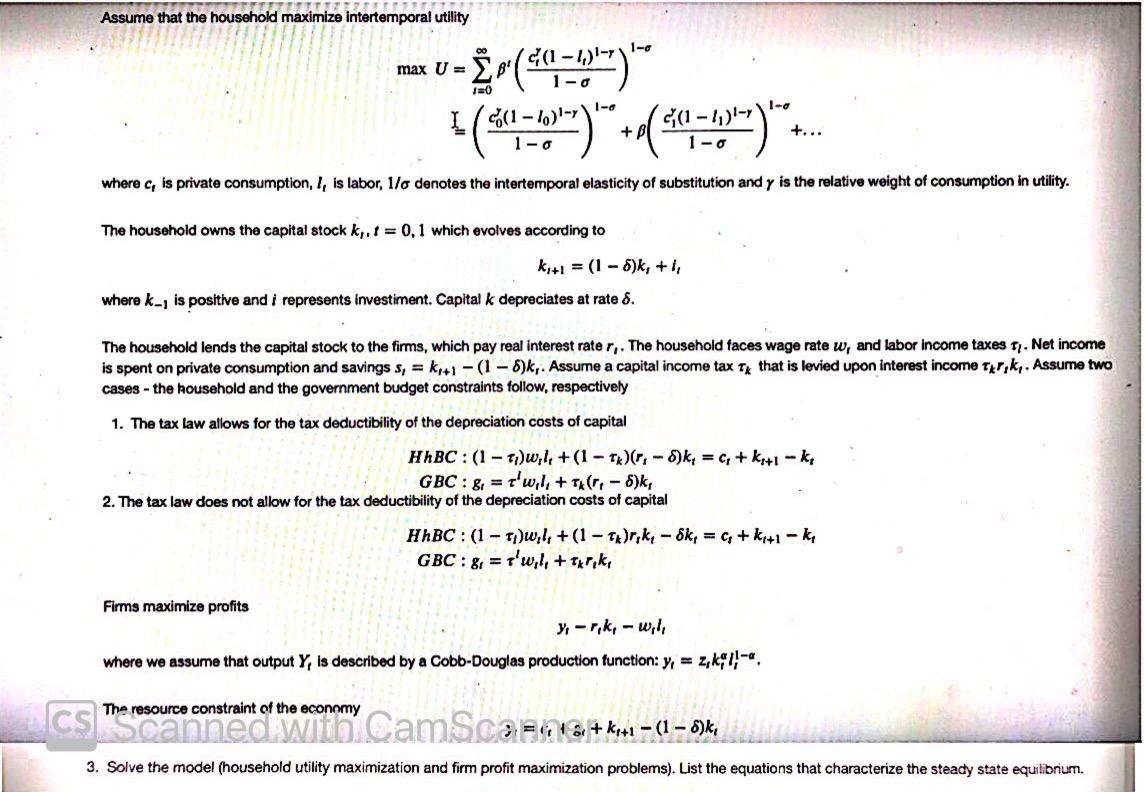

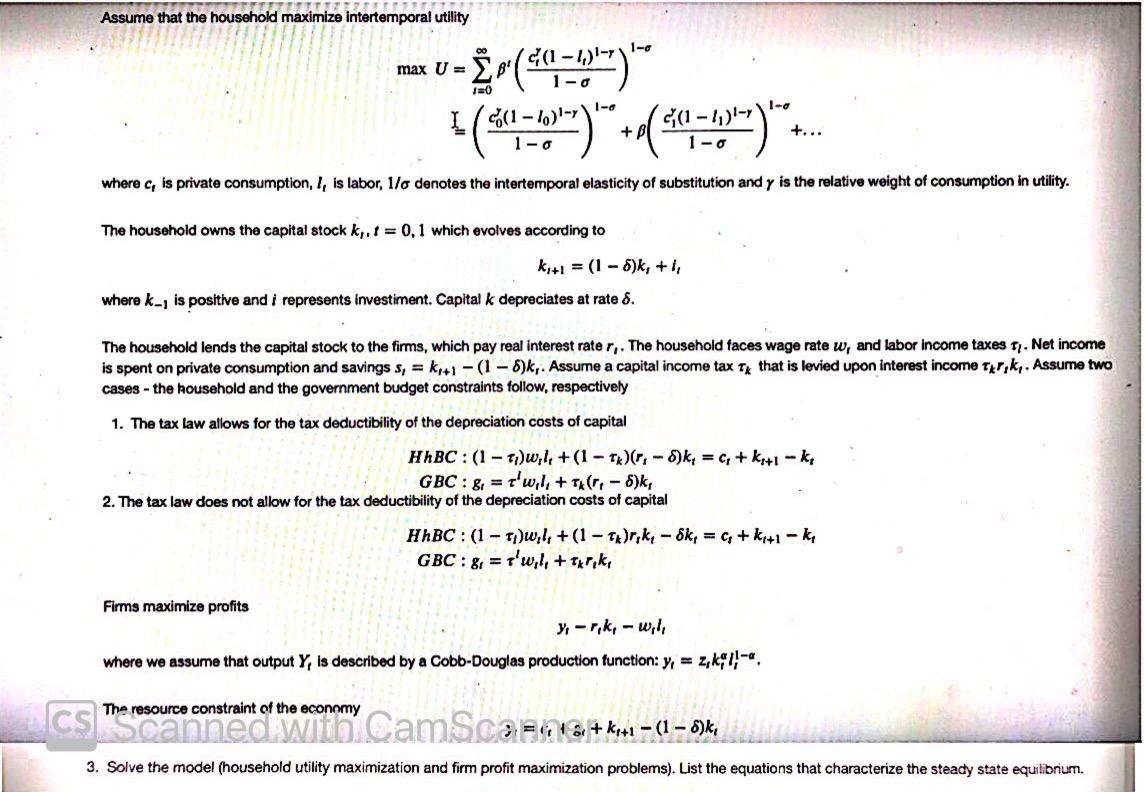

Assume that the household maximize intertemporal utility max U = - (44=1'7)" 1641-6")"+( 341 = "") 1-0 +... where c, is private consumption, I, is labor, 170 denotes the intertemporal elasticity of substitution and y is the relative weight of consumption in utility. The household owns the capital stock k. 1 = 0.1 which evolves according to ki+1 = (1-5)k, +1, where k-, is positive and i represents Investiment. Capital k depreciates at rate . The household lends the capital stock to the firms, which pay real interest rate r,. The household faces wage rate w, and labor income taxes 77. Net income is spent on private consumption and savings s, = kr+1-(1-)ky. Assure a capital income tax Ty that is levied upon interest income tarik,. Assume two cases - the household and the government budget constraints follow, respectively 1. The tax law allows for the tax deductibility of the depreciation costs of capital HhBC: (1 - i)w,, + (1 - 1)(-8)ky = 4, + k +1 -k GBC: 8 = t'w.l. + Thr, - )k, 2. The tax law does not allow for the tax deductibility of the depreciation costs of capital HhBC: (1 Tiwili + (1 - Tk)rik, - 8k, = 4 + k +1 k GBC: 8. = t'wil, + turik Firms maximize profits yrk, will where we assume that output Y, is described by a Cobb-Douglas production function: y = z;k$1]-a. The resource constraint of the economy cs the resource centenar yanmy CamScania + kod? (1 5)ki 3. Solve the model (household utility maximization and firm profit maximization problems). List the equations that