Question

Assume that there are 2 investors with superior stock-picking ability and they are both tracking the same passive portfolio. Also, assume that they have

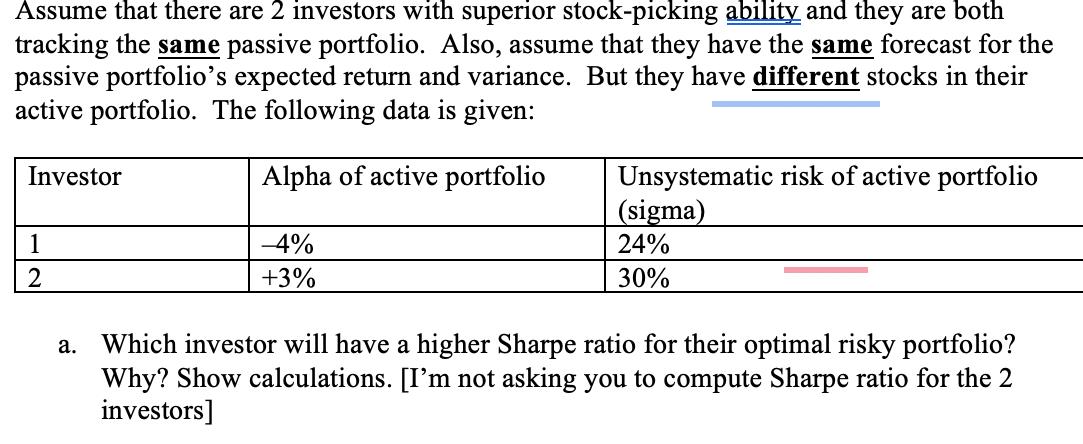

Assume that there are 2 investors with superior stock-picking ability and they are both tracking the same passive portfolio. Also, assume that they have the same forecast for the passive portfolio's expected return and variance. But they have different stocks in their active portfolio. The following data is given: Investor Alpha of active portfolio 1 2 -4% +3% Unsystematic risk of active portfolio (sigma) 24% 30% a. Which investor will have a higher Sharpe ratio for their optimal risky portfolio? Why? Show calculations. [I'm not asking you to compute Sharpe ratio for the 2 investors]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Public Finance and Public Policy

Authors: Jonathan Gruber

4th edition

1429278455, 978-1429278454

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App