Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume that the individual have beliefs that deviate from rational expectations. She believes that Stock A is expected to have a price of 1000 or

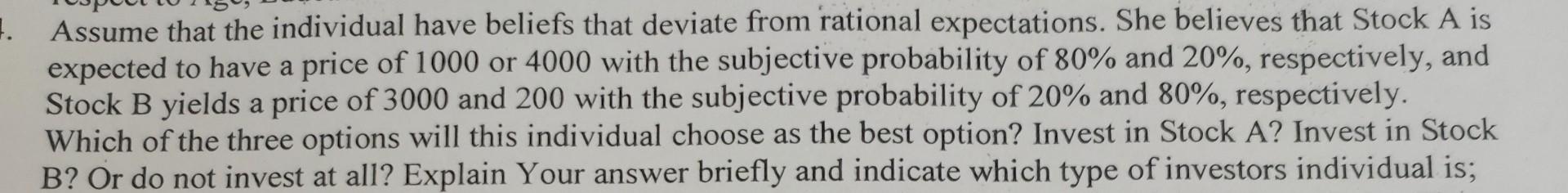

Assume that the individual have beliefs that deviate from rational expectations. She believes that Stock A is expected to have a price of 1000 or 4000 with the subjective probability of 80% and 20%, respectively, and Stock B yields a price of 3000 and 200 with the subjective probability of 20% and 80%, respectively. Which of the three options will this individual choose as the best option? Invest in Stock A? Invest in Stock B? Or do not invest at all? Explain Your answer briefly and indicate which type of investors individual is

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started