Assume that the corporate tax rate is 20% and the industry average of operating cash levels is 8% of sales revenue. Calculate the followings for Pixel Ltd. for the year ending in 2021. Use end-of-year values for balance sheet items.

4) Business Assets

5) Debt

6) Equity

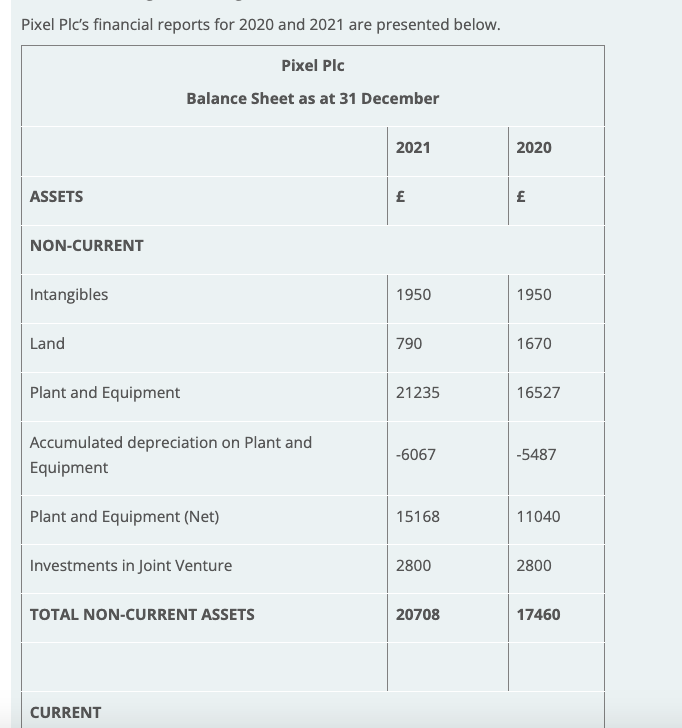

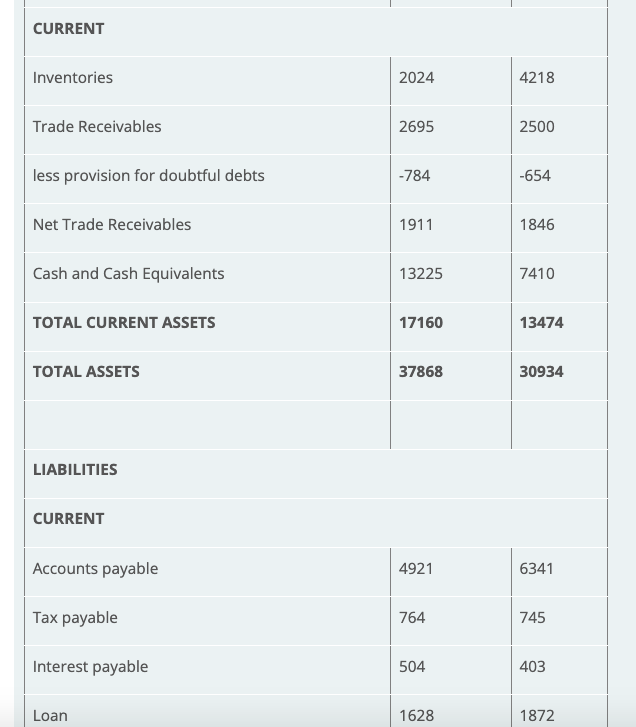

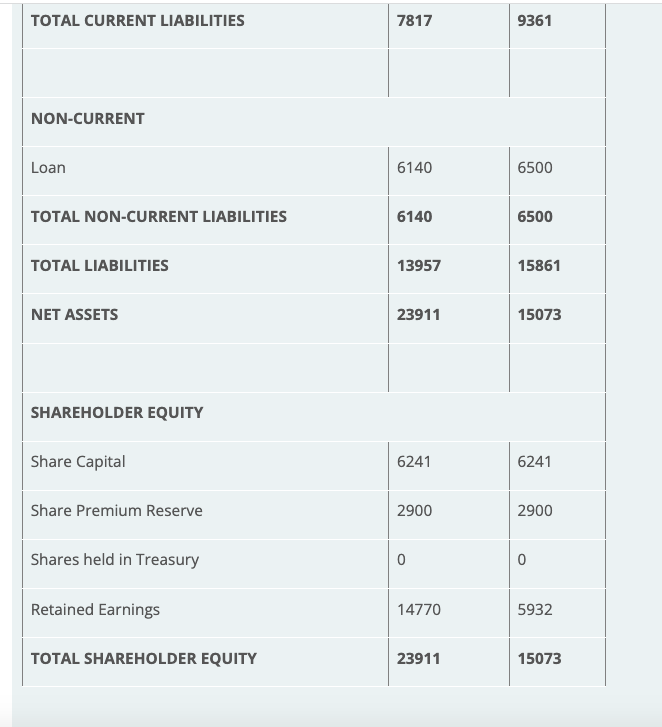

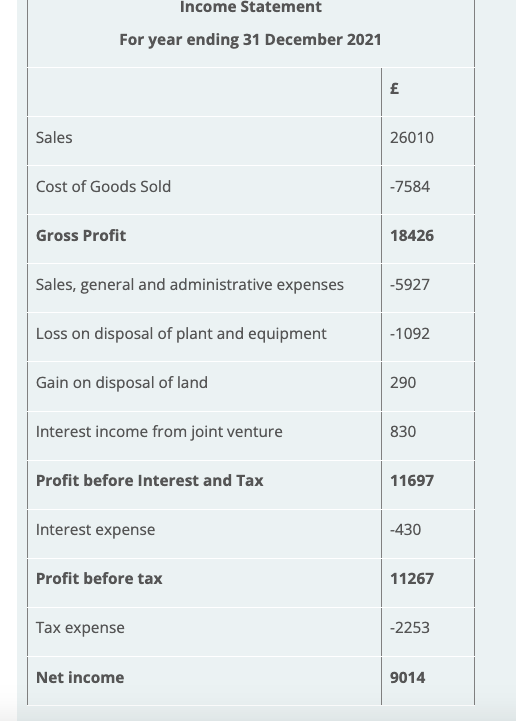

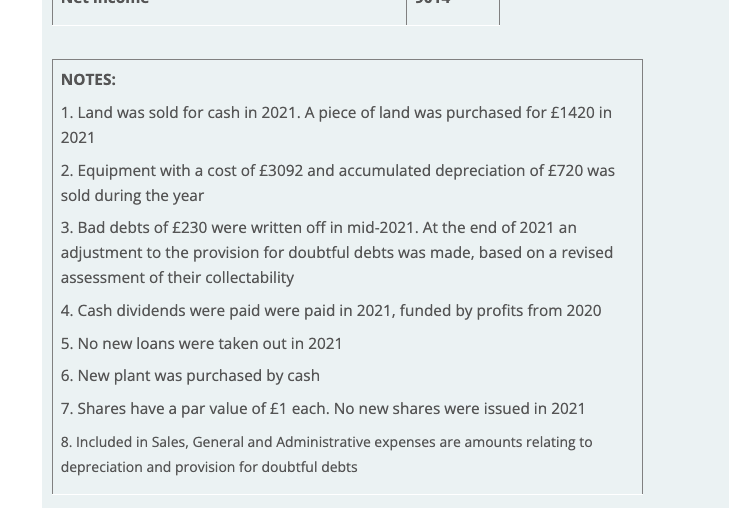

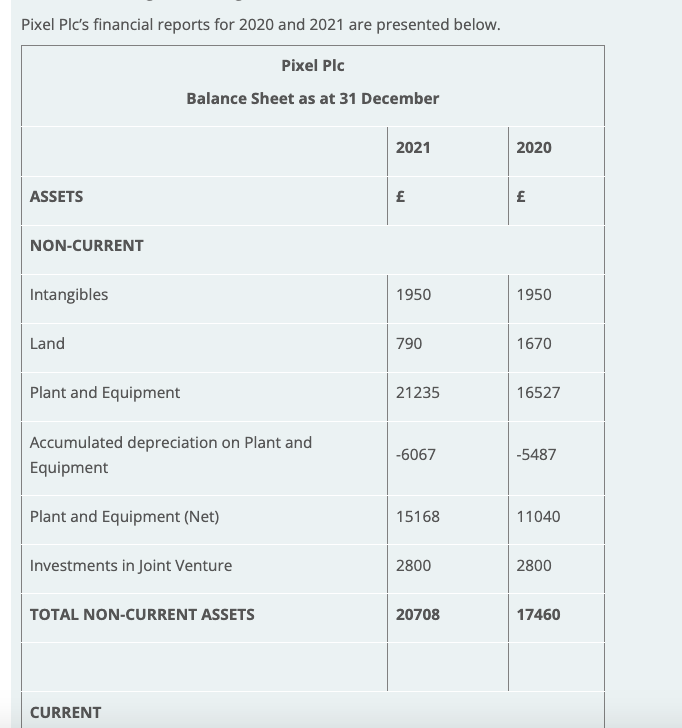

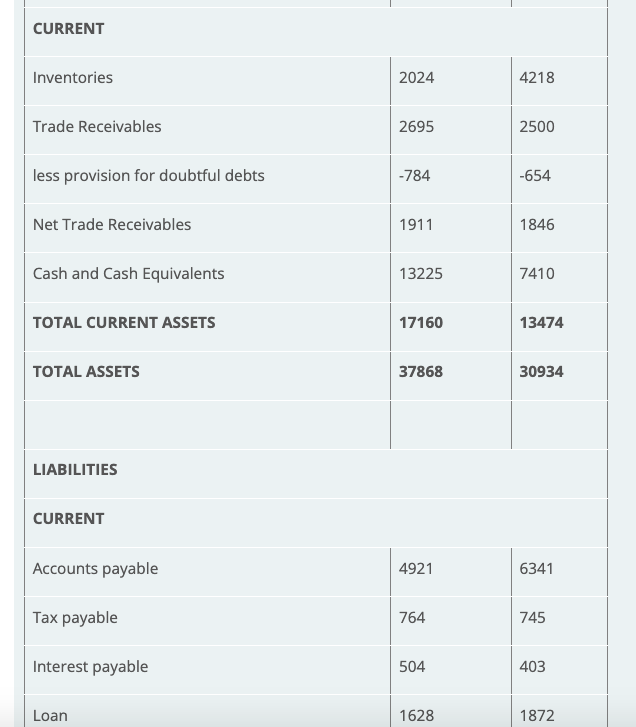

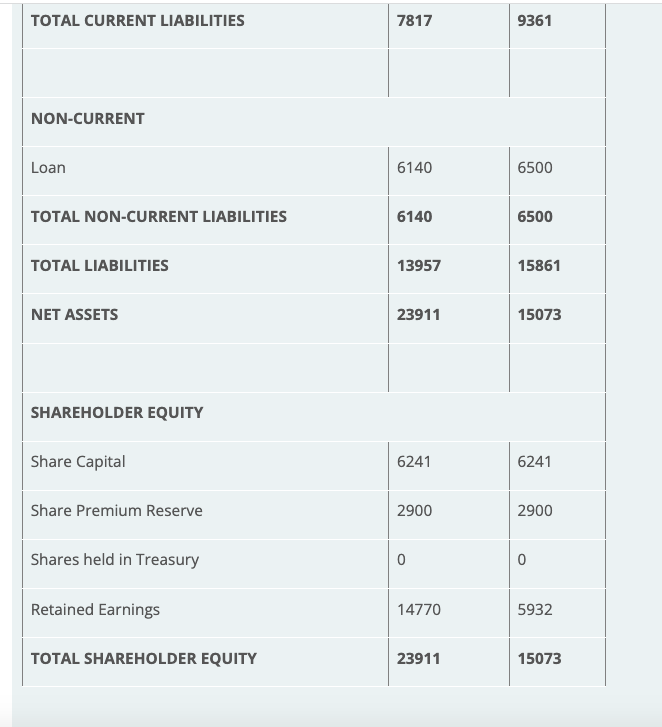

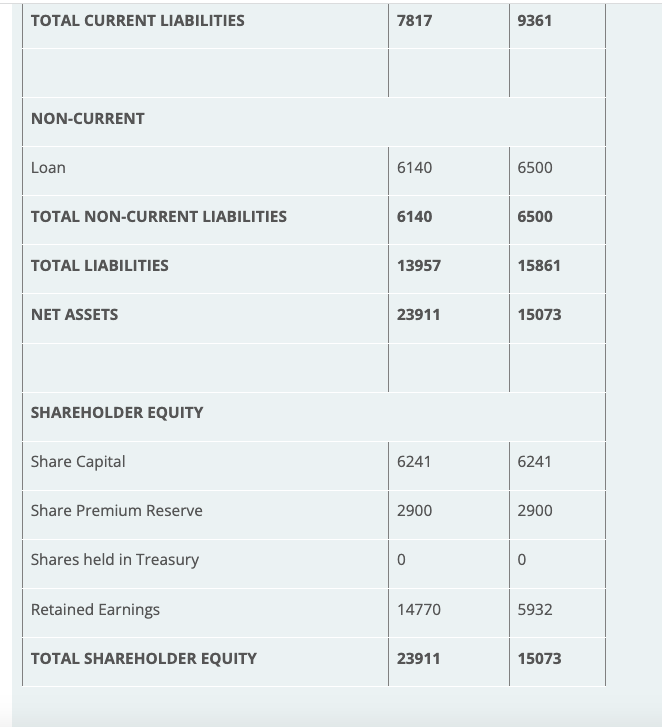

