Answered step by step

Verified Expert Solution

Question

1 Approved Answer

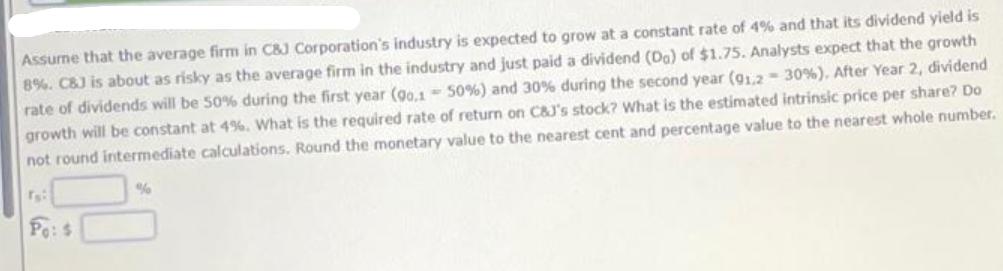

Assume that the average firm in C&J Corporation's industry is expected to grow at a constant rate of 4% and that its dividend yield

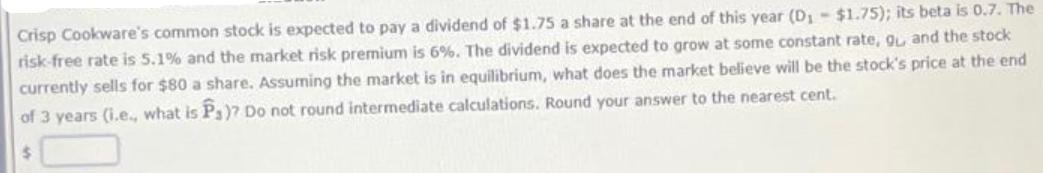

Assume that the average firm in C&J Corporation's industry is expected to grow at a constant rate of 4% and that its dividend yield is 8%. C&J is about as risky as the average firm in the industry and just paid a dividend (Da) of $1.75. Analysts expect that the growth rate of dividends will be 50% during the first year (90,1 - 50 %) and 30% during the second year (91,2 - 30 % ). After Year 2 , dividend growth will be constant at 4%. What is the required rate of return on C&J's stock? What is the estimated intrinsic price per share? Do not round intermediate calculations. Round the monetary value to the nearest cent and percentage value to the nearest whole number. Fo: $ % Crisp Cookware's common stock is expected to pay a dividend of $1.75 a share at the end of this year (D - $1.75); its beta is 0.7. The risk-free rate is 5.1% and the market risk premium is 6%. The dividend is expected to grow at some constant rate, gu and the stock currently sells for $80 a share. Assuming the market is in equilibrium, what does the market believe will be the stock's price at the end of 3 years (i.e., what is P3)? Do not round intermediate calculations. Round your answer to the nearest cent.

Step by Step Solution

★★★★★

3.49 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the required rate of return rs and the estimated intrinsic price per share Po for CJ Co...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started