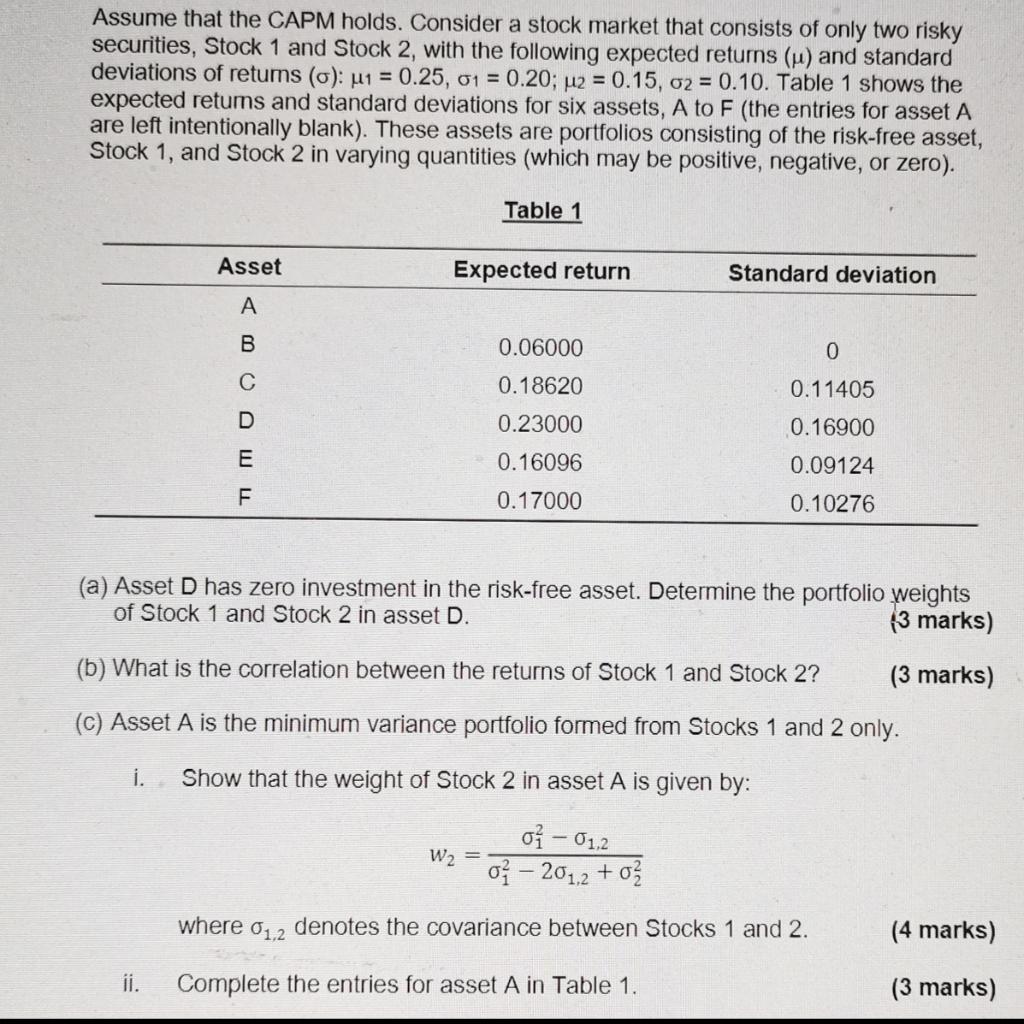

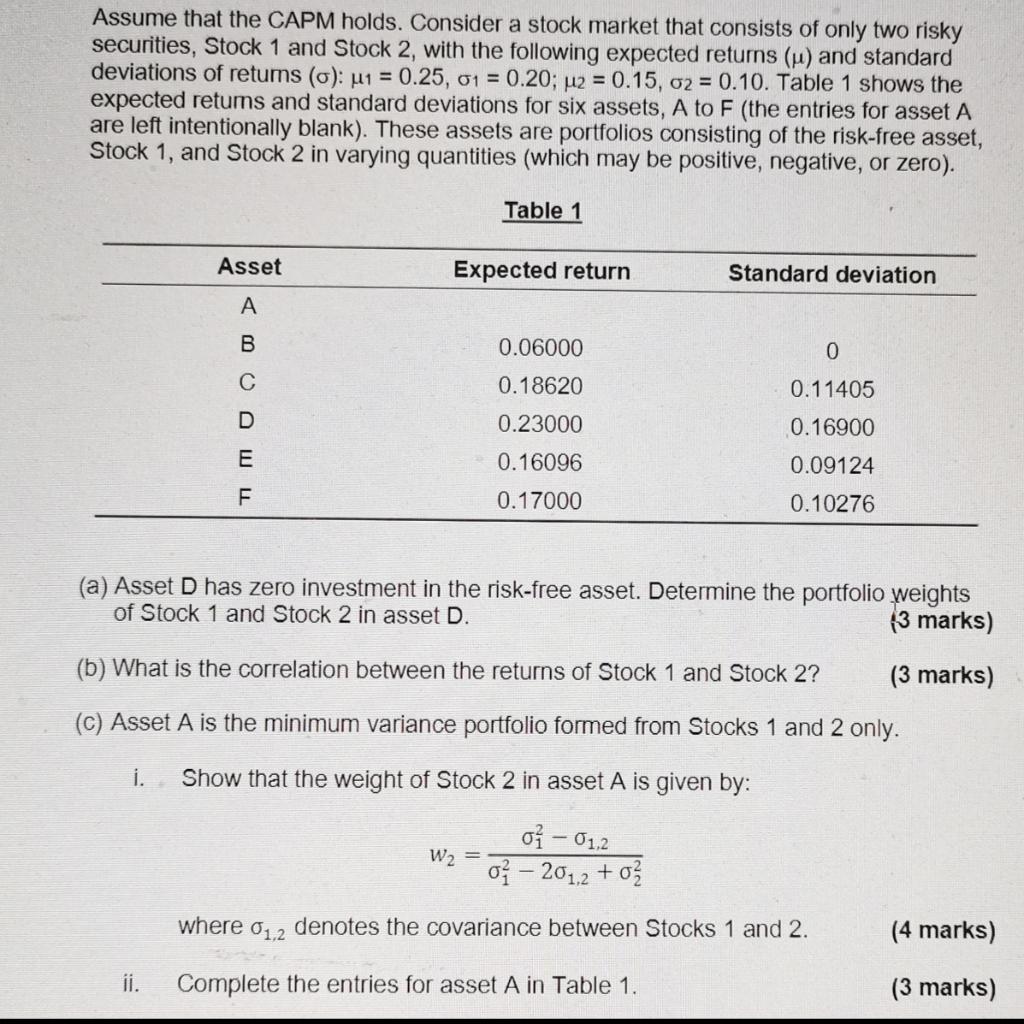

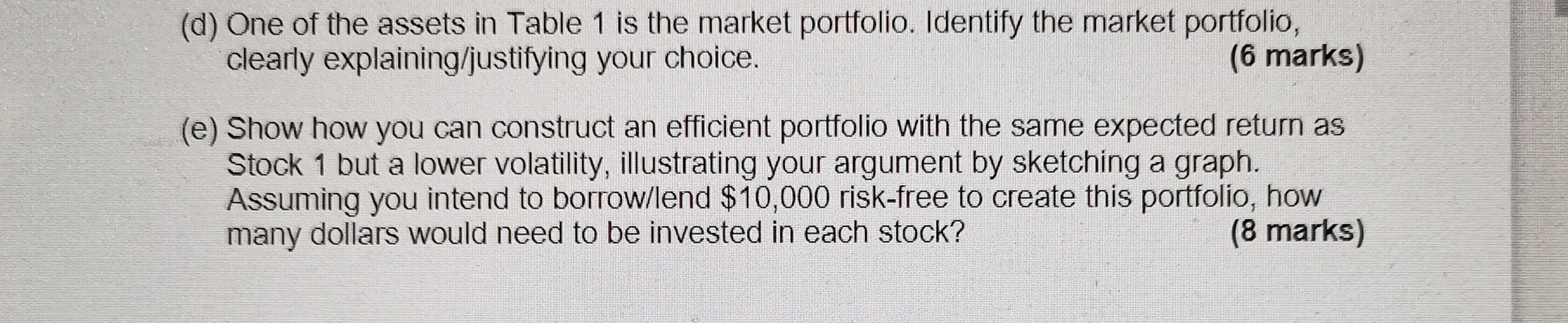

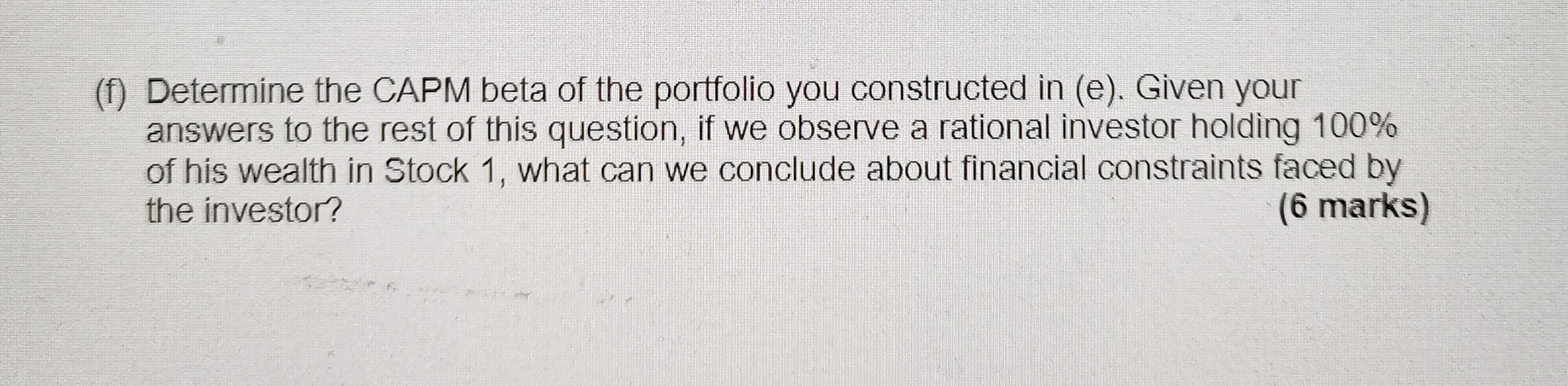

Assume that the CAPM holds. Consider a stock market that consists of only two risky securities, Stock 1 and Stock 2, with the following expected returns (u) and standard deviations of retums (o): u1 = 0.25, 01 = 0.20; u2 = 0.15, 02 = 0.10. Table 1 shows the expected retums and standard deviations for six assets, A to F (the entries for asset A are left intentionally blank). These assets are portfolios consisting of the risk-free asset, Stock 1, and Stock 2 in varying quantities (which may be positive, negative, or zero). Table 1 Asset Expected return Standard deviation B 0.06000 0 0.18620 0.11405 - D 0.23000 0.16900 E 0.16096 0.09124 0.17000 0.10276 (a) Asset D has zero investment in the risk-free asset. Determine the portfolio weights of Stock 1 and Stock 2 in asset D. 3 marks) (b) What is the correlation between the returns of Stock 1 and Stock 2? (3 marks) (C) Asset A is the minimum variance portfolio formed from Stocks 1 and 2 only. i. Show that the weight of Stock 2 in asset A is given by: oi -01,2 W2 = 0 2012 +03 where 01,2 denotes the covariance between Stocks 1 and 2. (4 marks) ii. Complete the entries for asset A in Table 