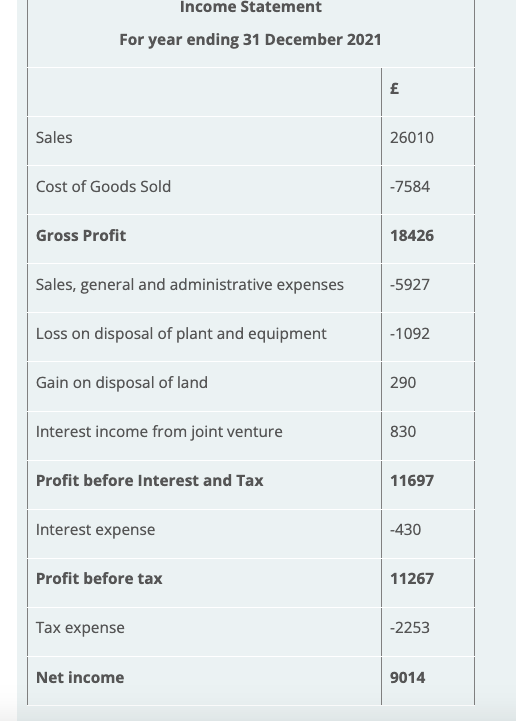

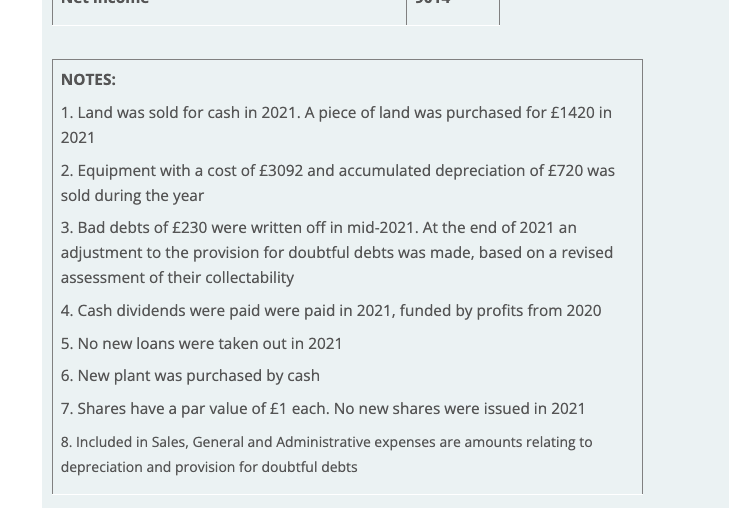

Pixel Plc's financial reports for 2020 and 2021 are presented below. Pixel Plc Balance Sheet as at 31 December 2021 2020 ASSETS NON-CURRENT Intangibles 1950 1950 Land 790 1670 Plant and Equipment 21235 16527 Accumulated depreciation on Plant and Equipment -6067 -5487 Plant and Equipment (Net) 15168 11040 Investments in Joint Venture 2800 2800 TOTAL NON-CURRENT ASSETS 20708 17460 CURRENT CURRENT Inventories 2024 4218 Trade Receivables 2695 2500 less provision for doubtful debts -784 -654 Net Trade Receivables 1911 1846 Cash and Cash Equivalents 