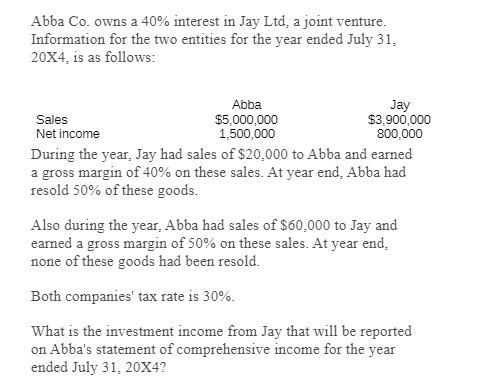

Abba Co. owns a 40% interest in Jay Ltd, a joint venture. Information for the two entities for the year ended July 31, 20X4,

Abba Co. owns a 40% interest in Jay Ltd, a joint venture. Information for the two entities for the year ended July 31, 20X4, is as follows: Sales Net income Abba $5,000,000 1,500,000 Jay $3,900,000 800,000 During the year, Jay had sales of $20,000 to Abba and earned a gross margin of 40% on these sales. At year end, Abba had resold 50% of these goods. Also during the year, Abba had sales of $60,000 to Jay and earned a gross margin of 50% on these sales. At year end. none of these goods had been resold. Both companies' tax rate is 30%. What is the investment income from Jay that will be reported on Abba's statement of comprehensive income for the year ended July 31, 20X4?

Step by Step Solution

3.38 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the investment income from Jay that will be reported on Abbas statement of comprehensiv...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started