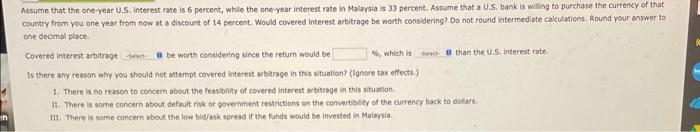

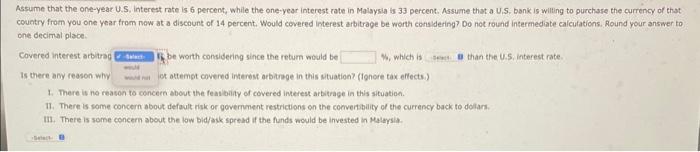

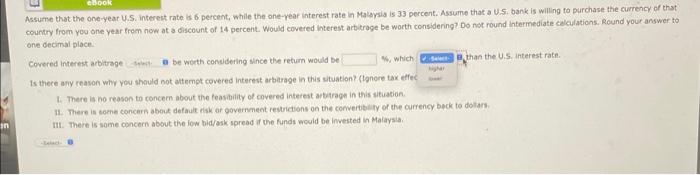

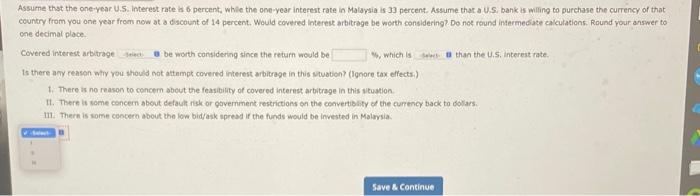

Assume that the one-year U.S. interest rase is 6 percent, while the one-year interest rate in Malyyia is 33 percent. Assume that a U.S. bank is wiling to purchase the currency of that country from you one year from now at a discount of 14 percent. Would covered interest arbltage be worth considering? Do not round intermediate cakulations. Round your answer to bne decimal place. Covered interest arbitrage be worth considering since the return would be which is than the U.5, interest rate. Is there any reasan why you should not attempt covered intereut arbitrage in this situotion? (Ignore tax effects.) 1. There is no reason to concern about the feasibinty of covered interest arbitrage in this situation II. There is some concern about defnult risk or qovemment restrictions on the convertiality of the currency back to dotars. II. There is some concern about the low bidgank seread if the funds would be invested in Matarsia. Assume that the one-year U.S, interest rate is 6 percent, while the one-year interest rate in Malaysia is 33 percent. Assume that a U.S. bank is willing to purchase the currency of that country from you one year trom now at a discount of 14 percent. Would covered interest arbitrage be worth consldering? Do not round intermediate calculations. Round your answer to one decimal place. Covered interest arbitrad be worth considering since the return wovid be W, which is than the 4.5 , interest rate Is there any reason why ot attemot covered interest arbitroge in this stuation? (ignore tax effects.) 1. There is no reason to concern about the feas bility of covered interest arbitrage in this situation. II. There is some concern about defoult risk or govemment restrictions on the comvertbility of the currency back to dolars. III. There is some concem about the low bid/ack sprehd if the funds would be invested in Malaysia. Assume that the one-year U.S. intereit rate is 6 percent, while the one-vear interest rate in Malgria is 33 percent. Assume that a U.5. bank is willing to purchase the currency of that country from you one year trom now at a discount of 14 percent. Would covered ihterest arbitrage be worth considening? Do not round intermediate calculations. Round your answer to one decimal place Covered interest arbitrage be worth conddering since the return would be which Is thece any ceavon why you thauld not atempt covered interest arbarage in this situation? (Hgnore tax effec 1. There is no reason to concem about the feasciity of covered interest artirage in this utuation. 11. There is some concern abou defoult risk ar government resuidions on the convertblity of the currency beck to dolars. IiI. There is some concern about the low bid/ask spread if whe funds would be invested in Malaysia. Assume thst the one-year U.5. interest rate is 6 percent, while the one-year intereit rate in Malaysia is 33 percent. Assume that a U.S. bank is wiling to purchase the currency of that counkry from you one year from now at a discount of 14 pertent. Would covered interes arbitrage be worth considering? Do not round intermeGate calculations. Round your answer to cone decimal place. Covered interest arbitrage be worth considering since the return would be 4. which is than the U.S. interest rate. Is there any reason whiy rou thould not attnmpt covered interest arbitrage in this vuotion? (Ignore tax effectsi) 1. There is no reason to concem about the feasibility of covered interest arbitrage in this wtuation. II. There it some concem about default risk or govermment restrictions on the convertiblify of the curnency back to bolars. 1II. Thern is some coocero about the low bidyask apread if the funds would be invested in Malmsia