13225 7410 TOTAL CURRENT ASSETS 17160 13474 TOTAL ASSETS 37868 30934 LIABILITIES CURRENT Accounts payable 4921 6341 Tax payable 764 745 Interest payable 504 403 Loan 1628 1872 TOTAL CURRENT LIABILITIES 7817 9361 NON-CURRENT Loan 6140 6500 TOTAL NON-CURRENT LIABILITIES 6140 6500 TOTAL LIABILITIES 13957 15861 NET ASSETS 23911 15073 SHAREHOLDER EQUITY Share Capital 6241 6241 Share Premium Reserve 2900 2900 Shares held in Treasury 0 0 Retained Earnings 14770 5932 TOTAL SHAREHOLDER EQUITY 23911 15073 TOTAL CURRENT LIABILITIES 7817 9361 NON-CURRENT Loan 6140 6500 TOTAL NON-CURRENT LIABILITIES 6140 6500 TOTAL LIABILITIES 13957 15861 NET ASSETS 23911 15073 SHAREHOLDER EQUITY Share Capital 6241 6241 Share Premium Reserve 2900 2900 Shares held in Treasury 0 0 Retained Earnings 14770 5932 TOTAL SHAREHOLDER EQUITY 23911 15073 Income Statement For year ending 31 December 2021 Sales 26010 Cost of Goods Sold -7584 Gross Profit 18426 Sales, general and administrative expenses -5927 Loss on disposal of plant and equipment -1092 Gain on disposal of land 290 Interest income from joint venture 830 Profit before Interest and Tax 11697 Interest expense -430 Profit before tax 11267 Tax expense -2253 Net income 9014 001 NOTES: 1. Land was sold for cash in 2021. A piece of land was purchased for 1420 in 2021 2. Equipment with a cost of 3092 and accumulated depreciation of 720 was sold during the year 3. Bad debts of 230 were written off in mid-2021. At the end of 2021 an adjustment to the provision for doubtful debts was made, based on a revised assessment of their collectability 4. Cash dividends were paid were paid in 2021, funded by profits from 2020 5. No new loans were taken out in 2021 6. New plant was purchased by cash 7. Shares have a par value of 1 each. No new shares were issued in 2021 8. Included in Sales, General and Administrative expenses are amounts relating to depreciation and provision for doubtful debts