Question

Assume that the net assets of 3 companies, G Ltd, H Ltd and I Ltd are represented by their respective share capital and retained profit,

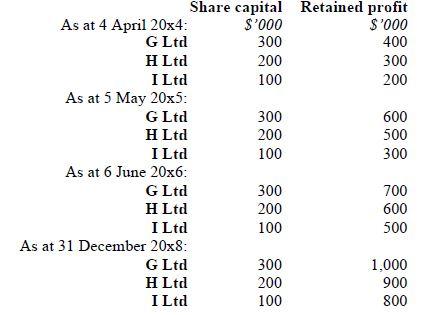

Assume that the net assets of 3 companies, G Ltd, H Ltd and I Ltd are represented by their respective share capital and retained profit, as follows:

For each of the following three independent scenarios, compute the amount of (i) group retained profit and (ii) non-controlling interest in G Ltds consolidated statement of financial position as at 31 December 20x8.

Scenario I: G Ltd acquires 90% controlling interest in H Ltd on 4 April 20x4 and H Ltd acquires 80% controlling interest in I Ltd on 5 May 20x5.

Scenario II: H Ltd acquires 80% controlling interest in I Ltd on 5 May 20x5, and G Ltd acquires 90% controlling interest in H Ltd on 6 June 20x6.

Scenario III: On 5 May 20x5, G Ltd acquires 90% controlling interest in H Ltd and 10% of I Ltd, and H Ltd acquires 70% controlling interest in I Ltd.

100 Share capital Retained profit As at 4 April 20x4: $'000 $'000 G Ltd 300 400 H Ltd 200 300 I Ltd 200 As at 5 May 20x5: GLtd 300 600 H Ltd 200 500 I Ltd 100 300 As at 6 June 20x6: G Ltd 300 700 H Ltd 200 600 I Ltd 100 500 As at 31 December 20x8: GLtd 300 1,000 H Ltd 200 I Ltd 100 800 900Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started