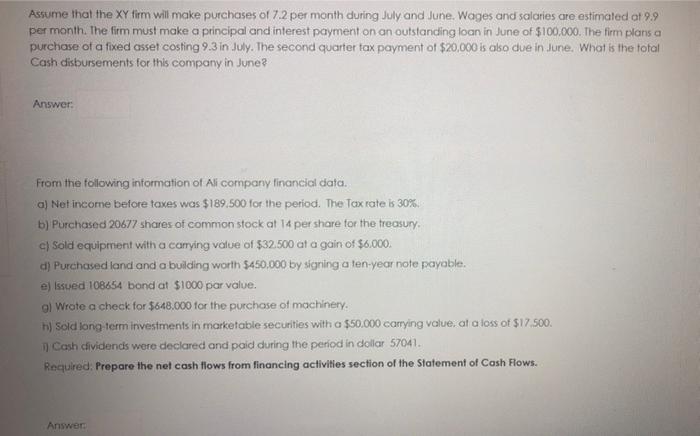

Assume that the XY firm will make purchases of 7.2 per month during July and June. Wages and salaries are estimated at 9.9 per month. The firm must make a principal and interest payment on an outstanding loan in June of $100.000. The firm plans a purchase of a fixed asset costing 9.3 in July. The second quarter tax payment of $20,000 is ako due in June. What is the total Cash disbursements for this company in June? Answer: From the following information of All company financial data. a) Net income before taxes was $189.500 for the period. The Tax rate is 30% b) Purchased 20677 shares of common stock at 14 per share for the treasury. c) Sold equipment with a carrying value of $32.500 at a gain of $6.000. d) Purchased land and a building worth $450.000 by signing a ten-year note payable. e) Issued 108654 bond at $1000 par value. al Wrote a check for $648.000 for the purchase of machinery h) Sold long term investments in marketable securities with a $50.000 carrying value, at a loss of $17.500. Cash dividends were declared and paid during the period in dollar 57041. Required. Prepare the net cash flows from financing activities section of the Statement of Cash Flows. Answer Assume that the XY firm will make purchases of 7.2 per month during July and June. Wages and salaries are estimated at 9.9 per month. The firm must make a principal and interest payment on an outstanding loan in June of $100.000. The firm plans a purchase of a fixed asset costing 9.3 in July. The second quarter tax payment of $20,000 is ako due in June. What is the total Cash disbursements for this company in June? Answer: From the following information of All company financial data. a) Net income before taxes was $189.500 for the period. The Tax rate is 30% b) Purchased 20677 shares of common stock at 14 per share for the treasury. c) Sold equipment with a carrying value of $32.500 at a gain of $6.000. d) Purchased land and a building worth $450.000 by signing a ten-year note payable. e) Issued 108654 bond at $1000 par value. al Wrote a check for $648.000 for the purchase of machinery h) Sold long term investments in marketable securities with a $50.000 carrying value, at a loss of $17.500. Cash dividends were declared and paid during the period in dollar 57041. Required. Prepare the net cash flows from financing activities section of the Statement of Cash Flows