Answered step by step

Verified Expert Solution

Question

1 Approved Answer

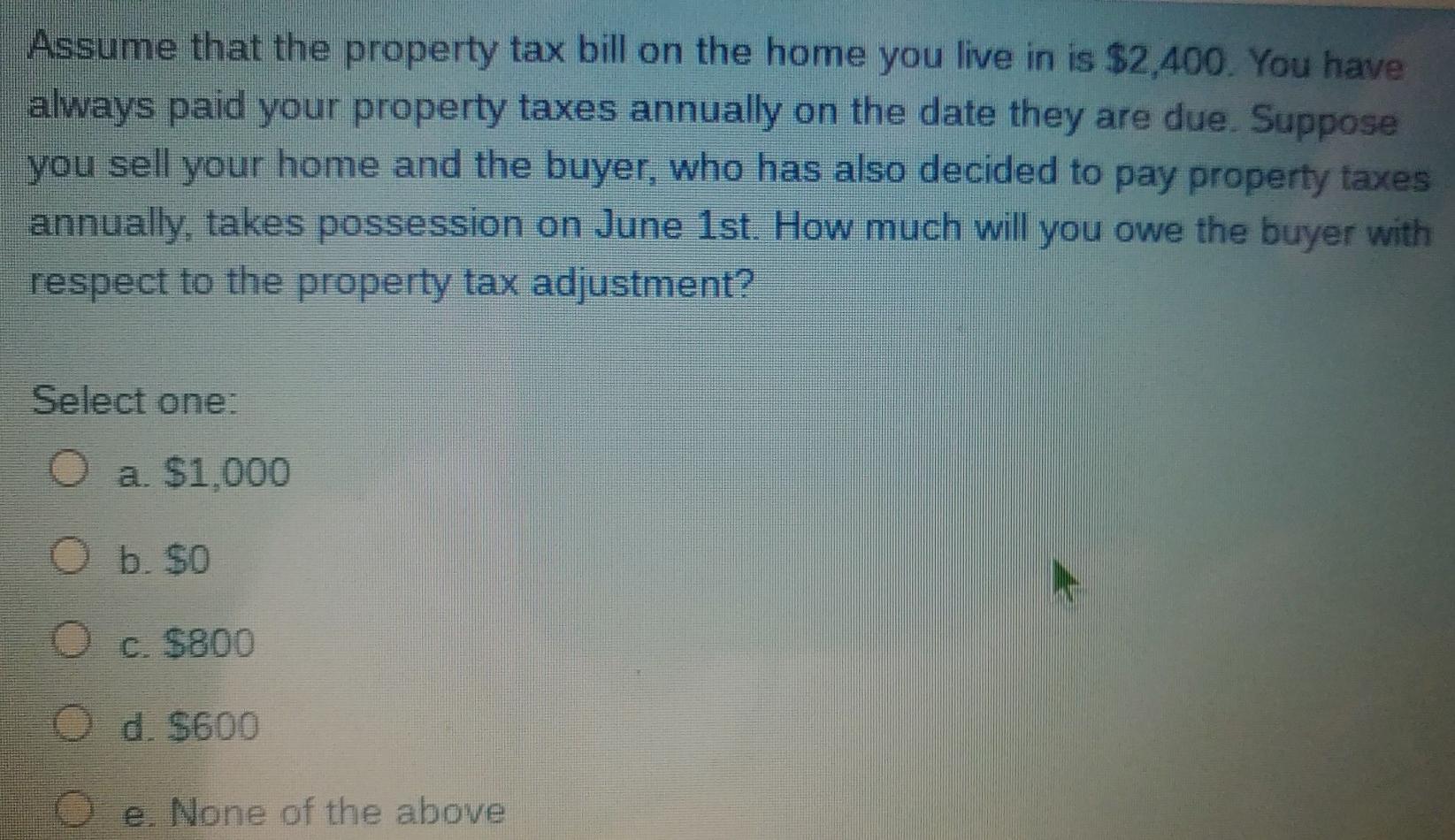

Assume that the property tax bill on the home you live in is $2,400. You have always paid your property taxes annually on the date

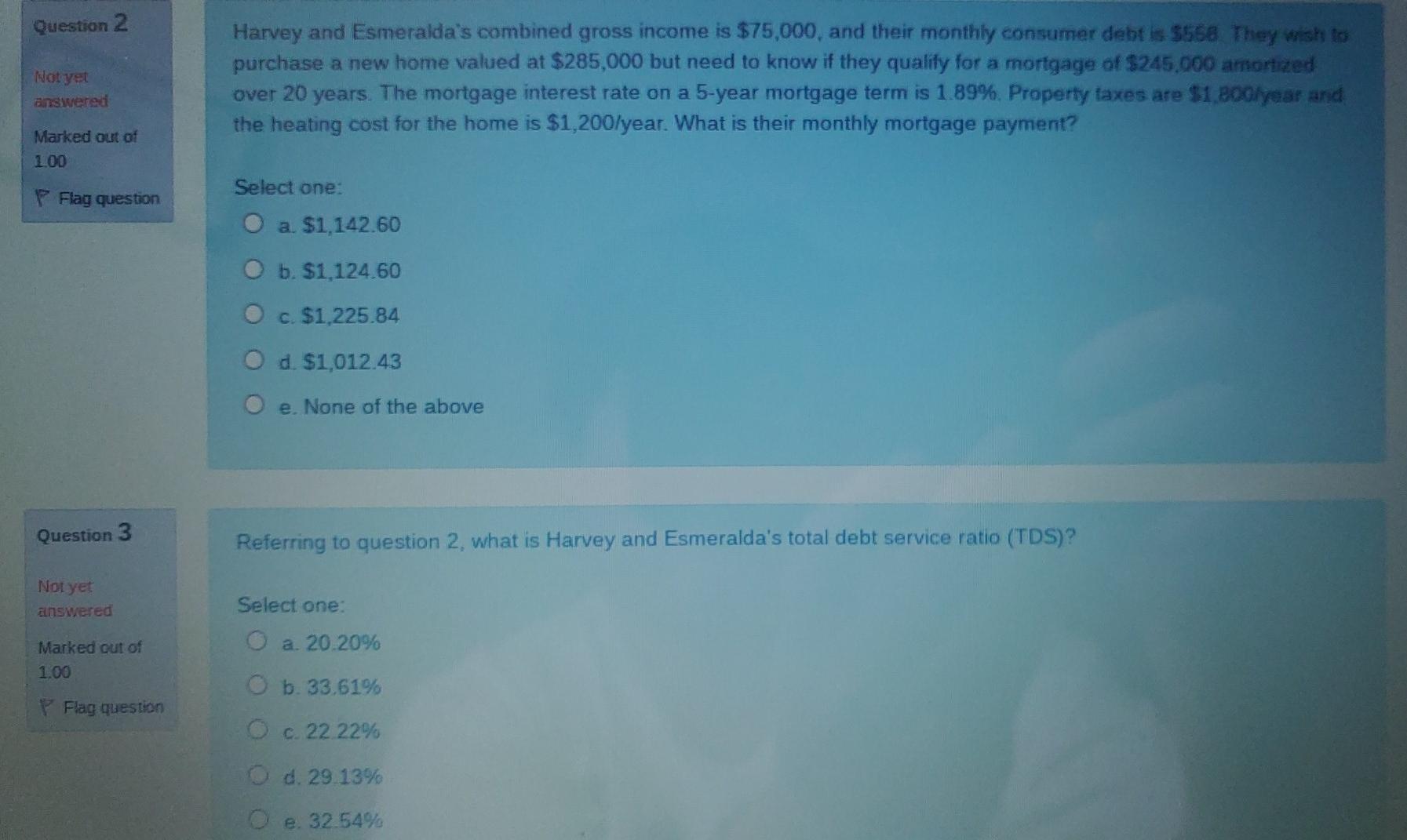

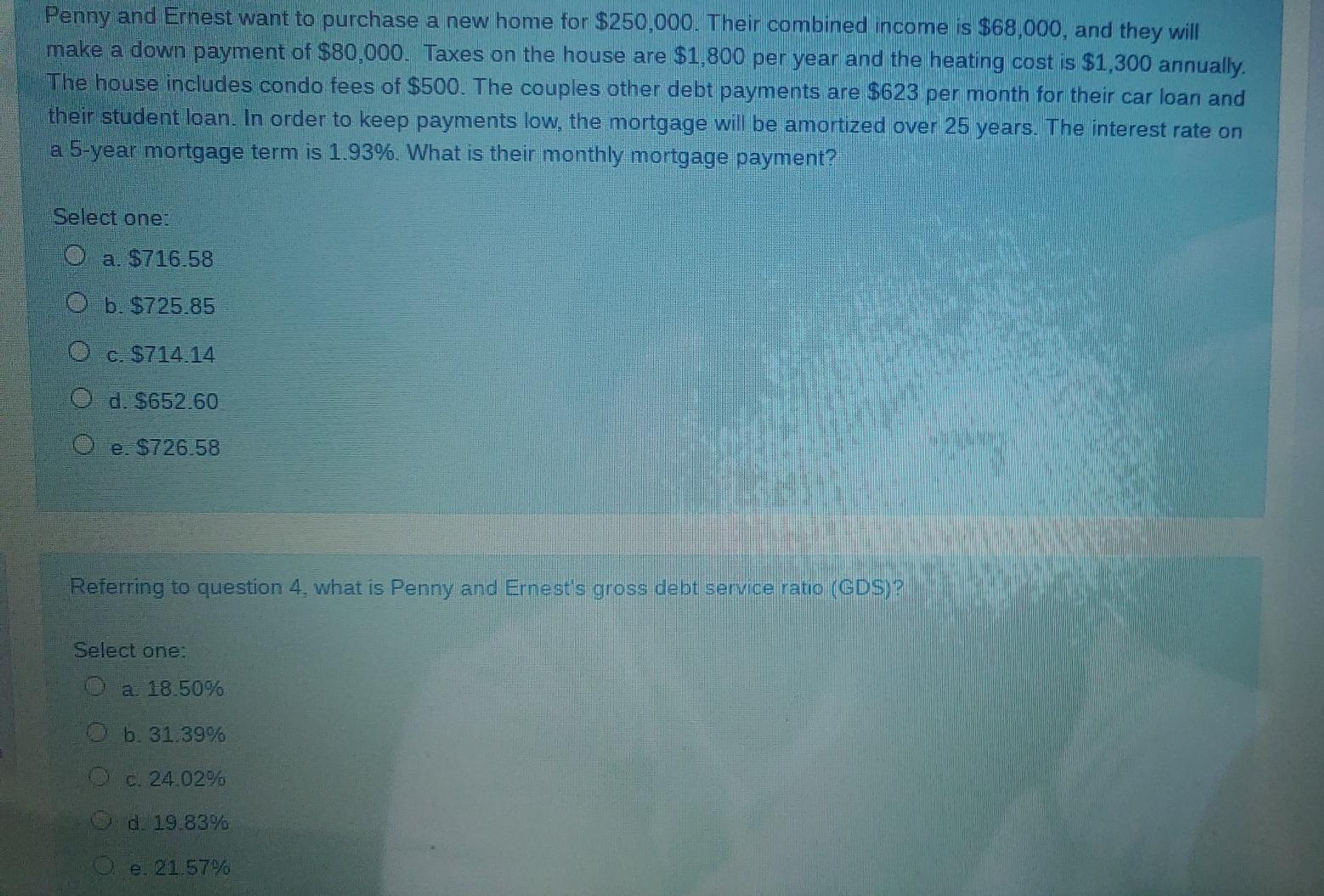

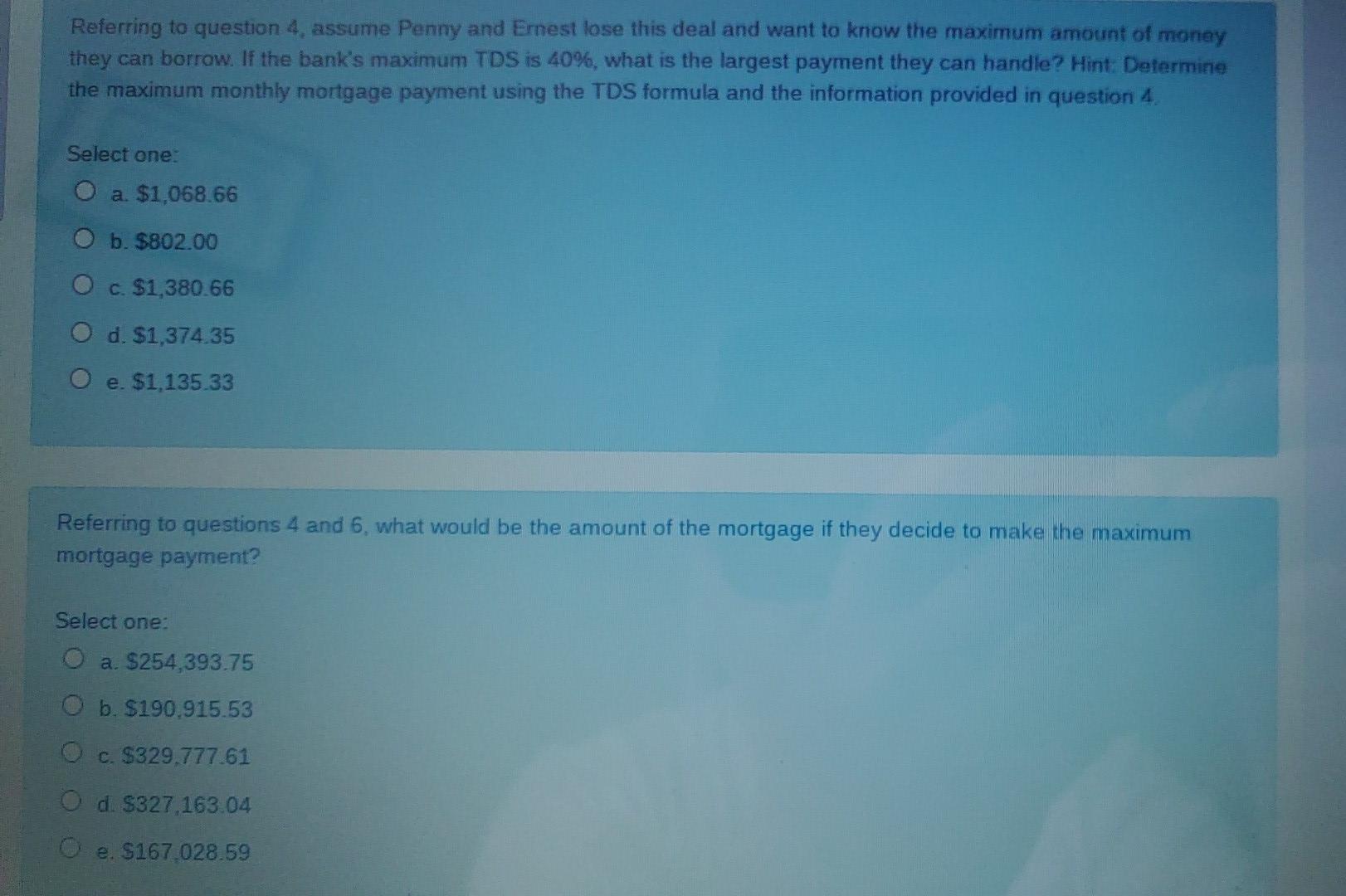

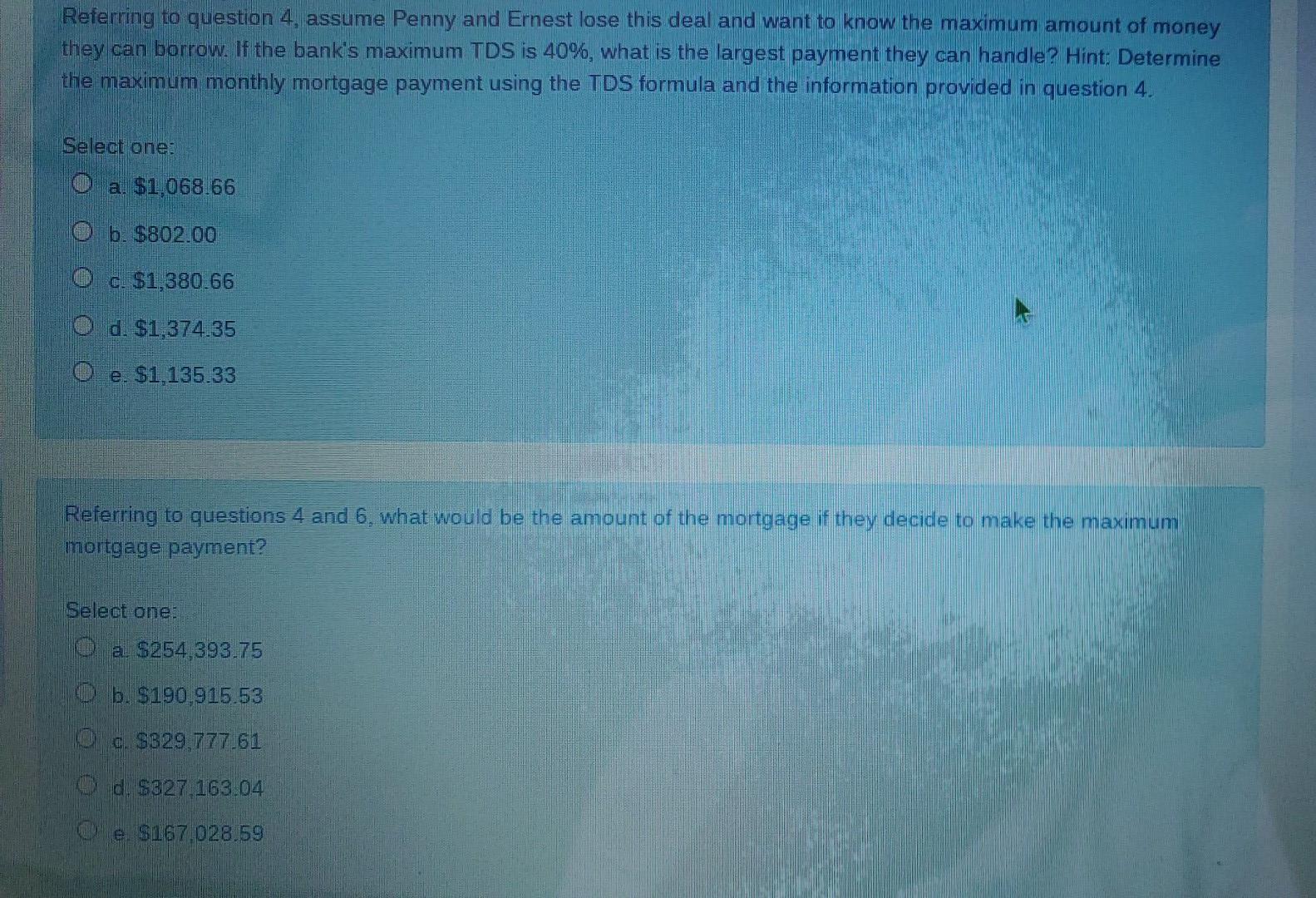

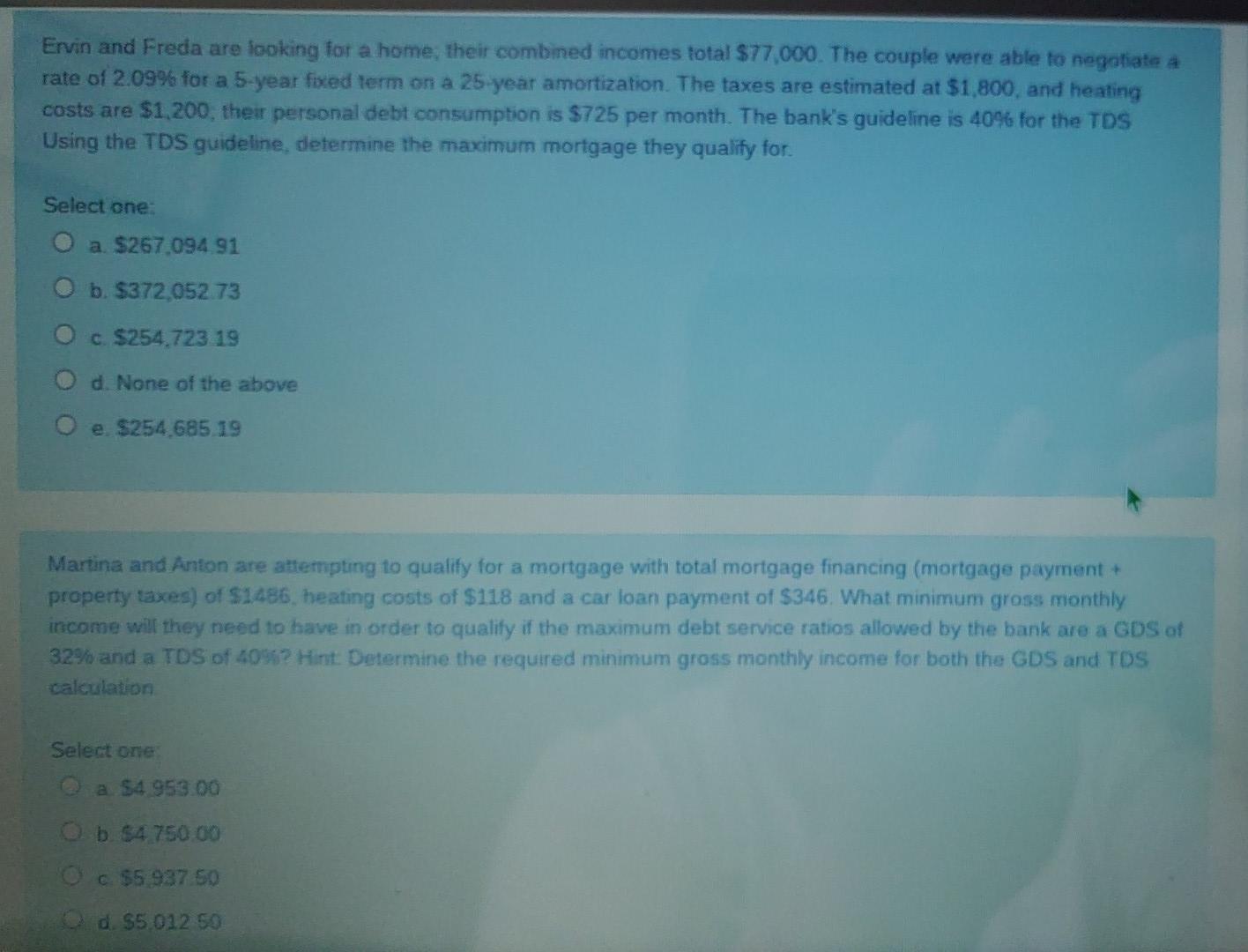

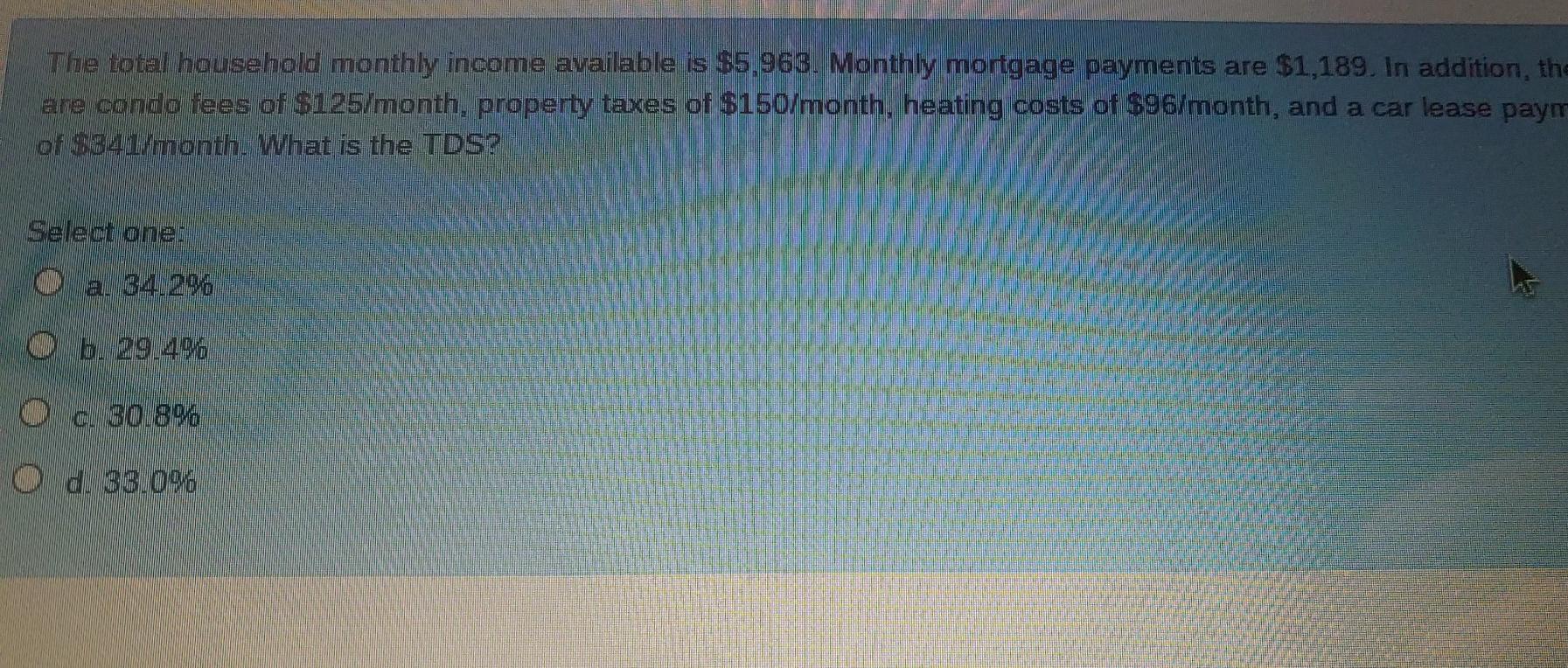

Assume that the property tax bill on the home you live in is $2,400. You have always paid your property taxes annually on the