Answered step by step

Verified Expert Solution

Question

1 Approved Answer

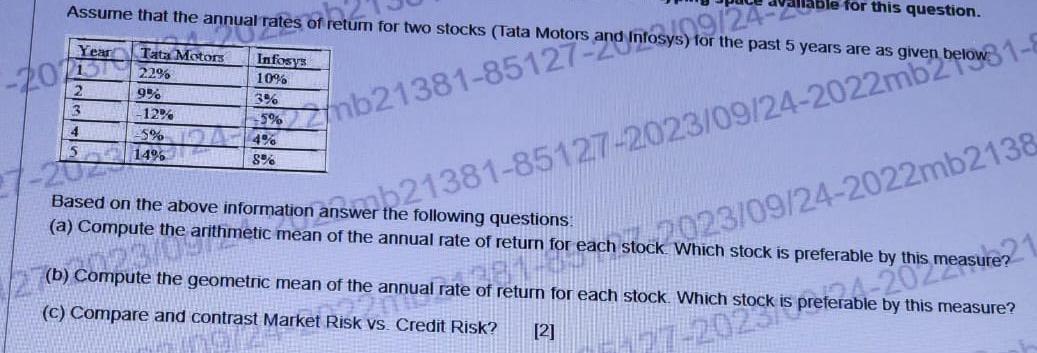

Assume that the annual rates of return for two stocks (Tata Motors e annual rate -201 Year Tata Motors Infosys 131 22% 9% 2

Assume that the annual rates of return for two stocks (Tata Motors e annual rate -201 Year Tata Motors Infosys 131 22% 9% 2 3 4 -12% -5% 14% 10% 3% nosy09/24- %mb21381-85127 Infosys 4% 8% able for this question. for the past 5 years are as given Based on the above information answer the following questions: (a) Compute the arithmetic mean of the annual rate of return for each stock. Which stock is preferable by this measure? answer 21381-85127-2023/09/24-2022mb231-8 (c) Compare and contrast Market Risk vs. Credit Risk? [2] (b) Compute the geometric mean of the annual rate of return for each stock. Which stock is preferable by this measure? annual 2023/09/24-2022mb2138 sure21 refer 4-2015 measu 77-2020 is pr

Step by Step Solution

★★★★★

3.39 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

a Arithmetic Mean To compute the arithmetic mean of the annual rate of return for each stock you simply add up the annual returns for each year and th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started