1. (3 marks) (d) One of the assets in Table 1 is the market portfolio. Identify the market portfolio, clearly explaining/justifying your choice. (6 marks) (e) Show how you can construct an efficient portfolio with the same expected return as Stock 1 but a lower volatility, illustrating your argument by sketching a graph. Assuming you intend to borrow/lend $10,000 risk-free to create this portfolio, how many dollars would need to be invested in each stock? (8 marks) (f) Determine the CAPM beta of the portfolio you constructed in (e). Given your answers to the rest of this question, if we observe a rational investor holding 100% of his wealth in Stock 1, what can we conclude about financial constraints faced by the investor? (6 marks) Assume that the CAPM holds. Consider a stock market that consists of only two risky securities, Stock 1 and Stock 2, with the following expected returns (u) and standard deviations of retums (o): u1 = 0.25, 01 = 0.20; u2 = 0.15, 02 = 0.10. Table 1 shows the expected retums and standard deviations for six assets, A to F (the entries for asset A are left intentionally blank). These assets are portfolios consisting of the risk-free asset, Stock 1, and Stock 2 in varying quantities (which may be positive, negative, or zero). Table 1 Asset Expected return Standard deviation B 0.06000 0 0.18620 0.11405 - D 0.23000 0.16900 E 0.16096 0.09124 0.17000 0.10276 (a) Asset D has zero investment in the risk-free asset. Determine the portfolio weights of Stock 1 and Stock 2 in asset D. 3 marks) (b) What is the correlation between the returns of Stock 1 and Stock 2? (3 marks) (C) Asset A is the minimum variance portfolio formed from Stocks 1 and 2 only. i. Show that the weight of Stock 2 in asset A is given by: oi -01,2 W2 = 0 2012 +03 where 01,2 denotes the covariance between Stocks 1 and 2. (4 marks) ii. Complete the entries for asset A in Table 1. (3 marks) (d) One of the assets in Table 1 is the market portfolio. Identify the market portfolio, clearly explaining/justifying your choice. (6 marks) (e) Show how you can construct an efficient portfolio with the same expected return as Stock 1 but a lower volatility, illustrating your argument by sketching a graph. Assuming you intend to borrow/lend $10,000 risk-free to create this portfolio, how many dollars would need to be invested in each stock? (8 marks) (f) Determine the CAPM beta of the portfolio you constructed in (e). Given your answers to the rest of this question, if we observe a rational investor holding 100% of his wealth in Stock 1, what can we conclude about financial constraints faced by the investor? (6 marks)