Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume that the conversion costs of TOGETHER Department in the current month decrease by 20%. What is the new conversion cost per equivalent unit and

Assume that the conversion costs of TOGETHER Department in the current month decrease by 20%. What is the new conversion cost per equivalent unit and costs of units completed and transferred out using Weighted Average Method.

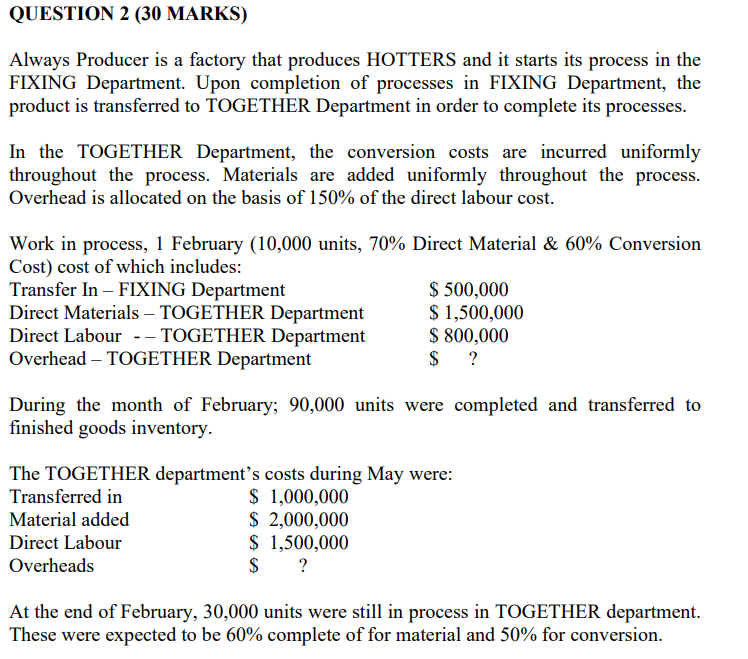

QUESTION 2 (30 MARKS) Always Producer is a factory that produces HOTTERS and it starts its process in the FIXING Department. Upon completion of processes in FIXING Department, the product is transferred to TOGETHER Department in order to complete its processes. In the TOGETHER Department, the conversion costs are incurred uniformly throughout the process. Materials are added uniformly throughout the process. Overhead is allocated on the basis of 150% of the direct labour cost. Work in process, 1 February (10,000 units, 70% Direct Material & 60% Conversion Cost) cost of which includes: Transfer In - FIXING Department $ 500,000 Direct Materials - TOGETHER Department $ 1,500,000 Direct Labour -- TOGETHER Department $ 800,000 Overhead TOGETHER Department $ ? During the month of February; 90,000 units were completed and transferred to finished goods inventory. The TOGETHER department's costs during May were: Transferred in $ 1,000,000 Material added $ 2,000,000 Direct Labour $ 1,500,000 Overheads $ ? At the end of February, 30,000 units were still in process in TOGETHER department. These were expected to be 60% complete of for material and 50% for conversion. QUESTION 2 (30 MARKS) Always Producer is a factory that produces HOTTERS and it starts its process in the FIXING Department. Upon completion of processes in FIXING Department, the product is transferred to TOGETHER Department in order to complete its processes. In the TOGETHER Department, the conversion costs are incurred uniformly throughout the process. Materials are added uniformly throughout the process. Overhead is allocated on the basis of 150% of the direct labour cost. Work in process, 1 February (10,000 units, 70% Direct Material & 60% Conversion Cost) cost of which includes: Transfer In - FIXING Department $ 500,000 Direct Materials - TOGETHER Department $ 1,500,000 Direct Labour -- TOGETHER Department $ 800,000 Overhead TOGETHER Department $ ? During the month of February; 90,000 units were completed and transferred to finished goods inventory. The TOGETHER department's costs during May were: Transferred in $ 1,000,000 Material added $ 2,000,000 Direct Labour $ 1,500,000 Overheads $ ? At the end of February, 30,000 units were still in process in TOGETHER department. These were expected to be 60% complete of for material and 50% for conversionStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started