characterize the steady state equilibrium. Assume that the household maximize intertemporal utility max U = - (44=1'7)" 1641-6")"+( 341 = "") 1-0 +... where c, is private consumption, I, is labor, 170 denotes the intertemporal elasticity of substitution and y is the relative weight of consumption in utility. The household owns the capital stock k. 1 = 0.1 which evolves according to ki+1 = (1-5)k, +1, where k-, is positive and i represents Investiment. Capital k depreciates at rate . The household lends the capital stock to the firms, which pay real interest rate r,. The household faces wage rate w, and labor income taxes 77. Net income is spent on private consumption and savings s, = kr+1-(1-)ky. Assure a capital income tax Ty that is levied upon interest income tarik,. Assume two cases - the household and the government budget constraints follow, respectively 1. The tax law allows for the tax deductibility of the depreciation costs of capital HhBC: (1 - i)w,, + (1 - 1)(-8)ky = 4, + k +1 -k GBC: 8 = t'w.l. + Thr, - )k, 2. The tax law does not allow for the tax deductibility of the depreciation costs of capital HhBC: (1 Tiwili + (1 - Tk)rik, - 8k, = 4 + k +1 k GBC: 8. = t'wil, + turik Firms maximize profits yrk, will where we assume that output Y, is described by a Cobb-Douglas production function: y = z;k$1]-a. The resource constraint of the economy cs the resource centenar yanmy CamScania + kod? (1 5)ki 3. Solve the model (household utility maximization and firm profit maximization problems). List the equations that characterize the steady state equilibrium