Answered step by step

Verified Expert Solution

Question

1 Approved Answer

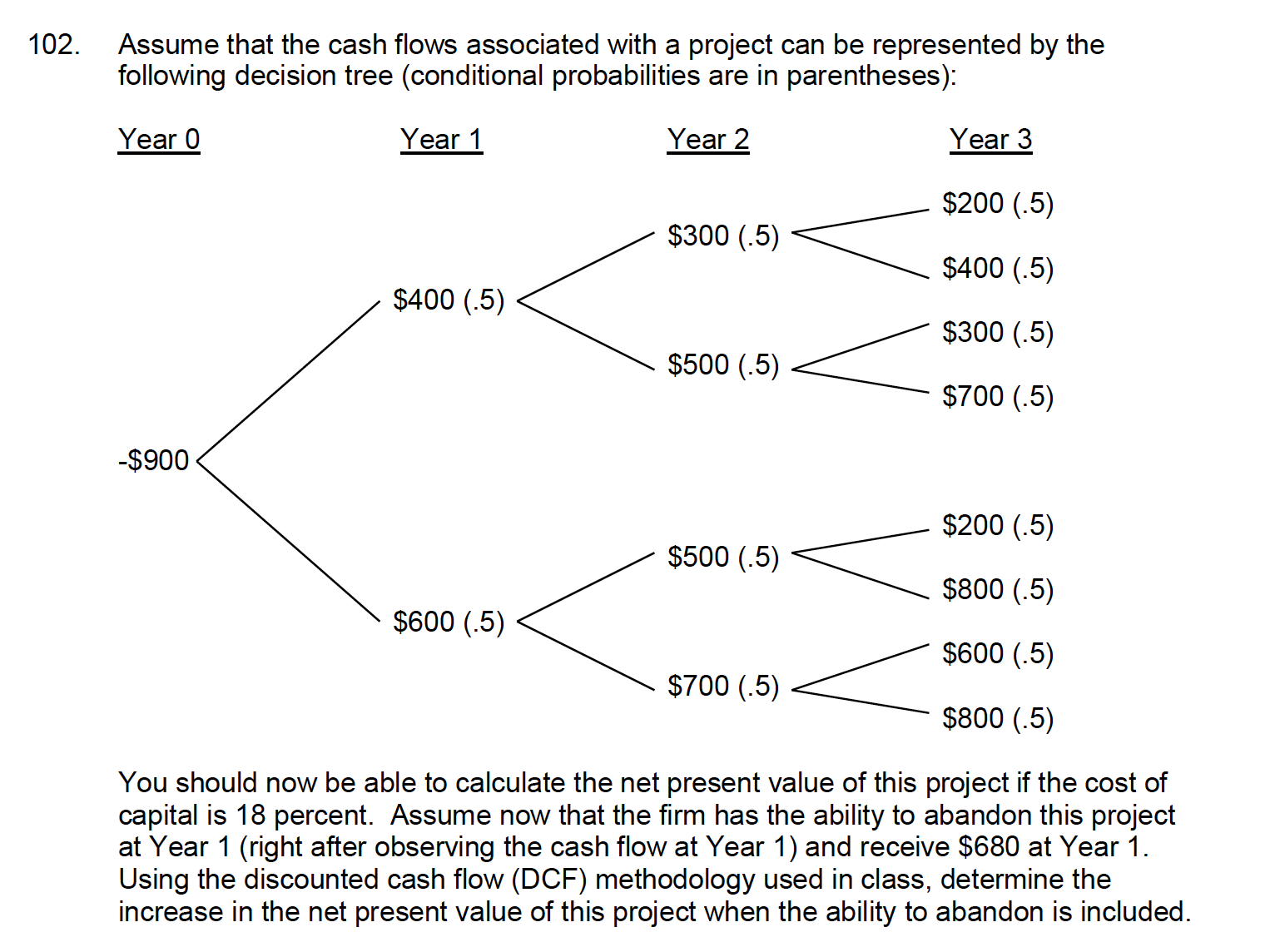

Assume that the cash flows associated with a project can be represented by the following decision tree ( conditional probabilities are in parentheses ) :

Assume that the cash flows associated with a project can be represented by the

following decision tree conditional probabilities are in parentheses:

You should now be able to calculate the net present value of this project if the cost of

capital is percent. Assume now that the firm has the ability to abandon this project

at Year right after observing the cash flow at Year and receive $ at Year

Using the discounted cash flow DCF methodology used in class, determine the

increase in the net present value of this project when the ability to abandon is included.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started