date they are due. Suppose you sell your home and the buyer, who has also decided to pay property taxes annually, takes possession on June 1st. How much will you owe the buyer with respect to the property tax adjustment? Select one: 0 a $1,000 O b. $0 O c. $800 O d. $600 oe. None of the above Question 2 Not yet answered Harvey and Esmeralda's combined gross income is $75,000, and their monthly consumer debt is $566 They wish to purchase a new home valued at $285,000 but need to know if they qualify for a mortgage of $245.000 amortized over 20 years. The mortgage interest rate on a 5-year mortgage term is 1.89%. Property taxes are $1.800lyear and the heating cost for the home is $1,200/year. What is their monthly mortgage payment? Marked out of 100 Select one: Flag question O a $1,142.60 O b. $1,124.60 O c. $1,225.84 O d. $1,012.43 e. None of the above Question 3 Referring to question 2. what is Harvey and Esmeralda's total debt service ratio (TDS)? Not yet answered Select one: O a. 20.20% Marked out of 1.00 O b. 33.61% Flag question O c.22.22% O d. 29 13% O e. 32.54% Penny and Ernest want to purchase a new home for $250,000. Their combined income is $68,000, and they will make a down payment of $80,000. Taxes on the house are $1,800 per year and the heating cost is $1,300 annually. The house includes condo fees of $500. The couples other debt payments are $623 per month for their car loan and their student loan. In order to keep payments low, the mortgage will be amortized over 25 years. The interest rate on a 5-year mortgage term is 1.93%. What is their monthly mortgage payment? Select one: a. $716.58 O b. $725.85 c. $714.14 d. $652.60 e. $726.58 Referring to question 4. what is Penny and Ernest's gross debt service ratio (GDS)? Select one: a. 18.50% b. 31.39% c. 24.02% d. 19 83% e. 21.57% Referring to question 4, assume Penny and Ernest lose this deal and want to