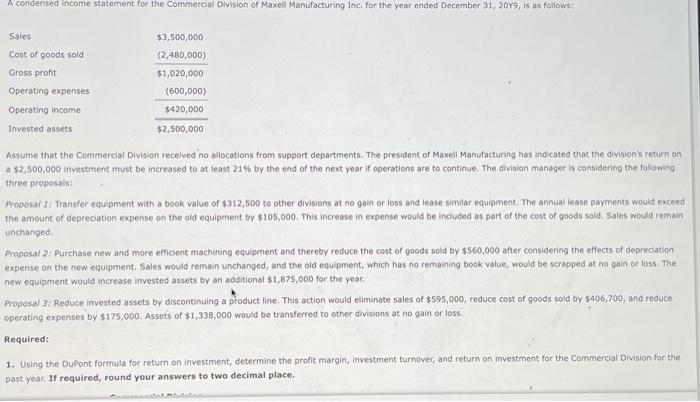

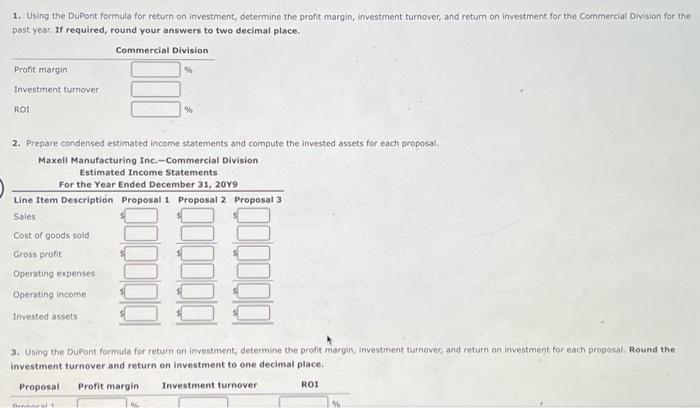

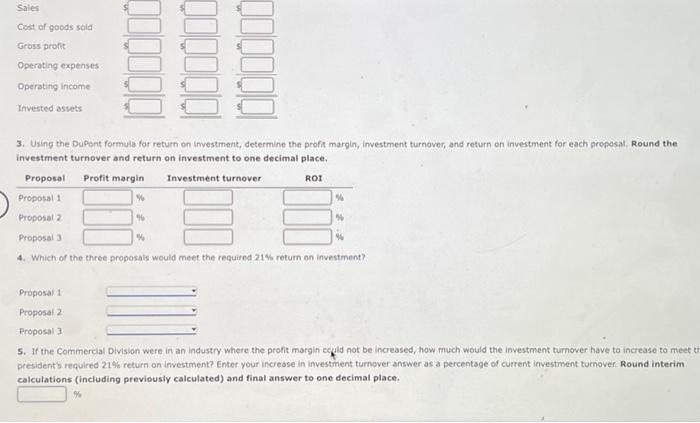

Assume that the Cormmercial Division recelved no allocations from support departments. The president of Maxell Manufacturing has indicatod that the division's return an a $2,500,000 investment must be increased to at least 21% by the end of the next year if operations are to continue. The divisian manager is eonsidering the following three proposals: Proposal 7 ; Fransfer equipment with a book value of $312,500 to other divisions at no gain or loss and lease similar equipment, The annual lease payments would exceed the amount of depreciation expense on the old equipment by $105,000. This increase in expense would be included as part of the cost of goods sold. Sales would remain unchanged. Proposal 2: Purchase new and more efficient machining equipment and thereby reduce the cost of goods sold by $560,000 after considering the effects of depreciation expense on the new equipment. Sales would remain unchanged, and the old equipment, which has no remaining book value, would be scrapped at no gain or loss. The new equipment would increase invested assets by an additional $1,675,000 for the year. Proposal 3: Reduce invested assets by discontinuing a product line. This action would eliminate sales of $595,000, reduce cost of goods sold by $406,700, and reduce operating expenses by $175,000. Assets of $1,338,000 would be transferred to other divisions at no gain or loss. Required: 1. Using the DuPont formula for return on investment, determine the profit margin, investment turnover, and return on investment for the Commercial Division for the past year, If required, round your answers to two decimal place. 1. Using the DuPont formula for return on investment, determine the profit margin, investment turnover, and return on investment for the Commereial Division for the past year, If required, round your answers to two decimal place. 2. Prepare condensed estimated income statements and compute the invested assets for each proposal. 3. Using the Dupont formula for return on investment, determine the profit margin, investment turnover, and return on investment for each proposal, Round the investment turnover and return on investment to one decimal place. 3. Using the DuPont formula for return on investment, determine the profit margin, investment turnover, and return on investment for each proposal. Round the investment turnover and return on investment to one decimal place. 4. Which of the three proposals would meet the required 21% return on investment? 5. If the Commercial Division were in an industry where the profit margin eculd not be increased, how much would the investment turnover have to increase to meet t president's required 21% return on investment? Enter your increase in investment turnover answer as a percentage of current investment turnover. Round interim calculations (including previously calculated) and final answer to one decimal place. \%