Question

Assume that the CAPM holds. Consider a stock market that consints of only two risky securities, Slock 1 and Stock 2, with the following expected

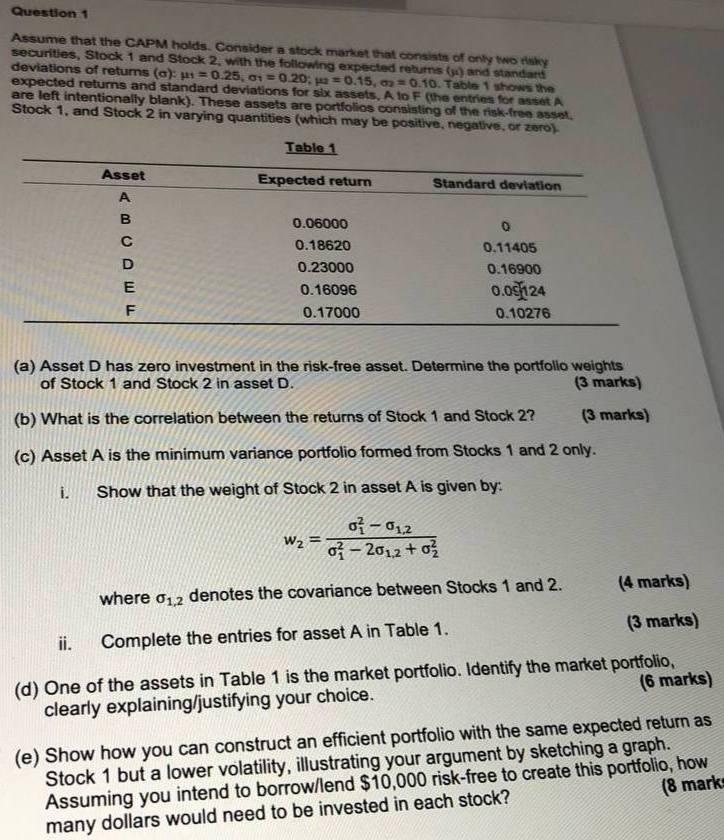

Assume that the CAPM holds. Consider a stock market that consints of only two risky securities, Slock 1 and Stock 2, with the following expected returns (u) and standard deviations of returns... (Full task on the photo)

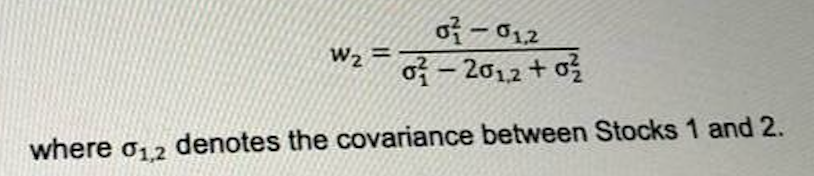

(a) Asset D has zero investment in the risk-free asset. Determine the portfolio weights of Stock 1 and Stock 2 in asset D. (b) What is the correlation between the returns of Stock 1 and Stock 2? (c) Asset A is the minimum variance portfolio formed from Stocks 1 and 2 only. Show that the weight of Stock 2 in asset A is given by:

(d) One of the assets in Table 1 is the market portfolio. Identify the market portfolio, clearly explaining/justifying your choice.

(e) Show how you can construct an efficient portfolio with the same expected return as Stock 1 but a lower volatility, illustrating your argument by sketching a graph. Assuming you intend to borrow/lend $10,000 risk-free to create this portfolio, how many dollars would need to be invested in each stock?

Question 1 Assume that the CAPM holds. Consider a stock market that consists of only two sky securities, Stock 1 and Stock 2. with the following expected returns () and standard deviations of returns (a): p=0.25, 0 = 0 20.= 0.15, +0.10. Table 1 shows the expected returns and standard deviations for six assets. A to F (the entries for asset A are left intentionally blank). These assets are portfolios consisting of the risk-free asset Stock 1. and Stock 2 in varying quantities (which may be positive, negativeor zero) Table 1 Asset Expected return Standard deviation A 0 - D E F 0.06000 0.18620 0.23000 0.16096 0.17000 0.11405 0.16900 0.024 0.10276 (a) Asset D has zero investment in the risk-free asset. Determine the portfolio weights of Stock 1 and Stock 2 in asset D. (3 marks) (b) What is the correlation between the returns of Stock 1 and Stock 2? (3 marks) (c) Asset A is the minimum variance portfolio formed from Stocks 1 and 2 only. i. Show that the weight of Stock 2 in asset A is given by: o - 012 W2 0 - 2012 + 0 (4 marks) where 01.2 denotes the covariance between Stocks 1 and 2. ii. Complete the entries for asset A in Table 1. (3 marks) (d) One of the assets in Table 1 is the market portfolio. Identify the market portfolio, clearly explaining/justifying your choice. (6 marks) (e) Show how you can construct an efficient portfolio with the same expected return as Stock 1 but a lower volatility, illustrating your argument by sketching a graph. Assuming you intend to borrow/lend $10,000 risk-free to create this portfolio, how many dollars would need to be invested in each stock? (8 mark - W2 = oz - 2012+ o % o-012 - where 01,2 denotes the covariance between Stocks 1 and 2. Question 1 Assume that the CAPM holds. Consider a stock market that consists of only two sky securities, Stock 1 and Stock 2. with the following expected returns () and standard deviations of returns (a): p=0.25, 0 = 0 20.= 0.15, +0.10. Table 1 shows the expected returns and standard deviations for six assets. A to F (the entries for asset A are left intentionally blank). These assets are portfolios consisting of the risk-free asset Stock 1. and Stock 2 in varying quantities (which may be positive, negativeor zero) Table 1 Asset Expected return Standard deviation A 0 - D E F 0.06000 0.18620 0.23000 0.16096 0.17000 0.11405 0.16900 0.024 0.10276 (a) Asset D has zero investment in the risk-free asset. Determine the portfolio weights of Stock 1 and Stock 2 in asset D. (3 marks) (b) What is the correlation between the returns of Stock 1 and Stock 2? (3 marks) (c) Asset A is the minimum variance portfolio formed from Stocks 1 and 2 only. i. Show that the weight of Stock 2 in asset A is given by: o - 012 W2 0 - 2012 + 0 (4 marks) where 01.2 denotes the covariance between Stocks 1 and 2. ii. Complete the entries for asset A in Table 1. (3 marks) (d) One of the assets in Table 1 is the market portfolio. Identify the market portfolio, clearly explaining/justifying your choice. (6 marks) (e) Show how you can construct an efficient portfolio with the same expected return as Stock 1 but a lower volatility, illustrating your argument by sketching a graph. Assuming you intend to borrow/lend $10,000 risk-free to create this portfolio, how many dollars would need to be invested in each stock? (8 mark - W2 = oz - 2012+ o % o-012 - where 01,2 denotes the covariance between Stocks 1 and 2Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started