know the maximum amount of money they can borrow. If the bank's maximum TDS is 40%, what is the largest payment they can handle? Hint: Determine the maximum monthly mortgage payment using the TDS formula and the information provided in question 4 Select one: O a. $1.068.66 b. $802.00 O c. $1,380.66 d. $1,374.35 e. $1,135.33 Referring to questions 4 and 6. what would be the amount of the mortgage if they decide to make the maximum mortgage payment? Select one: a $254,393.75 O b. $190.915.53 c. $329.777.61 Od $327,163.04 e. $167.028.59 Referring to question 4, assume Penny and Ernest lose this deal and want to know the maximum amount of money they can borrow. If the bank's maximum TDS is 40%, what is the largest payment they can handle? Hint: Determine the maximum monthly mortgage payment using the TDS formula and the information provided in question 4. Select one: O a. $1.068,66 b. $802.00 c. $1,380.66 d. $1,374.35 e. $1,135.33 Referring to questions 4 and 6, what would be the amount of the mortgage if they decide to make the maximum mortgage payment? Select one: a $254,393.75 O b. $190,915.53 c. $329,777,61 d. $327 163.04 e $167 028.59 Ervin and Freda are looking for a home, their combined incomes total $77,000. The couple were able to negotiate a rate of 2.09% for a 5-year fixed term on a 25-year amortization. The taxes are estimated at $1,800, and heating costs are $1,200, their personal debt consumption is $725 per month. The bank's guideline is 40% for the TDS Using the TDS guideline, determine the maximum mortgage they qualify for Select one: O a $267.094 91 O b. $372,052.73 O c. $254.723 19 d. None of the above e $254.685 19 Martina and Anton are attempting to qualify for a mortgage with total mortgage financing (mortgage payment + property taxes) of $1486. heating costs of $118 and a car loan payment of $346. What minimum gross monthly income will they need to have in order to qualify if the maximum debt service ratios allowed by the bank are a GDS of 32% and a TDS of 40? Hint Determine the required minimum gross monthly income for both the GDS and TDS calculation Select one a $4 953 00 Ob $4.750.00 O c $5 937 50 Od $5012 50 The total household monthly income available is $5.963. Monthly mortgage payments are $1,189. In addition, the are condo fees of $125/month, property taxes of $150/month, heating costs of $96/month, and a car lease paym of $841 month. What is the TDS? Select one: ob. 29 496 O c. 80.8% O d. 38.0%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started