Answered step by step

Verified Expert Solution

Question

1 Approved Answer

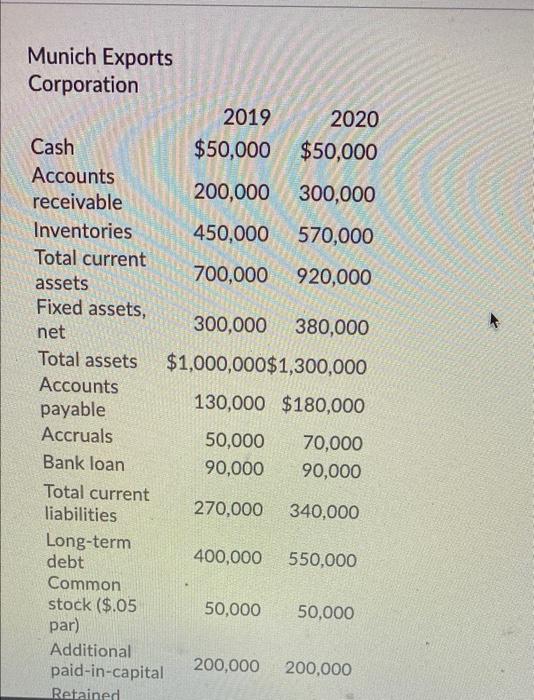

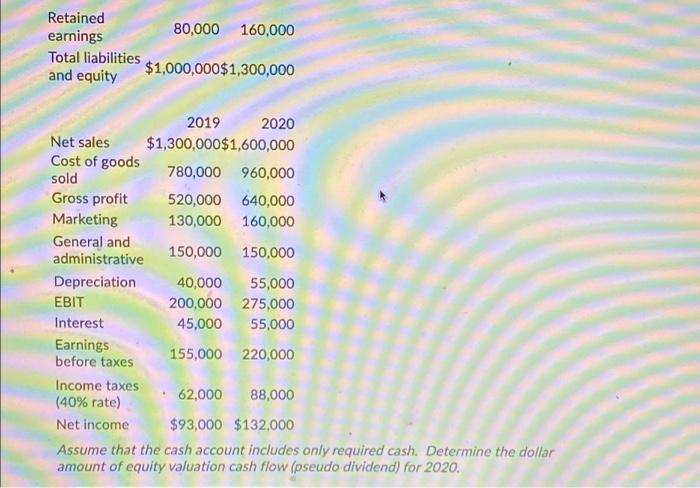

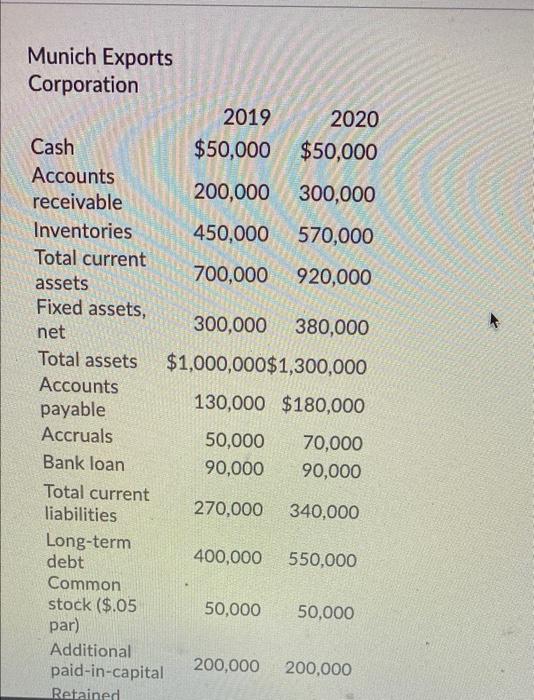

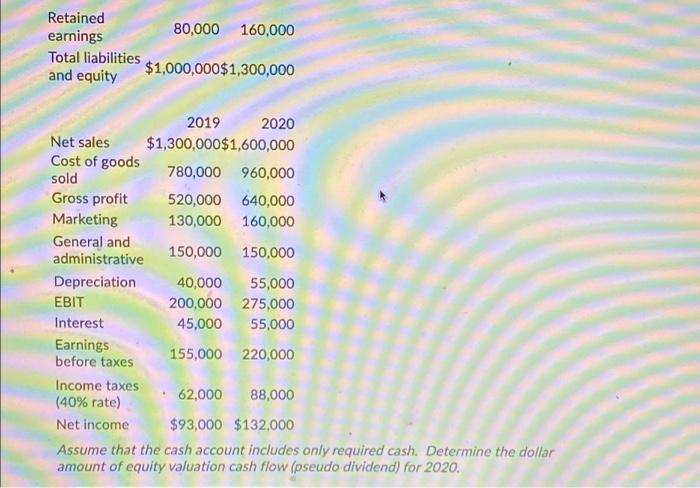

Assume that the cash account includes only required cash. Determine the dollar amount of equity valuation cash flow (psuedo dividend) for 2020. Munich Exports Corporation

Assume that the cash account includes only required cash. Determine the dollar amount of equity valuation cash flow (psuedo dividend) for 2020.

Munich Exports Corporation 2019 2020 Cash $50,000 $50,000 Accounts 200,000 300,000 receivable Inventories 450,000 570,000 Total current 700,000 920,000 assets Fixed assets, 300,000 380,000 net Total assets $1,000,000$1,300,000 Accounts payable 130,000 $180,000 Accruals 50,000 70,000 Bank loan 90,000 90,000 Total current liabilities 270,000 340,000 Long-term debt 400,000 550,000 Common stock ($.05 50,000 50,000 par) Additional paid-in-capital 200,000 200,000 Retained Retained 80,000 160,000 earnings Total liabilities and equity $1,000,000$1,300,000 2019 2020 Net sales $1,300,000$1,600,000 Cost of goods sold 780,000 960,000 Gross profit 520,000 640,000 Marketing 130,000 160,000 General and administrative 150,000 150,000 Depreciation 40,000 55,000 EBIT 200,000 275,000 Interest 45,000 55,000 Earnings 155,000 220,000 before taxes Income taxes 62,000 88,000 (40% rate) Net income $93,000 $132,000 Assume that the cash account includes only required cash. Determine the dollar amount of equity valuation cash flow (pseudo dividend) for 2020

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started