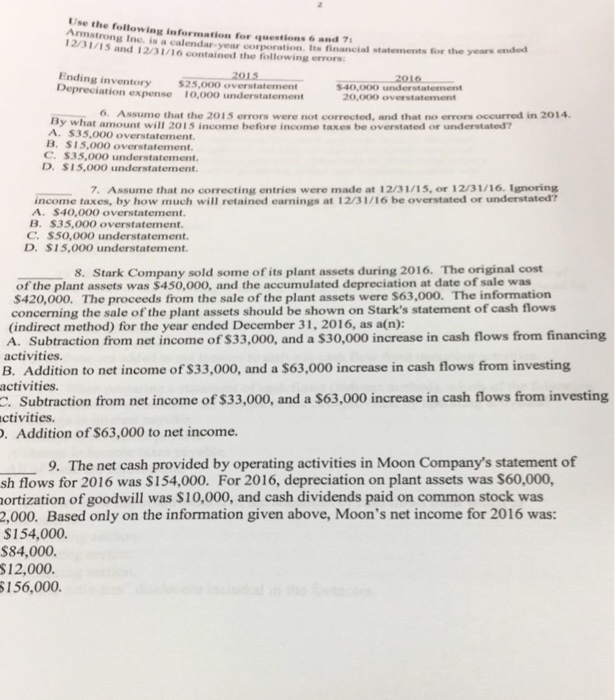

Assume that the 2015 errors were not corrected, and that no errors occurred in 2014. By what amount will 2015 income before income taxes be overstated or understated? A. $35,000 overstatement B, 15,000 overstatement C. $35,000 understatement D. $15,000 understatement. Assume that no correcting entries were made at 12/31/15, or 12/31/16. Ignoring income taxes, by how much will retained earnings at 12/31/16 be overstated or understated? A. $40,000 overstatement B. $35,000 overstatement. C $50,000 understatement. D. $15,000 understatement. Stark Company sold some of its plant assets during 2016. The original cost of the plant assets was $450,000, and the accumulated depreciation at date of sale was The proceeds from the sale of the plant assets were $63,000. The information concerning the sale of the plant assets should be shown on Stark's statement of cash flows (indirect method) for the year ended December 31, 2016, as a (n): A. Subtraction from net income of $33,000, and a $30,000 increase in cash flows from financing activities. B. Addition to net income of $33,000, and a $63,000 increase in cash flows from investing activities. C. Subtraction from net income of $33,000, and a $63,000 increase in cash flows from investing activities D. Addition of $63,000 to net income. The net cash provided by operating activities in Moon Company's statement of flows for 2016 was $154,000. For 2016, depreciation on plant assets was $60,000, of goodwill was $10,000, and cash dividends paid on common stock was 2,000. Based only on the information given above, Moon's net income for 2016 was: $154,000. $84,000. $12,000. $156,000

Assume that the 2015 errors were not corrected, and that no errors occurred in 2014. By what amount will 2015 income before income taxes be overstated or understated? A. $35,000 overstatement B, 15,000 overstatement C. $35,000 understatement D. $15,000 understatement. Assume that no correcting entries were made at 12/31/15, or 12/31/16. Ignoring income taxes, by how much will retained earnings at 12/31/16 be overstated or understated? A. $40,000 overstatement B. $35,000 overstatement. C $50,000 understatement. D. $15,000 understatement. Stark Company sold some of its plant assets during 2016. The original cost of the plant assets was $450,000, and the accumulated depreciation at date of sale was The proceeds from the sale of the plant assets were $63,000. The information concerning the sale of the plant assets should be shown on Stark's statement of cash flows (indirect method) for the year ended December 31, 2016, as a (n): A. Subtraction from net income of $33,000, and a $30,000 increase in cash flows from financing activities. B. Addition to net income of $33,000, and a $63,000 increase in cash flows from investing activities. C. Subtraction from net income of $33,000, and a $63,000 increase in cash flows from investing activities D. Addition of $63,000 to net income. The net cash provided by operating activities in Moon Company's statement of flows for 2016 was $154,000. For 2016, depreciation on plant assets was $60,000, of goodwill was $10,000, and cash dividends paid on common stock was 2,000. Based only on the information given above, Moon's net income for 2016 was: $154,000. $84,000. $12,000. $156,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started