Answered step by step

Verified Expert Solution

Question

1 Approved Answer

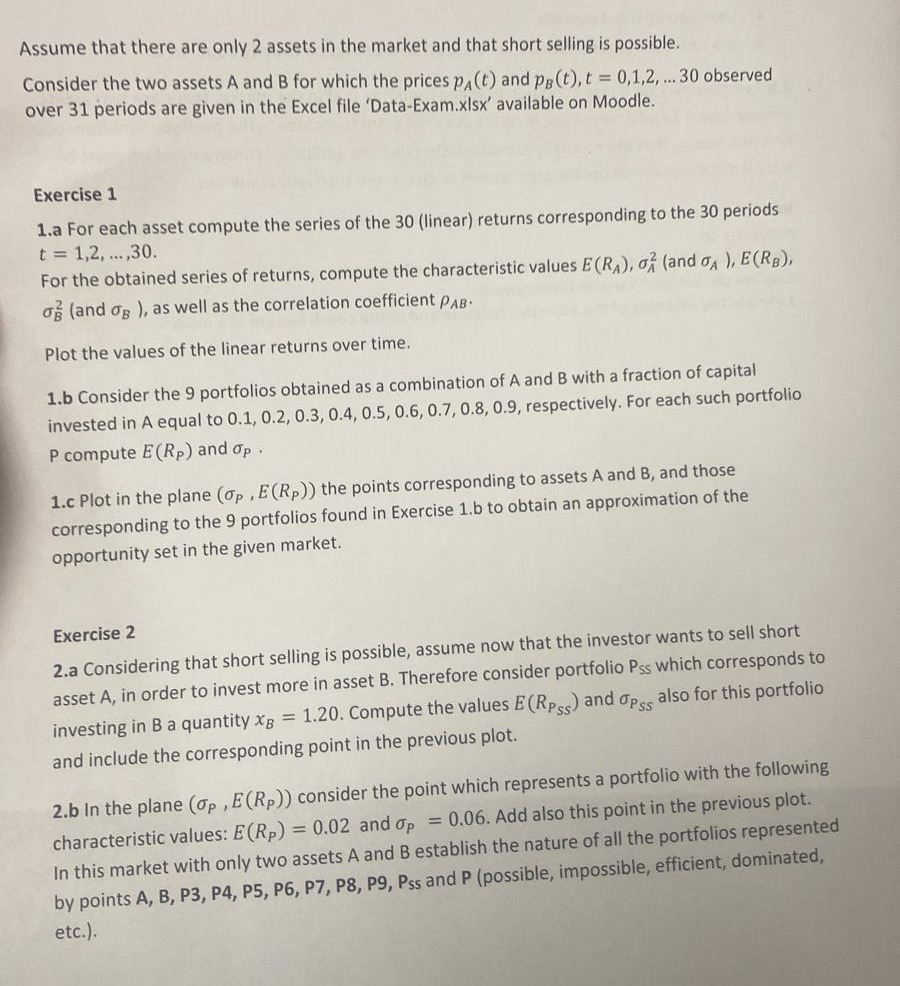

Assume that there are only 2 assets in the market and that short selling is possible. Consider the two assets A and B for which

Assume that there are only assets in the market and that short selling is possible.

Consider the two assets A and for which the prices and dots observed over periods are given in the Excel file 'DataExam.xIsx' available on Moodle.

Exercise

a For each asset compute the series of the linear returns corresponding to the periods dots,

For the obtained series of returns, compute the characteristic values and :and as well as the correlation coefficient

Plot the values of the linear returns over time.

b Consider the portfolios obtained as a combination of A and with a fraction of capital invested in A equal to respectively. For each such portfolio P compute and

c Plot in the plane the points corresponding to assets A and and those corresponding to the portfolios found in Exercise b to obtain an approximation of the opportunity set in the given market.

Exercise

a Considering that short selling is possible, assume now that the investor wants to sell short asset in order to invest more in asset Therefore consider portfolio which corresponds to investing in a quantity Compute the values and also for this portfolio and include the corresponding point in the previous plot.

b In the plane consider the point which represents a portfolio with the following characteristic values: and Add also this point in the previous plot. In this market with only two assets A and establish the nature of all the portfolios represented by points A B P P P P P P P Pss and P possible impossible, efficient, dominated, etc.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started